Question: Excel File Edit View Insert Format Tools Data Window Help 2011 AutoSave or OFF - Capital_Structure_Home... 1 page Qw Seared * za Q8 Thu Feb

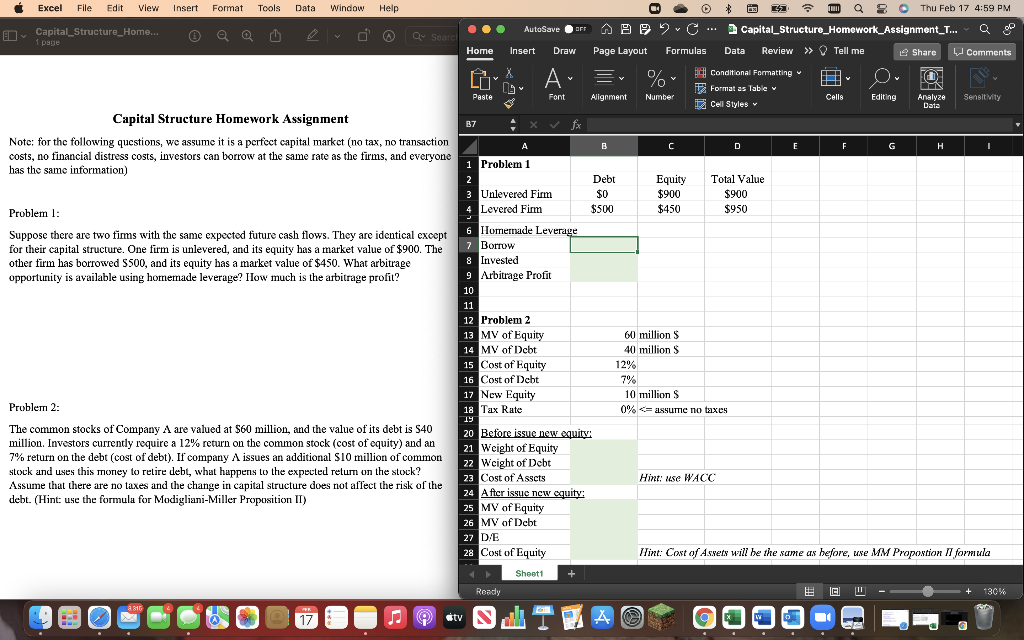

Excel File Edit View Insert Format Tools Data Window Help 2011 AutoSave or OFF - Capital_Structure_Home... 1 page Qw Seared * za Q8 Thu Feb 17 4:59 PM A92. Capital_Structure_Homework_Assignment_T... Qgo Page Layout Formulas Data Review >> Tell me Share U Comments Home Insert Draw A V % % Hv . Alignment FO Conditional Formatting F Format as Table Cell Styles Paste Font Number Cells Editing Analyze Data Sensit My B7 fx Capital Structure Homework Assignment Note: for the following questions, we assume it is a perfect capital market (no tax, no transaction costs, no financial distress costs, investors can borrow at the same rate as the firms, and everyone has the same information) A B C D E F H I Problem 1: Suppose there are two fims with the same expected future cash flows. They are identical except for their capital structure. One firm is unlevered, and its equity has a market value of $900. The other firm has borrowed 5500, and its equity has a market value of $450. What arbitrage opportunity is available using homemade leverage? Ilow much is the arbitrage profit? Problem 1 2 Debt Equity Total Value 3 Unlevered Firm $0 $900 $900 4 Levered Firm $500 $ $450 $950 6 Homemade Leverage 7 Borrow 8 Invested 9 Arbitrage Profit 10 11 12 Problem 2 13 MV of Equity 600 millions 14 MV of Debt 40 million S 15 Cost of Equity 12% 16 Cost of Debt 7% 17 New Equity 10 millions 18 Tax Rate 0% > Tell me Share U Comments Home Insert Draw A V % % Hv . Alignment FO Conditional Formatting F Format as Table Cell Styles Paste Font Number Cells Editing Analyze Data Sensit My B7 fx Capital Structure Homework Assignment Note: for the following questions, we assume it is a perfect capital market (no tax, no transaction costs, no financial distress costs, investors can borrow at the same rate as the firms, and everyone has the same information) A B C D E F H I Problem 1: Suppose there are two fims with the same expected future cash flows. They are identical except for their capital structure. One firm is unlevered, and its equity has a market value of $900. The other firm has borrowed 5500, and its equity has a market value of $450. What arbitrage opportunity is available using homemade leverage? Ilow much is the arbitrage profit? Problem 1 2 Debt Equity Total Value 3 Unlevered Firm $0 $900 $900 4 Levered Firm $500 $ $450 $950 6 Homemade Leverage 7 Borrow 8 Invested 9 Arbitrage Profit 10 11 12 Problem 2 13 MV of Equity 600 millions 14 MV of Debt 40 million S 15 Cost of Equity 12% 16 Cost of Debt 7% 17 New Equity 10 millions 18 Tax Rate 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts