Question: Please help me with this task 3. A start-up firm needs $100 million to launch its product. It has already signed a contract to provide

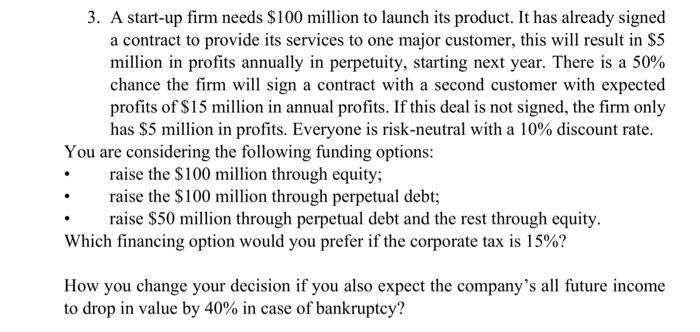

3. A start-up firm needs $100 million to launch its product. It has already signed a contract to provide its services to one major customer, this will result in $5 million in profits annually in perpetuity, starting next year. There is a 50% chance the firm will sign a contract with a second customer with expected profits of $15 million in annual profits. If this deal is not signed, the firm only has $5 million in profits. Everyone is risk-neutral with a 10% discount rate. You are considering the following funding options: raise the $100 million through equity; raise the $100 million through perpetual debt; raise $50 million through perpetual debt and the rest through equity. Which financing option would you prefer if the corporate tax is 15% ? How you change your decision if you also expect the company's all future income to drop in value by 40% in case of bankruptcy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts