Question: Excel Online Structured Activity: Free Cash Flows The data for Rhodes Corporation's has been collected in the Microsoft Excel Online file below. Open the spreadsheet

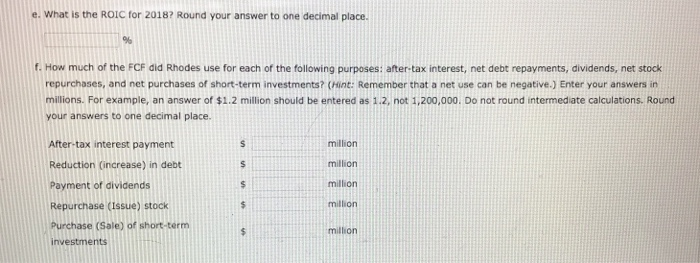

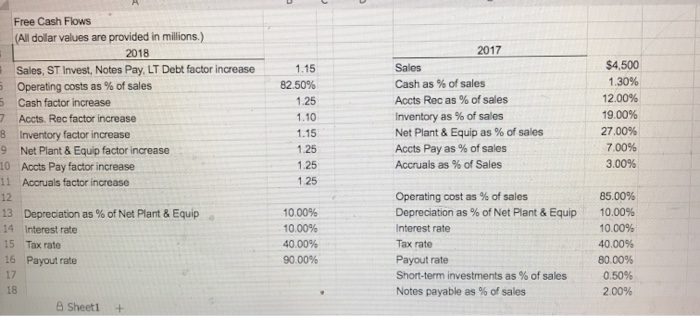

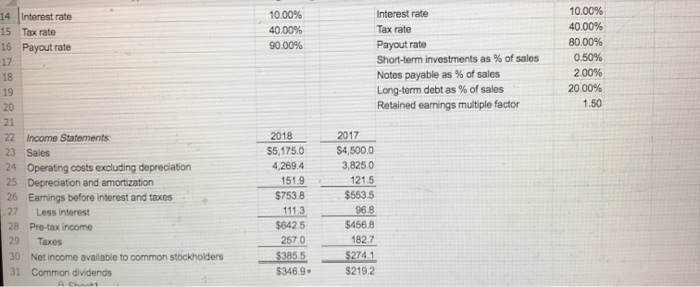

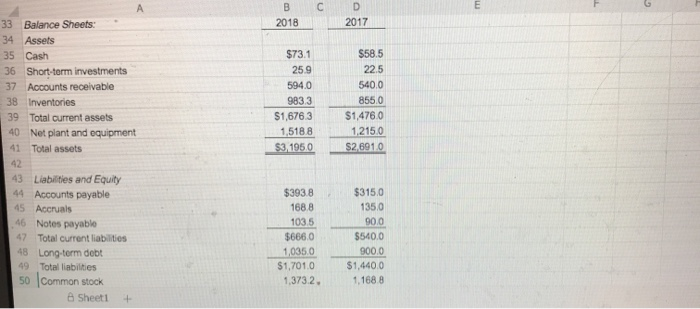

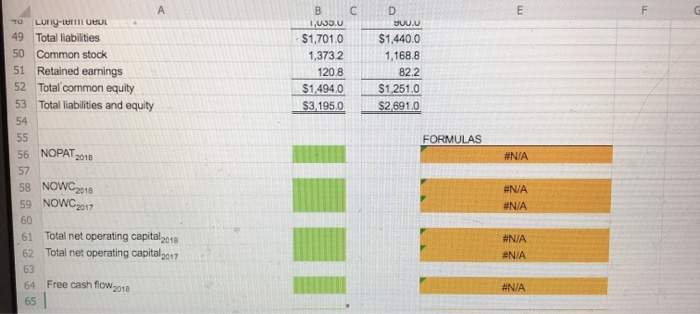

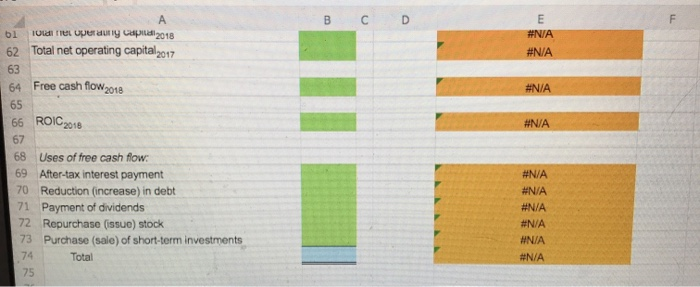

Excel Online Structured Activity: Free Cash Flows The data for Rhodes Corporation's has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. HiiHii e. What is the ROIC for 2018? Round your answer to one decimal place. 9% f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place. s million After-tax interest payment Reduction (increase) in debt $ million Payment of dividends $ million Repurchase (Issue) stock $ million Purchase (Sale) of short-term investments million Free Cash Flows (All dollar values are provided in millions.) 2018 Sales, ST Invest, Notes Pay, LT Debt factor increase 5 Operating costs as % of sales 5 Cash factor increase 7 Accts. Rec factor increase 8 Inventory factor increase 9 Net Plant & Equip factor increase 10 Accts Pay factor increase 11 Accruals factor increase 12 13 Depreciation as % of Net Plant & Equip 14 interest rate 15 Tax rate 16 Payout rate 17 18 Sheet1 + 1.15 82.50% 1.25 1.10 1.15 1.25 1.25 2017 Sales Cash as % of sales Accts Rec as % of sales Inventory as % of sales Net Plant & Equip as % of sales Accts Pay as % of sales Accruals as % of Sales $4,500 1.30% 12.00% 19.00% 27.00% 7.00% 3.00% 1 25 10.00% 10.00% 40.00% 90.00% Operating cost as % of sales Depreciation as % of Net Plant & Equip Interest rate Tax rate Payout rate Short-term investments as % of sales Notes payable as % of sales 85.00% 10.00% 10.00% 40.00% 80.00% 0.50% 2.00% 10.00% 40.00% 90.00% Interest rate Tax rate Payout rate Short-term investments as % of sales Notes payable as % of sales Long-term debt as % of sales Retained earnings multiple factor 10.00% 40.00% 80.00% 0.50% 2.00% 20.00% 1.50 14 Interest rate 15 Tax rate 16 Payout rate 17 18 19 20 21 22 Income Statements: 23 Sales 24 Operating costs excluding depreciation 25 Depreciation and amortization 26 Earnings before interest and taxes 27 Less interest 28 Pro-tax income 29 Taxes 30 Net income available to common stockholders 31 Common dividends 2018 $5,175.0 4,269.4 151.9 $7538 111.3 $642.5 2570 $385 5 $346.9 2017 $4,500.0 3,825 0 1215 $553.5 96.8 $456.8 182.7 $274.1 $2192 AC E G B 2018 D 2017 $73.1 25.9 594.0 9833 $1,6763 1,5188 $3,1950 $58.5 22.5 540.0 8550 $1,476,0 1,2150 $2,6910 33 Balance Sheets: 34 Assets 35 Cash 36 Short-term investments 37 Accounts receivable 38 Inventories 39 Total current assets 40 Net plant and equipment 41 Total assets 42 43 Liabilities and Equity 44 Accounts payable 45 Accruals 46 Notes payable 47 Total current liabilities 48 Long-term debt 49 Total liabilities 50 Common stock B Sheet + $393.8 168.8 103.5 $666.0 1,0350 $1,701.0 1,3732 $3150 1350 90.0 $540.0 900.0 $1,4400 1.168.8 E F TO B 1,033.0 $1,701.0 1,3732 120.8 $1,494.0 $3 195.0 D YUUU $1,440.0 1,168.8 822 $1,251.0 $2,691.0 FORMULAS A Long- UDL 49 Total liabilities 50 Common stock 51 Retained earnings 52 Total'common equity 53 Total liabilities and equity 54 55 56 NOPAT 2018 57 58 NOWC 2018 59 NOWC2017 60 61 Total net operating capital 2018 62 Total net operating capital 2017 63 64 Free cash flow 2018 65 | #N/A #N/A #N/A #N/A #N/A #N/A B C D F bi E #N/A #N/A #N/A #N/A Tout perut y capildl2018 62 Total net operating capital 2017 63 64 Free cash flow 2018 65 66 ROIC 2018 67 68 Uses of free cash flow: 69 After-tax interest payment 70 Reduction (increase) in debt 71 Payment of dividends 72 Repurchase (issue) stock 73 Purchase (sale) of short-term investments 74 Total 75 #N/A #N/A #N/A #N/A #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts