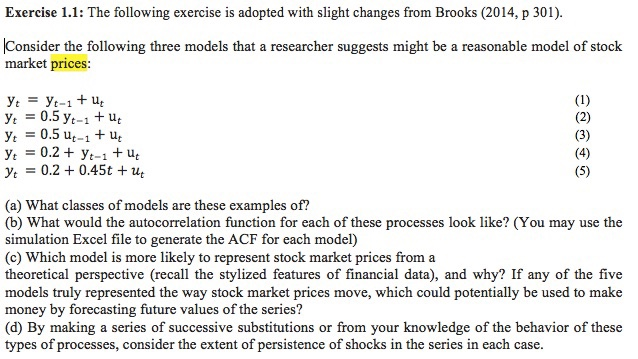

Question: Exercise 1.1: The following exercise is adopted with slight changes from Brooks (2014, p 301). Consider the following three models that a researcher suggests might

Exercise 1.1: The following exercise is adopted with slight changes from Brooks (2014, p 301). Consider the following three models that a researcher suggests might be a reasonable model of stock market prices yt = 0.5 ut-1 + ut yt0.20.45t +ut (a) What classes of models are these examples of? (b) What would the autocorrelation function for each of these processes look like? (You may use the simulation Excel file to generate the ACF for each model) (c) Which model is more likely to represent stock market prices from a theoretical perspective (recall the stylized features of financial data), and why? If any of the five model money by forecasting future values of the series? (d) By making a series of successive substitutions or from your knowledge of the behavior of these types of processes, consider the extent of persistence of shocks in the series in each case s truly represe nted the way stock market prices move, which could potentially be used to make Exercise 1.1: The following exercise is adopted with slight changes from Brooks (2014, p 301). Consider the following three models that a researcher suggests might be a reasonable model of stock market prices yt = 0.5 ut-1 + ut yt0.20.45t +ut (a) What classes of models are these examples of? (b) What would the autocorrelation function for each of these processes look like? (You may use the simulation Excel file to generate the ACF for each model) (c) Which model is more likely to represent stock market prices from a theoretical perspective (recall the stylized features of financial data), and why? If any of the five model money by forecasting future values of the series? (d) By making a series of successive substitutions or from your knowledge of the behavior of these types of processes, consider the extent of persistence of shocks in the series in each case s truly represe nted the way stock market prices move, which could potentially be used to make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts