Question: Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a

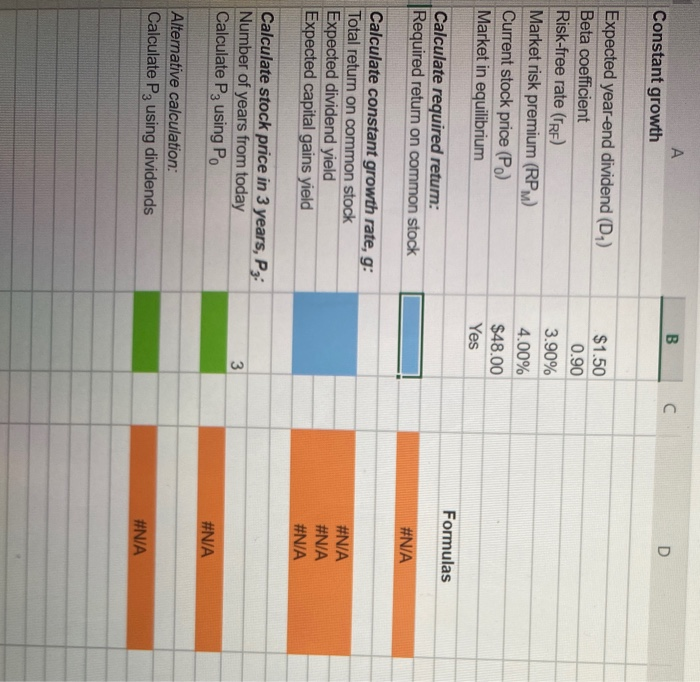

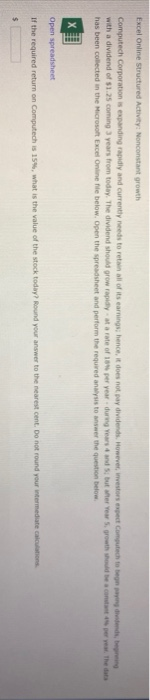

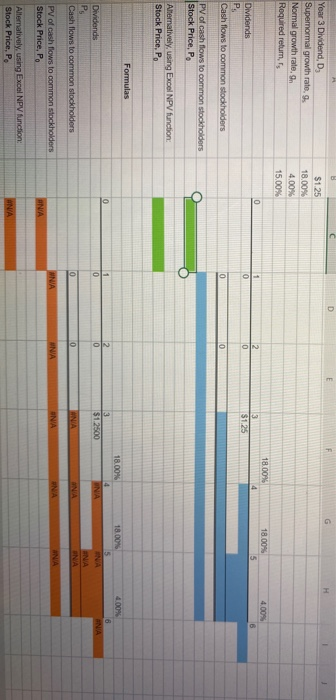

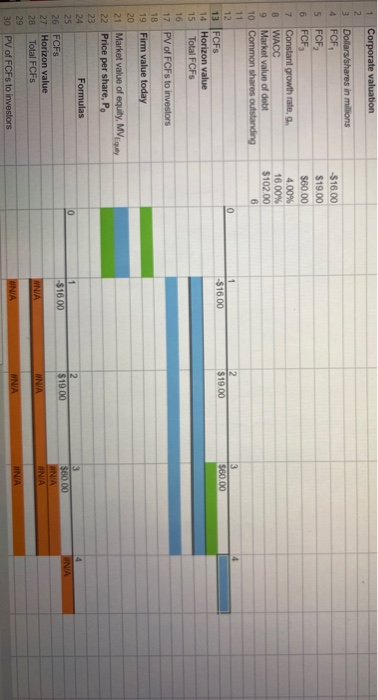

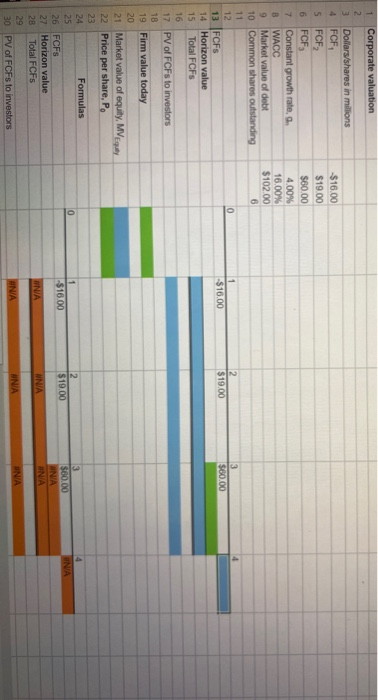

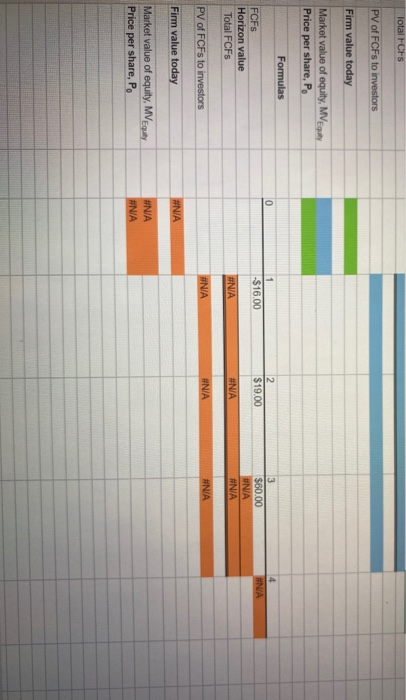

Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (0 - $1.50) and has a bea of a.. Ther e is 3.4 and the market risk premium is 4.0%. Justus currently sells for $48.00 a share, and its dividend is expected to grow at some constant rates. The data has been collected in the Microsoft Excel Online below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Round your answer to the round your Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? That is what is intermediate calculations. Check My Work Constant growth Expected year-end dividend (D) Beta coefficient Risk-free rate (TRF) Market risk premium (RPM) Current stock price (Po) Market in equilibrium $1.50 0.90 3.90% 4.00% $48.00 Yes Formulas Calculate required retur: Required return on common stock #N/A Calculate constant growth rate, g: Total return on common stock Expected dividend yield Expected capital gains yield #N/A #N/A #N/A Calculate stock price in 3 years, Pz: Number of years from today Calculate P3 using Po #N/A Alternative calculation: Calculate P3 using dividends #N/A Excel Online structured Activity: Nonconstant growth Computech Corporation expanding rapidly and currently needs to ren all of its earnings, hence, it does not pay dividends. However, investors with a dividend of $1.25 coming years from today. The dividend should grow rapid rate of 10 per year dur a nt and butter has been collected in the Microsoft Excel online le below. Open the spreadsheet and perform the requed any tower the question below Computachten the , per The data Open spreadsheet If the required return on Computech is 15%, what is the value of the stock today? Round your answer to the nearest cent. Do not round your mediate calculations Year 3 Dividend, D Superormal growth rate, Normal growth rate, Required rebum.rs $125 18.00% 4.00% 15.00% 18.00% 18.00% Dividends ON jollo Cash flows to common stockholders PV of cash flows to common stockholders Stock Price, P. O Alternatively, using Excel NPV function: Stock Price. Po Formulas 18.00% 18.00% 4.00% Dividends $12500 loo Cash flows to common stockholders ANA NA ANA PV of cash flows to common stockholders Stock Price, Po Alternatively, using Excel NPV function: Stock Price, P Excel Online Structured Activity: Corporate valuation Dantzler Corporation is a fast-growing supplier of the products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 4% rate Dantzler's WACC IS 16% Year FCF (S The data has been collected in the Micro Excel Online hile below. Open the spreadsheet and perform there Open spreadsheet a. What is Dantzler's horizon, or continuing value? (Hint: Find the value of all free cash flows beyond Year discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13.550,000 should be entered as 13.55 milion B. What is the firm's value today! Round your answer to two decimal places. Enter your answer in milions. For example, an answer of $13,550,000 should be entered as 13:55. Do not round your intermediate calculations Suppose Dantzler has $10 milion of debit and 6 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decmal places. Write out your answer completely. For example, 0.00025 million should be entered as 250. Check My Work Selo 1 Corporate valuation 6 Dollars/shares in millions FCF, FCF FCF Constant growth rate, WACC Market value of debt Common shares outstanding $16.00 $19.00 $60.00 4.00% 16.00% $102.00 10 $16.00 $19.00 $60.00 13 FCFS 14 Horizon value 15 Total FCFS 17 PV of FCFs to investors 19 Firm value today Market value of equity, MV Egy 22 Price per share, Po Formulas $16.00 $19.00 $60.00 NA 26 FCFS 27 Horizon value 28 Total FCFs WNIA WNA INA WNA WNIA 30 PV of FCFs to investors ANA 1 Corporate valuation 6 Dollars/shares in millions FCF, FCF FCF Constant growth rate, WACC Market value of debt Common shares outstanding $16.00 $19.00 $60.00 4.00% 16.00% $102.00 10 $16.00 $19.00 $60.00 13 FCFS 14 Horizon value 15 Total FCFS 17 PV of FCFs to investors 19 Firm value today Market value of equity, MV Egy 22 Price per share, Po Formulas $16.00 $19.00 $60.00 NA 26 FCFS 27 Horizon value 28 Total FCFs WNIA WNA INA WNA WNIA 30 PV of FCFs to investors ANA Total FCF PV of FCFs to investors Firm value today Market value of equity, MV Equity Price per share, Po Formulas $16.00 $19.00 NA FCFS Horizon value Total FCFs $60.00 #N/A #N/A NA #N/A PV of FCFs to investors #N/A #N/A WNA Firm value today #N/A Market value of equity, MV Equity Price per share, Po #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts