Question: Excel File Edit Data Window Help View Insert Format Tools BE SU 00 AutoSave OFF Week 2 Chapter 3 Home Insert Draw Page Layout Formulas

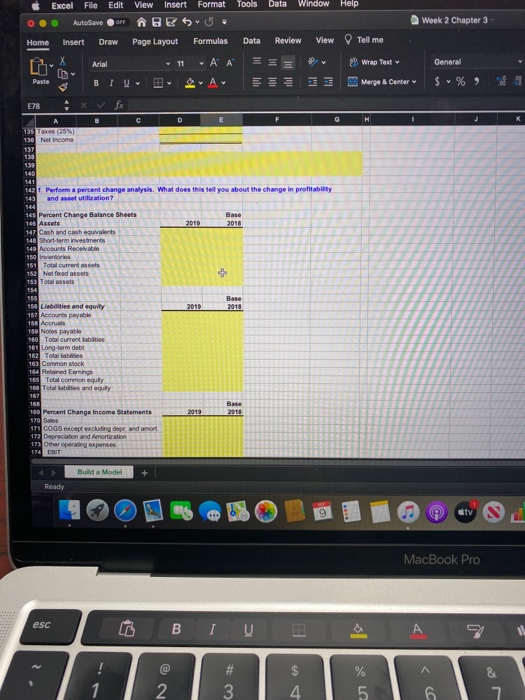

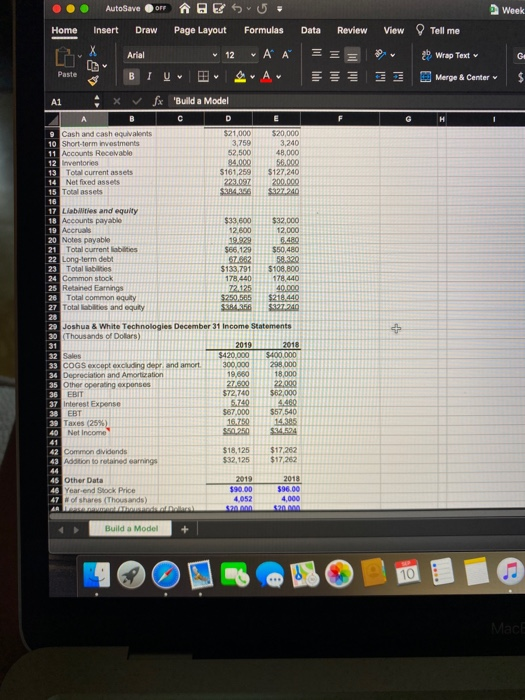

Excel File Edit Data Window Help View Insert Format Tools BE SU 00 AutoSave OFF Week 2 Chapter 3 Home Insert Draw Page Layout Formulas Data Review View Tell me X Arial 11 + A A == Wrap Text General Paste B I U Av Merge & Center $ % 9 E78 B D G K A 735 Taxes (5) 136 Net Income 137 138 140 141 142 Perform a percent change analysis. What does this tell you about the change in profitability 143 and asset utilisation? 144 145 Percent Change Balance Sheets 145 Assets 2010 2018 147 Cash and cash equivalent 148 Short-term investments 149 Accounts Receivable 151 Total current assets 152 Not fad assets 153 Total assets 154 Base 2019 2018 154 Liabilities and equity 157 Accounts payable 150 Accruas 159 Nobos payable 160 Total current abilities 161 Long-term debit 162 Total 163 Common sock 164 Retained ning 165 Totalcommon equity 168 Totes and equity 167 168 100 Percent Change Income Statements 170 Sales 171 COGS except excluding depr. and amort 172 Depreciation and Amortization 173 Other operating expenses 174 HT 2019 2015 Build a Model Ready 9 otv MacBook Pro esc BI U ol . @ $ 4. % 5 & 7 2 6 AutoSave OFF @@ Week Home Insert Draw Page Layout Formulas Data Review View O Tell me Arial 12 v AA == P ab Wrap Text Paste B Av Merge & Center H A1 X fx 'Bulld a Model B D E 9 Cash and cash equivalents $21,000 $20,000 10 Short-term investments 3,759 3,240 11 Accounts Receivable 52,500 48,000 12 Inventories 84.000 56.000 13 Total current assets S161,259 $127.240 14 Net foxed assets 223.097 200.000 15 Total assets $384256 $327240 16 17 Liabilities and equity 18 Accounts payable $33.600 $32,000 19 Accruals 12.800 12,000 20 Notes payable 19.929 8.40 21 Total current abilities $66.129 $50,480 22 Long-term debt 67.882 58.320 23 Total abis $133,791 $108,800 24 Common stock 178,440 178,440 25 Retained Earnings 72.25 40.000 28 Totalcommon equity $250,565 $218.440 27 Total liabilities and equity $384.356 $3272240 28 20 Joshua & White Technologies December 31 Income Statements 30 (Thousands of Dollars) 31 2019 2018 32 Sales $420,000 $400.000 33 COGS except excluding dep and amort 300,000 298 000 34 Depreciation and Amortization 19,660 18,000 35 Other operating expenses 27.600 22.000 36 EBIT $72,740 $62,000 37 Interest Expense 4.480 30 EBT $67.000 $57,540 39 Taxes (25%) 16.70 14,385 40 Net Income $501230 $94.524 41 42 Common dividends $18,125 $17.262 43 Addition to retained earnings $32.125 $17,262 44 45 Other Data 2019 2018 46 Year-end Stock Price $90.00 $96.00 47 of shares (Thousands) 4.052 4,000 AA Thousada Dollar $20.00 $20.00 Build a Model 10 Mact Excel File Edit Data Window Help View Insert Format Tools BE SU 00 AutoSave OFF Week 2 Chapter 3 Home Insert Draw Page Layout Formulas Data Review View Tell me X Arial 11 + A A == Wrap Text General Paste B I U Av Merge & Center $ % 9 E78 B D G K A 735 Taxes (5) 136 Net Income 137 138 140 141 142 Perform a percent change analysis. What does this tell you about the change in profitability 143 and asset utilisation? 144 145 Percent Change Balance Sheets 145 Assets 2010 2018 147 Cash and cash equivalent 148 Short-term investments 149 Accounts Receivable 151 Total current assets 152 Not fad assets 153 Total assets 154 Base 2019 2018 154 Liabilities and equity 157 Accounts payable 150 Accruas 159 Nobos payable 160 Total current abilities 161 Long-term debit 162 Total 163 Common sock 164 Retained ning 165 Totalcommon equity 168 Totes and equity 167 168 100 Percent Change Income Statements 170 Sales 171 COGS except excluding depr. and amort 172 Depreciation and Amortization 173 Other operating expenses 174 HT 2019 2015 Build a Model Ready 9 otv MacBook Pro esc BI U ol . @ $ 4. % 5 & 7 2 6 AutoSave OFF @@ Week Home Insert Draw Page Layout Formulas Data Review View O Tell me Arial 12 v AA == P ab Wrap Text Paste B Av Merge & Center H A1 X fx 'Bulld a Model B D E 9 Cash and cash equivalents $21,000 $20,000 10 Short-term investments 3,759 3,240 11 Accounts Receivable 52,500 48,000 12 Inventories 84.000 56.000 13 Total current assets S161,259 $127.240 14 Net foxed assets 223.097 200.000 15 Total assets $384256 $327240 16 17 Liabilities and equity 18 Accounts payable $33.600 $32,000 19 Accruals 12.800 12,000 20 Notes payable 19.929 8.40 21 Total current abilities $66.129 $50,480 22 Long-term debt 67.882 58.320 23 Total abis $133,791 $108,800 24 Common stock 178,440 178,440 25 Retained Earnings 72.25 40.000 28 Totalcommon equity $250,565 $218.440 27 Total liabilities and equity $384.356 $3272240 28 20 Joshua & White Technologies December 31 Income Statements 30 (Thousands of Dollars) 31 2019 2018 32 Sales $420,000 $400.000 33 COGS except excluding dep and amort 300,000 298 000 34 Depreciation and Amortization 19,660 18,000 35 Other operating expenses 27.600 22.000 36 EBIT $72,740 $62,000 37 Interest Expense 4.480 30 EBT $67.000 $57,540 39 Taxes (25%) 16.70 14,385 40 Net Income $501230 $94.524 41 42 Common dividends $18,125 $17.262 43 Addition to retained earnings $32.125 $17,262 44 45 Other Data 2019 2018 46 Year-end Stock Price $90.00 $96.00 47 of shares (Thousands) 4.052 4,000 AA Thousada Dollar $20.00 $20.00 Build a Model 10 Mact

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts