Question: Exercise 1 (4.5 points) - What are the most common amortization methods of loan repayment? - Define the Internal return rate and explain how does

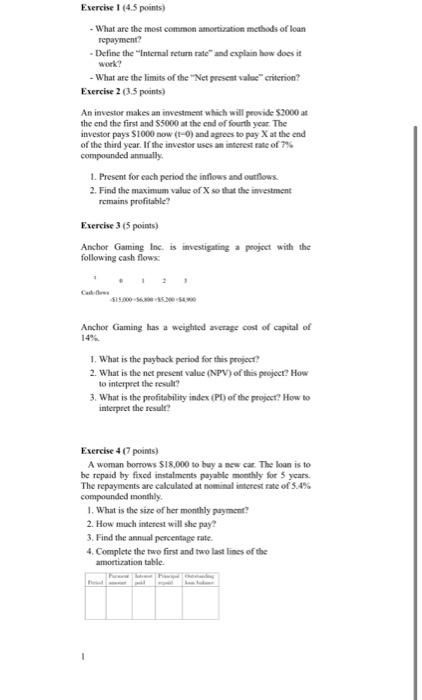

Exercise 1 (4.5 points) - What are the most common amortization methods of loan repayment? - Define the "Internal return rate" and explain how does it work? - What are the limits of the "Net present value criterion? Exercise 2 (3.5 points) An investor makes an investment which will provide $2000 at the end the first and $5000 at the end of fourth year. The investor pays $1000 now (1-0) and agrees to pay X at the end of the third year. If the investor uses an interest rate of 7% compounded annually. 1. Present for each period the inflows and outflows 2. Find the maximum value of X so that the investment remains profitable? Exercise 3 (5 points) Anchor Gaming Inc. is investigating a project with the following cash flows: Cad-des Anchor Gaming has a weighted average cost of capital of 14% 1. What is the payback period for this project? 2. What is the net present value (NPV) of this project? How to interpret the result? 3. What is the profitability index (Pl) of the project? How to interpret the result? Exercise 4 (7 points) A woman borrows $18,000 to buy a new car. The loan is to be repaid by fixed instalments payable monthly for 5 years. The repayments are calculated at nominal interest rate of 5.4% compounded monthly. 1. What is the size of her monthly payment? 2. How much interest will she pay? 3. Find the annual percentage rate. 4. Complete the two first and two last lines of the amortization table. F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts