Question: Exercise 15-17 Overhead rate calculation, allocation, and analysis LO P3 Moonrise Bakery applies factory overhead based on direct labor costs. The company incurred the following

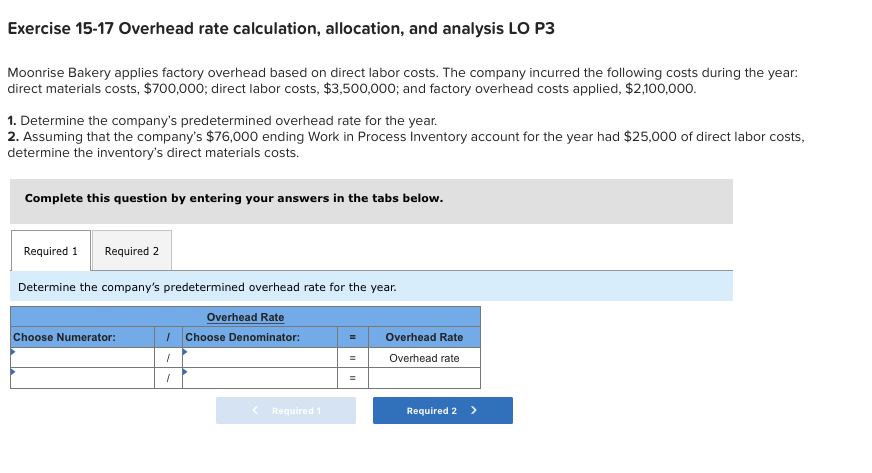

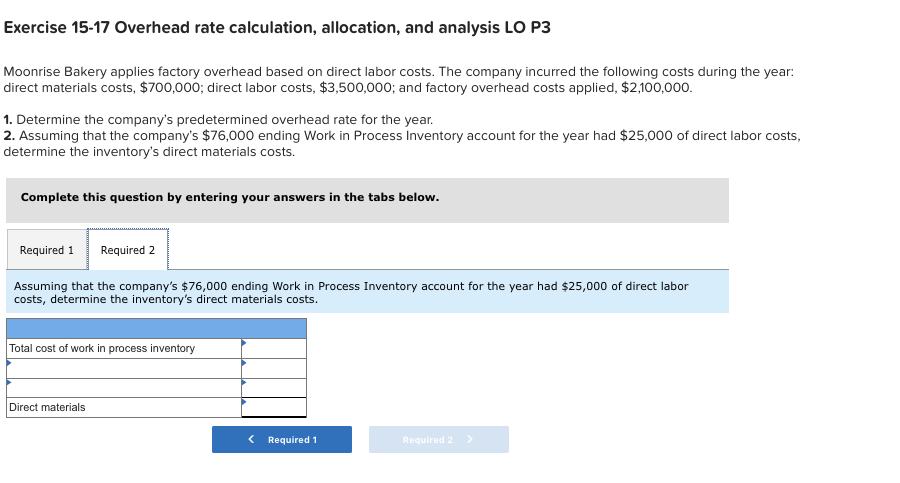

Exercise 15-17 Overhead rate calculation, allocation, and analysis LO P3 Moonrise Bakery applies factory overhead based on direct labor costs. The company incurred the following costs during the year: direct materials costs, $700,000; direct labor costs, $3,500,000; and factory overhead costs applied, $2,100,000. 1. Determine the company's predetermined overhead rate for the year. 2. Assuming that the company's $76,000 ending Work in Process Inventory account for the year had $25,000 of direct labor costs, determine the inventory's direct materials costs. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the company's predetermined overhead rate for the year. Overhead Rate Choose Denominator: Choose Numerator: I = Overhead Rate Overhead rate ( Required 1 Required 2 > Exercise 15-17 Overhead rate calculation, allocation, and analysis LO P3 Moonrise Bakery applies factory overhead based on direct labor costs. The company incurred the following costs during the year: direct materials costs, $700,000; direct labor costs, $3,500,000; and factory overhead costs applied, $2,100,000. 1. Determine the company's predetermined overhead rate for the year. 2. Assuming that the company's $76,000 ending Work in Process Inventory account for the year had $25,000 of direct labor costs, determine the inventory's direct materials costs. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming that the company's $76,000 ending Work in Process Inventory account for the year had $25,000 of direct labor costs, determine the inventory's direct materials costs. Total cost of work in process inventory Direct materials Required 1 Required 2 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts