Question: Exercise 1 A start-up firm needs $100 million to launch its product. It has already signed a contract to provide its services to one major

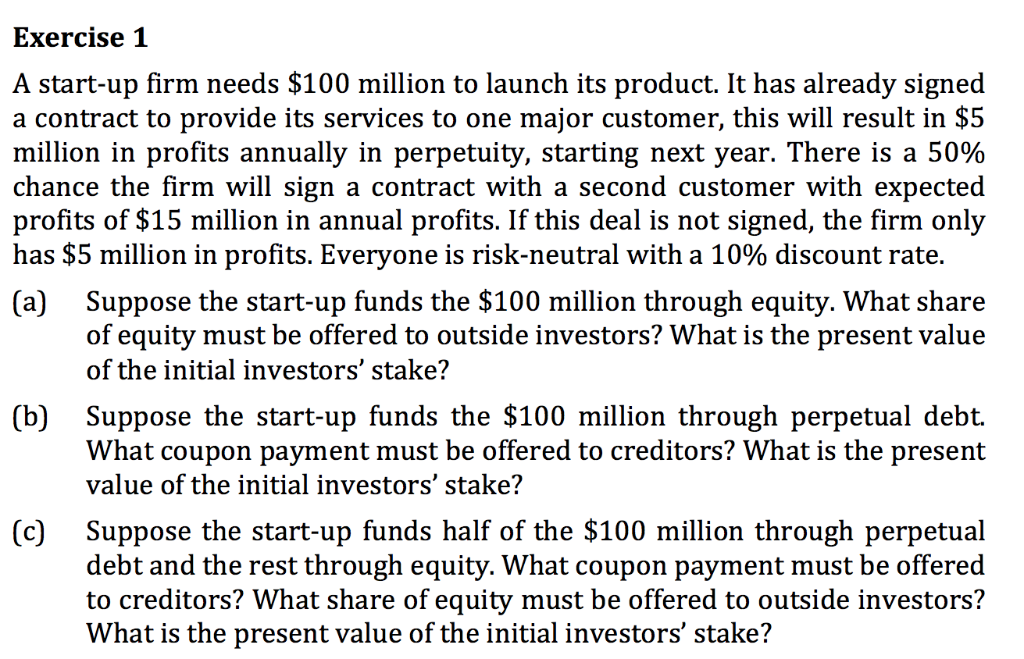

Exercise 1 A start-up firm needs $100 million to launch its product. It has already signed a contract to provide its services to one major customer, this will result in $5 million in profits annually in perpetuity, starting next year. There is a 50% chance the firm will sign a contract with a second customer with expected profits of $15 million in annual profits. If this deal is not signed, the firm only s $5 million in profits. Everyone is risk-neutral with a 10% discount rate. (a) Suppose the start-up funds the $100 million through equity. What share of equity must be offered to outside investors? What is the present value of the initial investors' stake? Suppose the start-up funds the $100 million through perpetual debt. What coupon payment must be offered to creditors? What is the present (b) value of the initial investors' stake? (c) Suppose the start-up funds half of the $100 million through perpetual debt and the rest through equity. What coupon payment must be offered to creditors? What share of equity must be offered to outside investors? What is the present value of the initial investors' stake

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts