Question: EXCEL ANSWERS ONLY. Please show work in excel Table 1 Partial Long-Term Debt Listing for TECO Energy Face Amount Maturity Year 1997 Years to Maturity

EXCEL ANSWERS ONLY. Please show work in excel

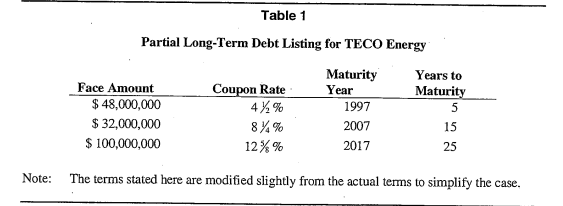

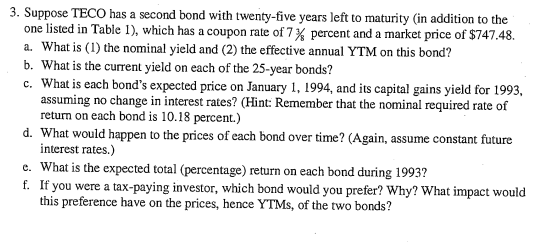

Table 1 Partial Long-Term Debt Listing for TECO Energy Face Amount Maturity Year 1997 Years to Maturity 5 $ 48,000,000 $ 32,000,000 Coupon Rate 4 %% 84% 12%% 2007 15 $ 100,000,000 2017 25 Note: The terms stated here are modified slightly from the actual terms to simplify the case. 3. Suppose TECO has a second bond with twenty-five years left to maturity (in addition to the one listed in Table 1), which has a coupon rate of 7% percent and a market price of $747.48. a. What is (1) the nominal yield and (2) the effective annual YTM on this bond? b. What is the current yield on each of the 25-year bonds? c. What is each bond's expected price on January 1, 1994, and its capital gains yield for 1993, assuming no change in interest rates? (Hint: Remember that the nominal required rate of return on each bond is 10.18 percent.) d. What would happen to the prices of each bond over time? (Again, assume constant future interest rates.) e. What is the expected total (percentage) return on each bond during 1993? f. If you were a tax-paying investor, which bond would you prefer? Why? What impact would this preference have on the prices, hence YTMs, of the two bonds? Table 1 Partial Long-Term Debt Listing for TECO Energy Face Amount Maturity Year 1997 Years to Maturity 5 $ 48,000,000 $ 32,000,000 Coupon Rate 4 %% 84% 12%% 2007 15 $ 100,000,000 2017 25 Note: The terms stated here are modified slightly from the actual terms to simplify the case. 3. Suppose TECO has a second bond with twenty-five years left to maturity (in addition to the one listed in Table 1), which has a coupon rate of 7% percent and a market price of $747.48. a. What is (1) the nominal yield and (2) the effective annual YTM on this bond? b. What is the current yield on each of the 25-year bonds? c. What is each bond's expected price on January 1, 1994, and its capital gains yield for 1993, assuming no change in interest rates? (Hint: Remember that the nominal required rate of return on each bond is 10.18 percent.) d. What would happen to the prices of each bond over time? (Again, assume constant future interest rates.) e. What is the expected total (percentage) return on each bond during 1993? f. If you were a tax-paying investor, which bond would you prefer? Why? What impact would this preference have on the prices, hence YTMs, of the two bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts