Question: Excel Activity: Evaluating Risk and Retum Start with the partial model in the file CO2 P15 Huld Model.xtex. The file contains data for this problert.

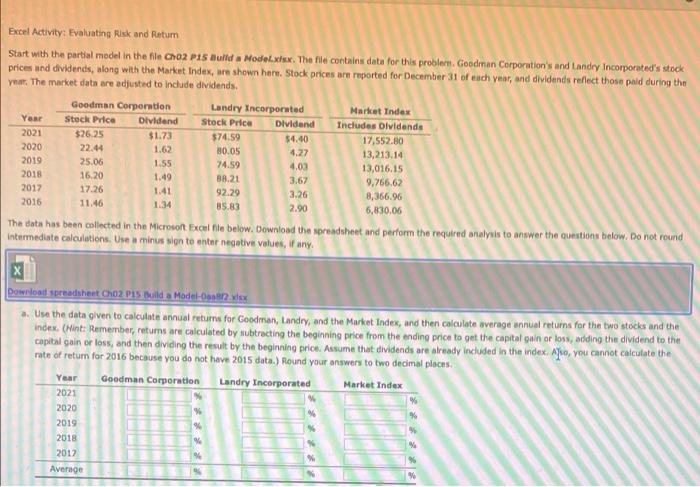

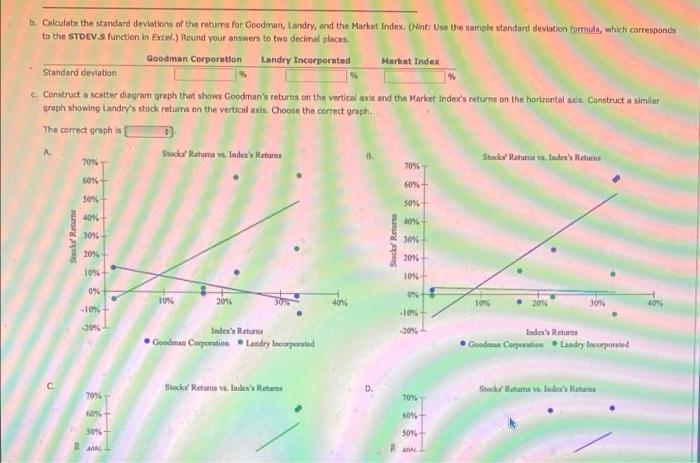

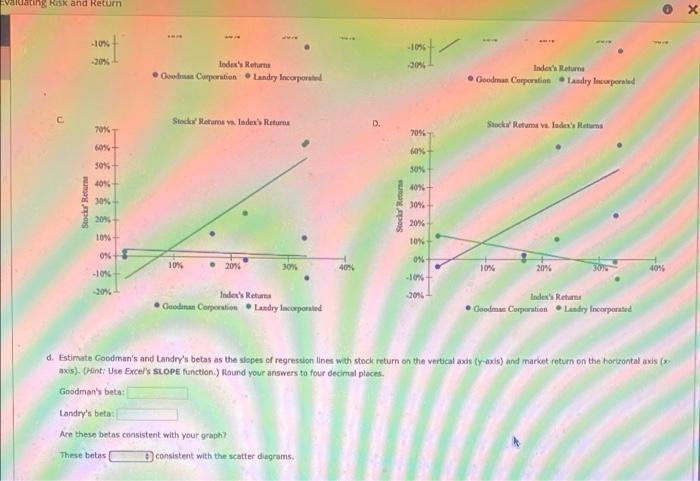

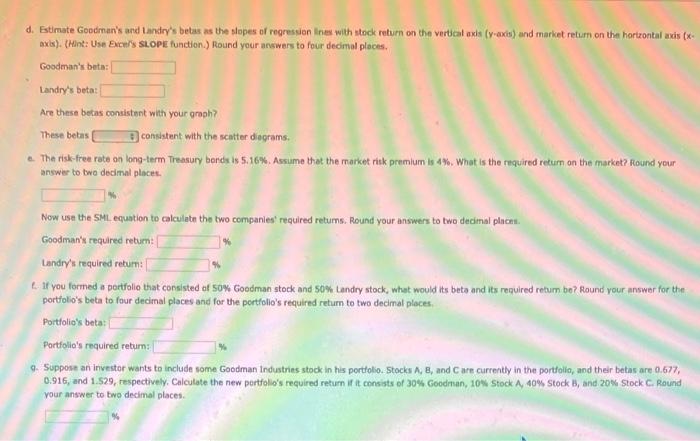

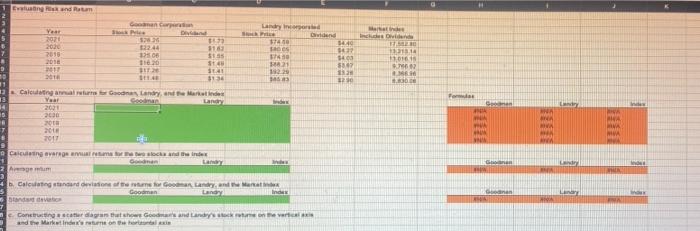

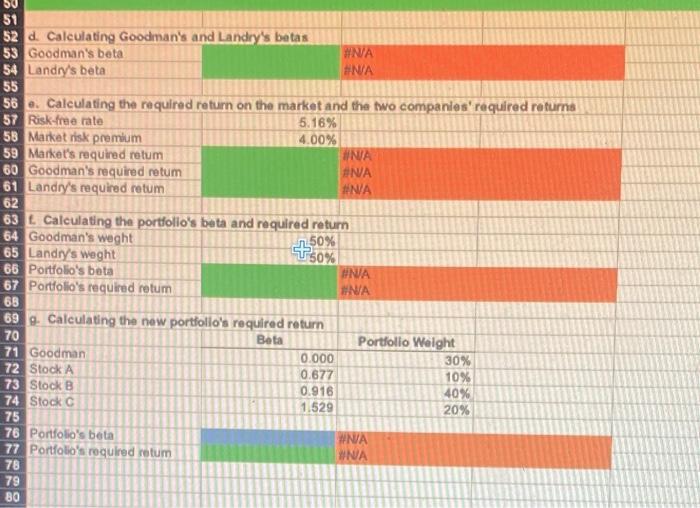

Excel Activity: Evaluating Risk and Retum Start with the partial model in the file CO2 P15 Huld Model.xtex. The file contains data for this problert. Goodman Corporation's and Landry Incorporated's stock prices und dividends, along with the Market Index, are shown here. Stock prices are reported for December 31 of each year, and dividends reflect those paid during the year. The market data are adjusted to include dividends. Goodman Corporation Landry Incorporated Market Index Year Stock Price Dividend Stock Price Dividend Includes Dividends $26.25 $1.73 $74.59 $4.00 17,552.80 2020 22.44 1.62 30.05 4.27 13,213.14 2019 25.06 1.55 74.59 4.00 13,016.15 2018 16.20 1.49 88.21 3.67 9,766.62 2017 17.26 1.41 92.29 3.26 8,366.96 2016 11.46 1.34 85.83 2.90 6,830.06 2021 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any, Download spreadsheet Cho2 Pistolda Modelo xex 1. Use the data given to calculate annual returra for Goodman, Landry, and the Market Index, and then calculate average annual retums for the two stocks and the Index. (Hint: Remember, retums are calculated by subtracting the beginning price from the ending price to get the capital gain or loss, adding the dividend to the capital gain or loss, and then dividing the result by the beginning price. Assume that dividends are already induded in the index. Also, you cannot calculate the rate of return for 2016 because you do not have 2015 data.) Round your answers to two decimal places Year Landry Incorporated Market Index Goodman Corporation 2021 2020 2019 2018 2012 Average b. Calculate the standard deviations of the returns for Goodman, Landry, and the Market Index. (Hint: Use the sample standard deviation formula, which corresponds to the STDEV.S function in Excel) Round your answers to two decimal places Goodman Corporation Landry Incorporated Maricut Index Standard deviation % Construct a scatter diagram graph that shows Goodman's returns on the vertical axis and the Market Index's returns on the horizontal act. Construct a similar graph showing Landry's stock retums on the vertical ads. Choose the correct graph. The correct graph is A Stock Retumu vs. Todex's Returns Stock Returto ve. Index's Returns 70% 70% 60% 60% 30% 50% 40% Sto Return 40% 30% 30% Stockor Rens 20% 2017 10% 10% 0% 09 10% 20% 10% 20% 30% 40% -10% -10% -2016 Index's Returns Index's Retur Goedmee Corporation Landry Incorporated Goodman Corporation Landry Incorporated Stock Returs va. India's Retur D. Stecker Bastuttavu. India's Blature 70% 70% 60 6096 30% 50% A ating Risk and Return X -10% -1096 Index's Returns Good Corporation Landey Incorporated Index Return Goodmus Corporation Landey leoperated Stade Rename ya Index's Retur D. 70% Shock Retuma velude's Heurs 70% 60%+ 30% 50% 40% 40% Stock Return 30% Stock Rom 30% 20% 20% 10% 10% 0%- 0% 10% 20% 30% 40% 10% 20% 30 40% -10% -1046 2016 20% Index's Returns Goodman Corporation Landry newported Index Return Goodma Corporation Landry Incorporated d. Estimate Goodman's and Landry's betas as the slopes of regression lines with stock return on the vertical and ty-axts) and market return on the horizontal andis ( nxis). (Hint: Use Excu's SLOPE function.) Round your answers to four decimal places. Goodman's beta Landry's beta Are these betas consistent with your graph? These betes consistent with the scatter diagrams. d. Estimate Goodman's and Landry's bebas as the slopes of regression lines with stock return on the vertical axis (y-axda) and market return on the horizontal axis (x- axls). (Hint: Use Exce' SLOPE function.) Round your answers to four decimal places Goodman's beta Landry's beta: Are these botas consistent with your graph? These bebas consistent with the scatter diagrams e. The risk-free rate on long-term Treasury borde is 5.16%. Assume that the market riik premium is 4%. What is the required return on the market? Round your answer to two decimal places. % Now use the SMI equation to calculate the two companies' required retums. Round your answers to two decimal plicht Goodman's required return: Landry's required retur: l. 18 you formed a portfolio that consisted of 50% Goodman stock and 50% Landry stock, what would ta beta and its required retum bo? Round your answer for the portfolio's beta to four decimal places and for the portfolio's required return to two decimal places, Portfolio's bata: Portfolio's required retum 9. Suppose an investor wants to include some Goodman Industries stock in his portfolio. Stocks A, B, and are currently in the portfolio, and their batas are 0.677, 0.916, and 1.529, respectively. Calculate the new portfolio's required return if it consists of 30% Goodman, 10% Stock A, 40% Stock B, and 20% Stock C. Round your answer to two decimal places H Eating and Raam Landry widend BO Includes Yea 207 2000 2018 2016 2017 1410 aces 11244 12808 120 3181 $135 Stre 1 LOS S07 1114 10 . . . 12 18 123 313 Calculating marre Gods Landry, and the artides Lady 2003 200 . 2015 2011 G Cad Gricing avarage och andre Sedan 2 Agen Calculating standardition of the name to Gommar, tandry, and are Goodman Land Indes na Constructing cardigans that shows Good and Landey on the wat and the Market Indoor 50% SO 51 52 d. Calculating Goodman's and Landry's batas 53 Goodman's beta WNA 54 Landry's beta INA 55 56. Calculating the required return on the market and the two companies' required returns 57 Risk-free rate 5.16% 58 Market risk premium 4.00% 59 Market's required retum #NA 60 Goodman's required retum #NA 61 Landry's required retum #NA 62 63 L Calculating the portfolio's beta and required return 64 Goodman's weght 65 Landry's weght 66 Portfolio's beta INA 67 Portfolio's required retum #N/A 68 69 - Calculating the new portfollo's required return 70 Beta Portfolio Weight 71 Goodman 0.000 30% 72 Stock A 0.677 10% 73 Stock B 0.916 40% 74 Stock C 1.529 20% 75 76 Portfolio's beta #NA 77 Portfolio's required retum WNA 78 79 80 +50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts