Question: Exercise (13 points) Consider a country operating under fixed exchange rates and characterized by: Consumption: C = 0.89 + 1000 ; Investment: 1 = -1001

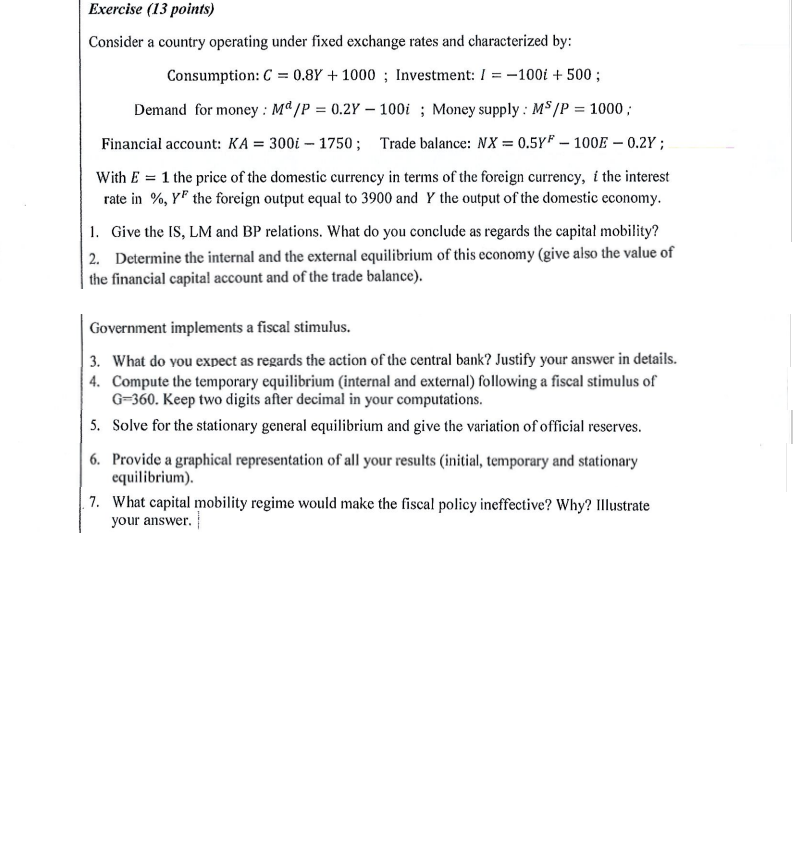

Exercise (13 points) Consider a country operating under fixed exchange rates and characterized by: Consumption: C = 0.89 + 1000 ; Investment: 1 = -1001 + 500 ; Demand for money: M/P = 0.2Y 100i ; Money supply: MS/P = 1000; Financial account: KA = 300i 1750; Trade balance: NX = 0.5YP 100E 0.27 ; With E = 1 the price of the domestic currency in terms of the foreign currency, i the interest rate in %, y the foreign output equal to 3900 and Y the output of the domestic economy. 1. Give the IS, LM and BP relations. What do you conclude as regards the capital mobility? 2. Determine the internal and the external equilibrium of this economy (give also the value of the financial capital account and of the trade balance). Government implements a fiscal stimulus. 3. What do you expect as regards the action of the central bank? Justify your answer in details. 4. Compute the temporary equilibrium (internal and external) following a fiscal stimulus of G=360. Keep two digits after decimal in your computations. 5. Solve for the stationary general equilibrium and give the variation of official reserves. 6. Provide a graphical representation of all your results (initial, temporary and stationary equilibrium). 7. What capital mobility regime would make the fiscal policy ineffective? Why? Illustrate your answer. Exercise (13 points) Consider a country operating under fixed exchange rates and characterized by: Consumption: C = 0.89 + 1000 ; Investment: 1 = -1001 + 500 ; Demand for money: M/P = 0.2Y 100i ; Money supply: MS/P = 1000; Financial account: KA = 300i 1750; Trade balance: NX = 0.5YP 100E 0.27 ; With E = 1 the price of the domestic currency in terms of the foreign currency, i the interest rate in %, y the foreign output equal to 3900 and Y the output of the domestic economy. 1. Give the IS, LM and BP relations. What do you conclude as regards the capital mobility? 2. Determine the internal and the external equilibrium of this economy (give also the value of the financial capital account and of the trade balance). Government implements a fiscal stimulus. 3. What do you expect as regards the action of the central bank? Justify your answer in details. 4. Compute the temporary equilibrium (internal and external) following a fiscal stimulus of G=360. Keep two digits after decimal in your computations. 5. Solve for the stationary general equilibrium and give the variation of official reserves. 6. Provide a graphical representation of all your results (initial, temporary and stationary equilibrium). 7. What capital mobility regime would make the fiscal policy ineffective? Why? Illustrate your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts