Question: Excel file procedure to answer the next problem Problem 2 - estimating the value of the company with the multiples method The following information from

Excel file procedure to answer the next problem

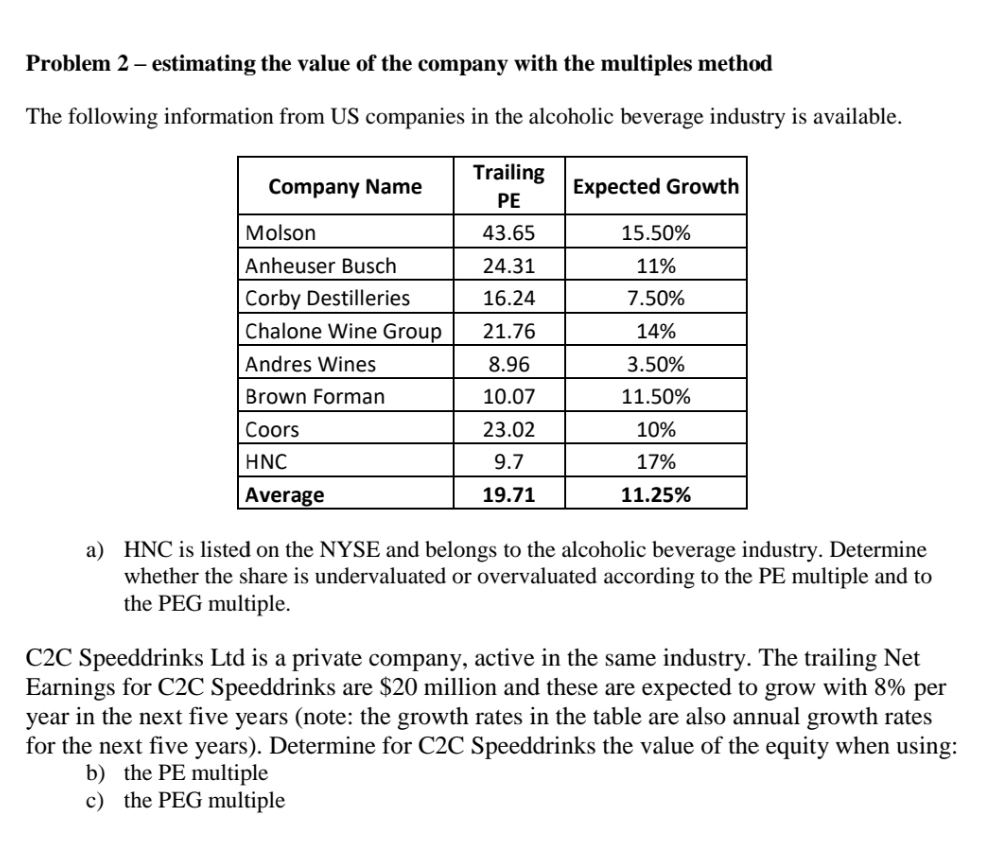

Problem 2 - estimating the value of the company with the multiples method The following information from US companies in the alcoholic beverage industry is available. Trailing Company Name PE Expected Growth Molson 43.65 15.50% Anheuser Busch 24.31 11% Corby Destilleries 16.24 7.50% Chalone Wine Group 21.76 14% Andres Wines 8.96 3.50% Brown Forman 10.07 11.50% Coors 23.02 10% HNC 9.7 17% Average 19.71 11.25% a) HNC is listed on the NYSE and belongs to the alcoholic beverage industry. Determine whether the share is undervaluated or overvaluated according to the PE multiple and to the PEG multiple. C2C Speeddrinks Lid is a private company, active in the same industry. The trailing Net Earnings for C2C Speeddrinks are $20 million and these are expected to grow with 8% per year in the next five years (note: the growth rates in the table are also annual growth rates for the next five years). Determine for C2C Speeddrinks the value of the equity when using: b) the PE multiple c) the PEG multiple

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts