Question: Exercise 11-52 (Static) Physical Quantities Method; Sell or Process Further (LO 11-3, 4) Forest Products, Incorporated, manufactures three products (FP-10, FP-20, and FP-40) from a

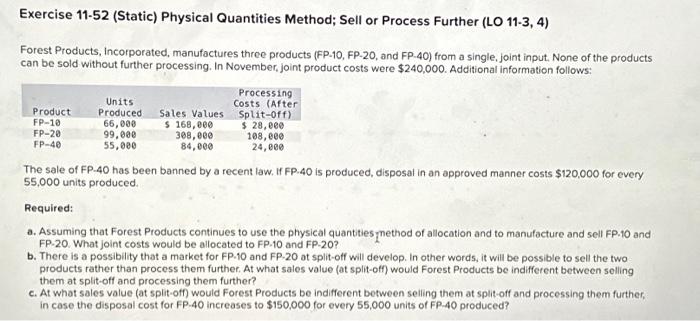

Exercise 11-52 (Static) Physical Quantities Method; Sell or Process Further (LO 11-3,4) Forest Products, Incorporated, manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were $240,000. Additional information follows: The sale of FP-40 has been banned by a recent law. If FP. 40 is produced, disposal in an approved manner costs $120,000 for every 55,000 units produced. Required: a. Assuming that Forest Products continues to use the physical quantities method of allocation and to manufacture and sell FP.10 and FP.20. What joint costs would be allocated to FP-10 and FP-20? b. There is a possibility that a market for FP.10 and FP.20 at split-off will develop. In other words, it will be possible to sell the two products rather than process them further. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further? c. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further, in case the disposal cost for FP.-40 increases to $150,000 for every 55,000 units of FP-40 produced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts