Question: please assist with this question Consider a mean-variance portfolio model with two securities, with respective returns SA and SB, where the expected return E[SB]=0.25E[SA] and

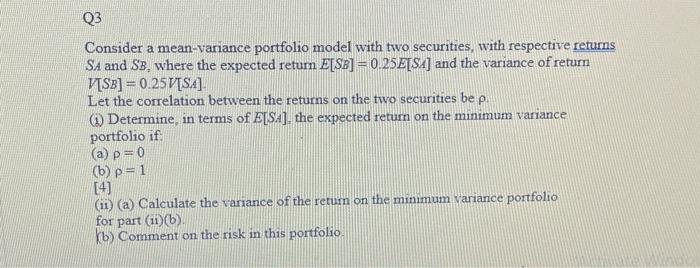

Consider a mean-variance portfolio model with two securities, with respective returns SA and SB, where the expected return E[SB]=0.25E[SA] and the variance of retum V[SB]=0.25V[SA] Let the correlation between the returns on the two securities be . (i) Determine, in terms of E[S.A], the expected return on the minimum variance portfolio if: (a) p=0 (b) =1 [4] (ii) (a) Calculate the variance of the retum on the minimum variance portfolio for part (ii)(b). (b) Comment on the risk in this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts