Question: Question 1: Question 2: Presented below is information related to Bonita Inc.'s inventory, assuming Bonita uses lower-of-LIFO cost-or-market. (a) The two limits to market value

Question 1:

Question 2:

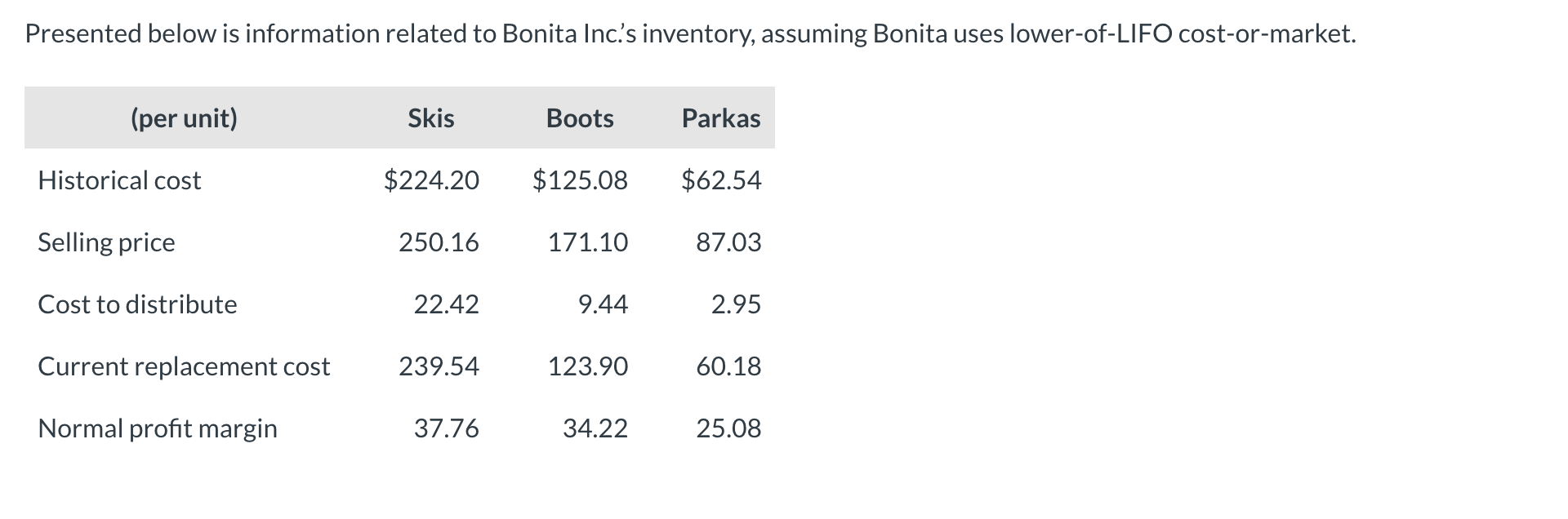

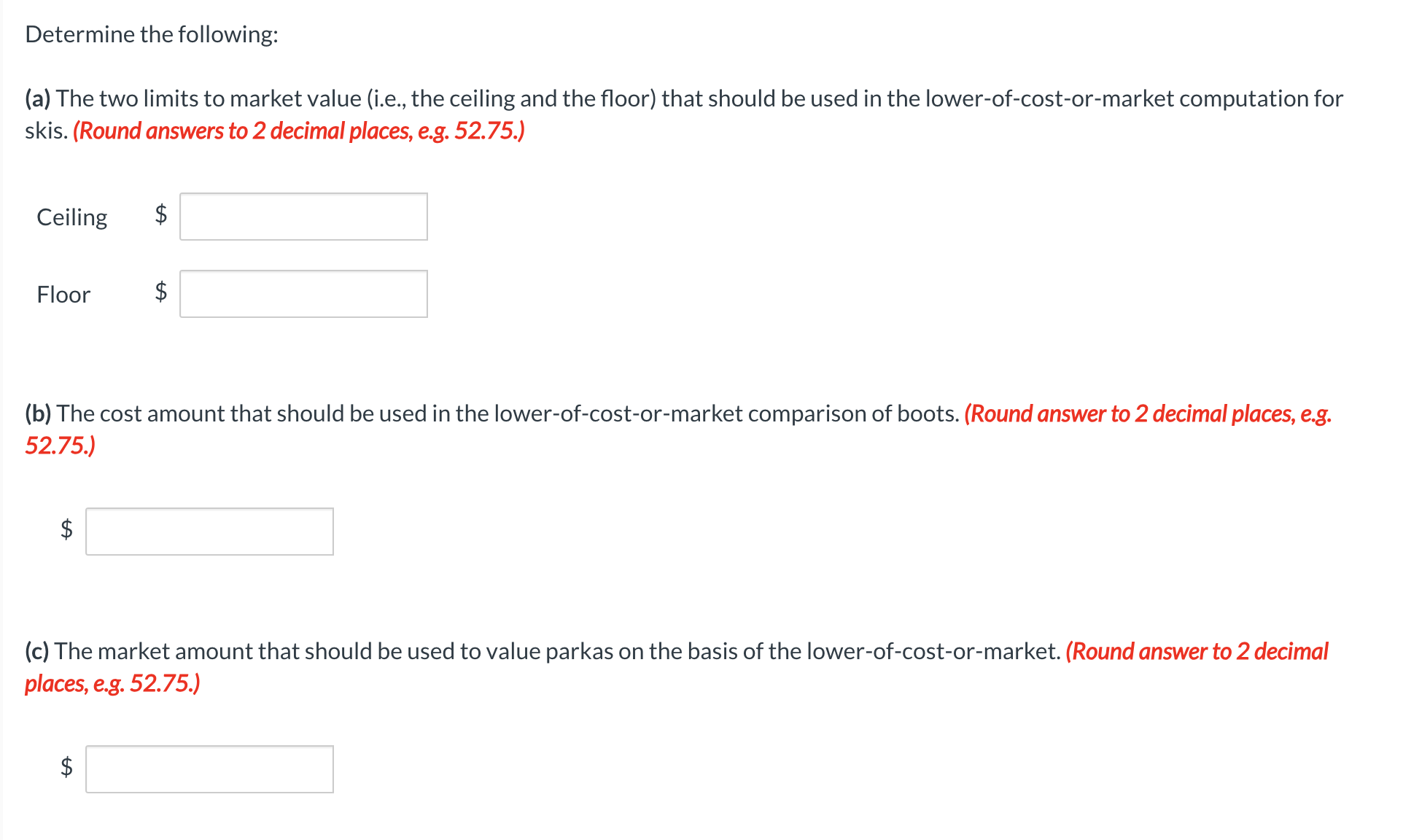

Presented below is information related to Bonita Inc.'s inventory, assuming Bonita uses lower-of-LIFO cost-or-market. (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling \$ Floor (b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answer to 2 decimal places, e.g. 52.75.) $ (c) The market amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answer to 2 decimal places, e.g. 52.75.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts