Question: Exercise 1.4. Consider a mean-variance portfolio model with two securities, SA and SB , where the expected return and the variance of return for Sp

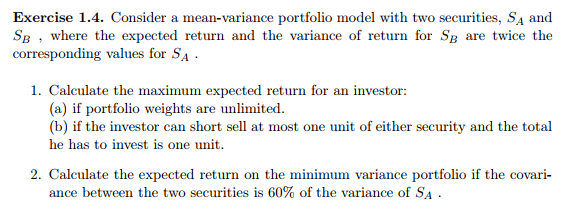

Exercise 1.4. Consider a mean-variance portfolio model with two securities, SA and SB , where the expected return and the variance of return for Sp are twice the corresponding values for SA 1. Calculate the maximum expected return for an investor: (a) if portfolio weights are unlimited. (b) if the investor can short sell at most one unit of either security and the total he has to invest is one unit 2. Calculate the expected return on the minimum variance portfolio if the covari- ance between the two securities is 60% of the variance of SA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts