Question: Excel Online Structured Activity: Constant growth You are considering an investment Corporation's stock, which is expected to pay a dividend of 12.25 a share at

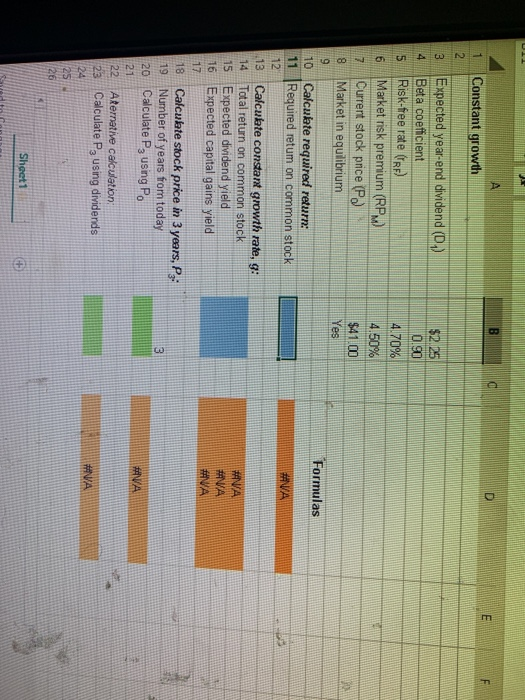

Excel Online Structured Activity: Constant growth You are considering an investment Corporation's stock, which is expected to pay a dividend of 12.25 a share at the end of the Year (0, - 12.25) and has a bit of the risk free is 4.5%. Just currently sells for $41.00 a share, and its dividend is expected to grow some constant rate, The data has been collected in the Microsoft Excel Online e below. Open the s analysis tower the question below and the market premium h eet and perform the required Assuming the market is in t rum, what does the market believe will be the stock price at the end of years (That is what is Ps) Round your answer to two decimal places. Do not round your intermediate calculations. Check My Work Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of 2.25 a share at the end of the year (0, - 12.25) and has a bea of 0.9. The risk re i se and the market premium is 4.54. Justus currently sells for $41.00 a share and its dividend is expected to grow at some constant rate . The data has been collected in the Microsoft Excel Online below Open the order and perform the reward analysis to anwwer the question below. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of years (That is what is P. Round your answer to two decimal places. Do not found your intermediate calculations 1 Constant growth Expected year-end dividend (O.) Beta coefficient Risk-fee rate (RF) Market risk premium (RPM) Current stock price (P. Market in equilibrium 4.70% E 4.50% $41.00 8 Formulas #VA NA 10 Calculate required return: 11 Required retum on common stock 112 13 Calculate constant growth rate, g: 14 Total return on common stock 15 Expected dividend yield 16 Expected capital gains yield 17 18 Calculate stock price in 3 years, P. Number of years from today 20 Calculate P, using Po MA #VA 22 Aternative calculation Calculate P, using dividends Sheet1 Excel Online Structured Activity: Constant growth You are considering an investment Corporation's stock, which is expected to pay a dividend of 12.25 a share at the end of the Year (0, - 12.25) and has a bit of the risk free is 4.5%. Just currently sells for $41.00 a share, and its dividend is expected to grow some constant rate, The data has been collected in the Microsoft Excel Online e below. Open the s analysis tower the question below and the market premium h eet and perform the required Assuming the market is in t rum, what does the market believe will be the stock price at the end of years (That is what is Ps) Round your answer to two decimal places. Do not round your intermediate calculations. Check My Work Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of 2.25 a share at the end of the year (0, - 12.25) and has a bea of 0.9. The risk re i se and the market premium is 4.54. Justus currently sells for $41.00 a share and its dividend is expected to grow at some constant rate . The data has been collected in the Microsoft Excel Online below Open the order and perform the reward analysis to anwwer the question below. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of years (That is what is P. Round your answer to two decimal places. Do not found your intermediate calculations 1 Constant growth Expected year-end dividend (O.) Beta coefficient Risk-fee rate (RF) Market risk premium (RPM) Current stock price (P. Market in equilibrium 4.70% E 4.50% $41.00 8 Formulas #VA NA 10 Calculate required return: 11 Required retum on common stock 112 13 Calculate constant growth rate, g: 14 Total return on common stock 15 Expected dividend yield 16 Expected capital gains yield 17 18 Calculate stock price in 3 years, P. Number of years from today 20 Calculate P, using Po MA #VA 22 Aternative calculation Calculate P, using dividends Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts