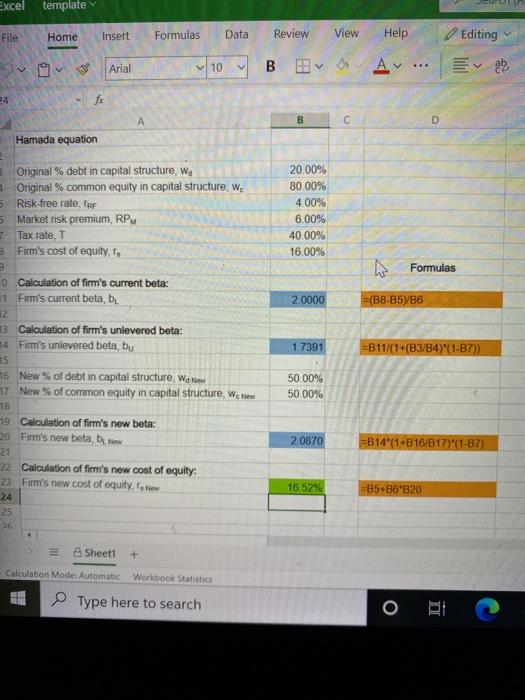

Question: Excel template File Home Insert Formulas Data Review View Help Editing Arial 10 7 ... B B A. A B D Hamada equation B. Original

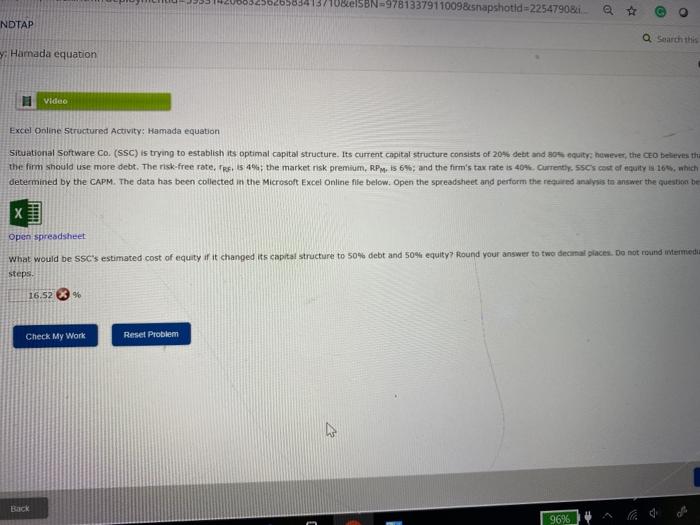

Excel template File Home Insert Formulas Data Review View Help Editing Arial 10 7 ... B B A. A B D Hamada equation B. Original % debt in capital structure, w Original % common equity in capital structure, we 5 Risk-free rate, fer 5 Market risk premium, RPM Tax rate. T Firm's cost of equity, 20.00% 80.00% 4.00% 6.00% 40.00% 16.00% N Formulas 2.0000 (B8-B5786 0 Calculation of firm's current beta: 1 Firm's current beta, b. 12 13 Calculation of firrn's unlevered beta: 4 Firm's unlevered beta, bu 1 7391 =B11/(1+(B3/B4)"(1-B7)) 50.00% 50.00% 2.0870 176 New % of debt in capital structure, Wario 17 New % of common equity in capital structure, We New 18 19 Calculation of firm's new beta: 20 Firm's new beta. Drew 21 22 Calculation of firm's new cost of equity 23 Firm's new cost of equity. Toto 24 25 06 =B14"(1-B16/17)"(1-87) 16.52% -B5-B64B20 Sheet1 + Calculation Mode: Automatic Workbook Statistics Type here to search o 113710BelSBN 9781337911009&snapshotld-22547908. NDTAP Q Search this y Hamada equation Video Excel Online Structured Activity: Hamada equation Situational Software Co. (SSC) is trying to establish its optimal capital structure. Its current capital structure consists of 20% debt and equity, however, the CEO Delves the the firm should use more debt. The risk-free rate, Fre, is 4%; the market risk premium, RPM. is 6%; and the firm's tax rate is 40%. Currently. SSC's cost of mouty 164, which determined by the CAPM. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question be x Tim Open spreadsheet What would be SSC's estimated cost of equity if it changed its capital structure to 50% debt and 50% equity? Round your answer to two decimal places. Do not round Wermedia steps. 16.52 966 Check My Work Reset Problem Back 96%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts