Question: Every question I asked today was 100% wrong. So this is attempt two. Please dont answer the question if you're not sure of the answer.

Every question I asked today was 100% wrong. So this is attempt two. Please dont answer the question if you're not sure of the answer. I wasted 13 questions today.

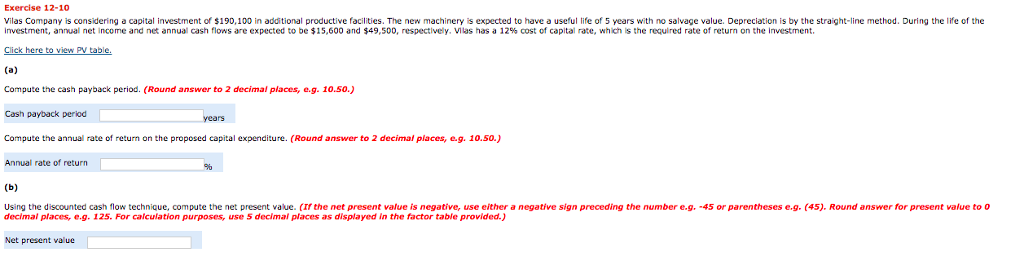

Exercise 12-10 Vilas Company is considering a capital investment of $190,100 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be 600 and $49,500, respectively. Vilas has a 12% cost of capital rate, which is the required rate of return on the investment Click here to view PV table Compute the cash payback period. (Round answer to 2 decimal places, e.g. 10.50.) Cash payback period Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.9. 10.50.) Annual rate of retu (b) sing the discounted cash flow technique, compute the net present value. (Tr the net present value is negative, use either a negative sign preceding the number e.g. 45 or parentheses e.g. (45). Round answer for present value to o decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts