Question: Excel File Insert Format Tools Data Window Help L2 Fri Mar 18 2:44 AM Edit View AO AutoSave OFF Module 06 Assignment a go Home

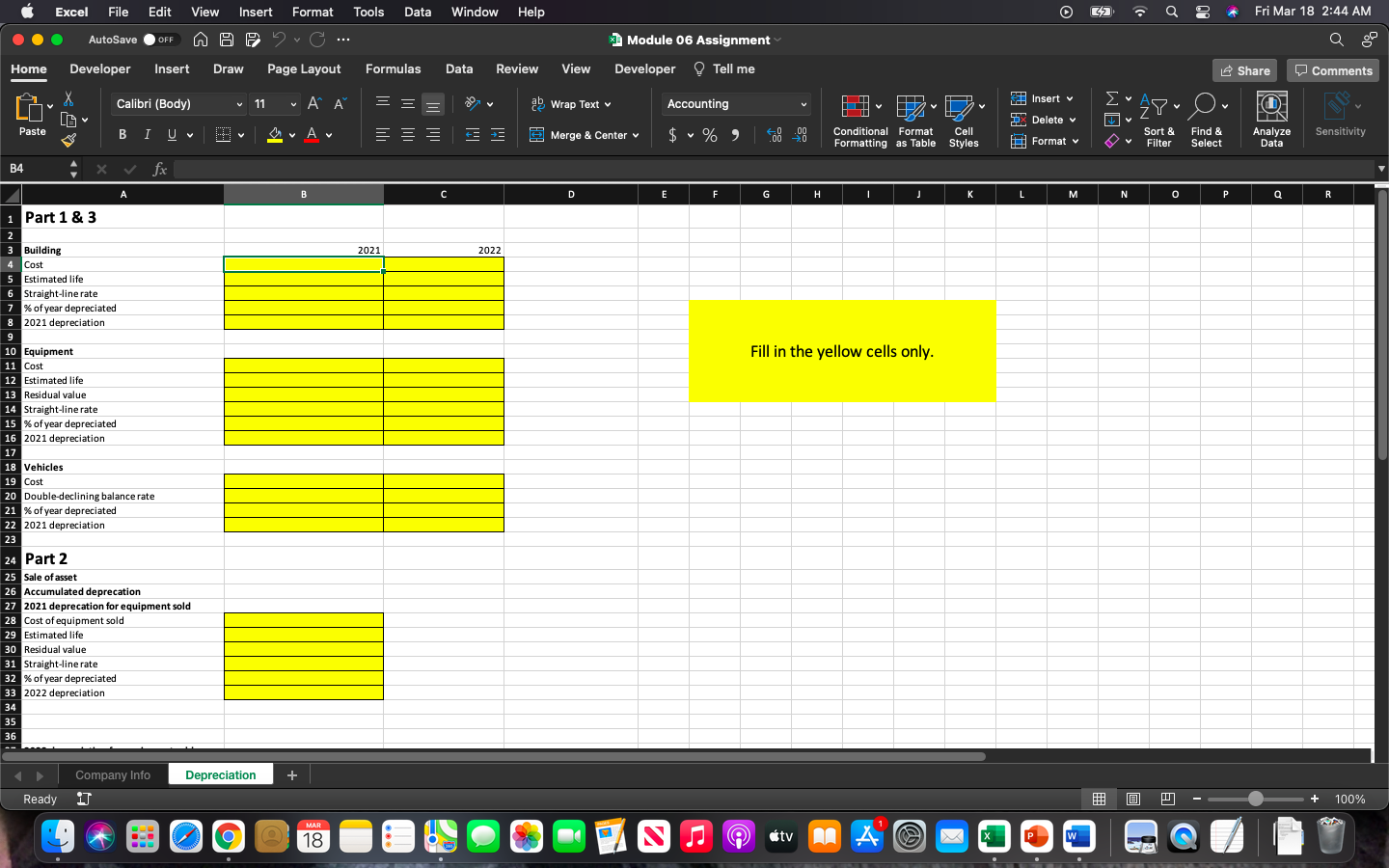

Excel File Insert Format Tools Data Window Help L2 Fri Mar 18 2:44 AM Edit View AO AutoSave OFF Module 06 Assignment a go Home Developer Insert Draw Page Layout Formulas Data Review View Developer Tell me Share Comments Insert v Calibri (Body) 11 LG = = c ab Wrap Text Accounting Tv V TH TV 28. O o DX Delete v V Paste BIU A == == = Merge & Center $ % ) HO .00 .00 7.0 Conditional Format Cell Formatting as Table Styles Sensitivity Sort & Filter Format Find & Select Analyze Data B4 - x fx A . B C D E E F G G . H T J K L L M . N 0 P P Q R 2021 2022 Fill in the yellow cells only. 1 Part 1 & 3 2 3 Building 4 Cost 5 Estimated life 6 Straight-line rate 7 % of year depreciated 8 2021 depreciation 9 10 Equipment 11 Cost 12 Estimated life 13 Residual value 14 Straight-line rate 15 % of year depreciated 16 2021 depreciation 17 18 Vehicles 19 Cost 20 Double-declining balance rate 21 % of year depreciated 22 2021 depreciation 23 24 Part 2 25 Sale of asset 26 Accumulated deprecation 27 2021 deprecation for equipment sold 28 Cost of equipment sold 29 Estimated life 30 Residual value 31 Straight-line rate 32 % of year depreciated 33 2022 depreciation 34 35 36 Depreciation + Company Info Ready 1T 100% MAR 18 tv MA P W Excel File Insert Format Tools Data Window Help L2 Fri Mar 18 2:44 AM Edit View AO AutoSave OFF Module 06 Assignment a go Home Developer Insert Draw Page Layout Formulas Data Review View Developer Tell me Share Comments Insert v Calibri (Body) 11 LG = = c ab Wrap Text Accounting Tv V TH TV 28. O o DX Delete v V Paste BIU A == == = Merge & Center $ % ) HO .00 .00 7.0 Conditional Format Cell Formatting as Table Styles Sensitivity Sort & Filter Format Find & Select Analyze Data B4 - x fx A . B C D E E F G G . H T J K L L M . N 0 P P Q R 2021 2022 Fill in the yellow cells only. 1 Part 1 & 3 2 3 Building 4 Cost 5 Estimated life 6 Straight-line rate 7 % of year depreciated 8 2021 depreciation 9 10 Equipment 11 Cost 12 Estimated life 13 Residual value 14 Straight-line rate 15 % of year depreciated 16 2021 depreciation 17 18 Vehicles 19 Cost 20 Double-declining balance rate 21 % of year depreciated 22 2021 depreciation 23 24 Part 2 25 Sale of asset 26 Accumulated deprecation 27 2021 deprecation for equipment sold 28 Cost of equipment sold 29 Estimated life 30 Residual value 31 Straight-line rate 32 % of year depreciated 33 2022 depreciation 34 35 36 Depreciation + Company Info Ready 1T 100% MAR 18 tv MA P W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts