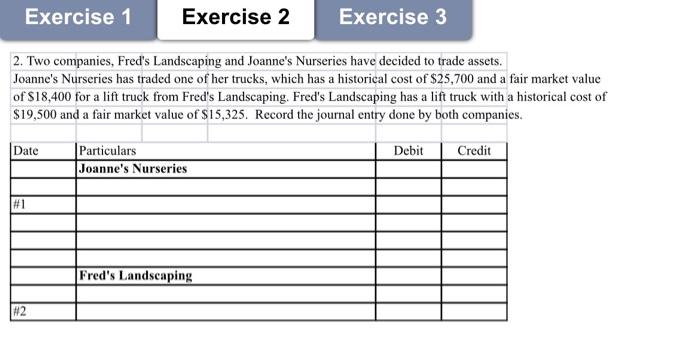

Question: exercise 2 Exercise 1 Exercise 2 Exercise 3 2. Two companies, Fred's Landscaping and Joanne's Nurseries have decided to trade assets. Joanne's Nurseries has traded

Exercise 1 Exercise 2 Exercise 3 2. Two companies, Fred's Landscaping and Joanne's Nurseries have decided to trade assets. Joanne's Nurseries has traded one of her trucks, which has a historical cost of $25,700 and a fair market value of $18,400 for a lift truck from Fred's Landscaping. Fred's Landscaping has a lift truck with a historical cost of $19,500 and a fair market value of $15,325. Record the journal entry done by both companies, Date Debit Credit Particulars Joanne's Nurseries #1 Fred's Landscaping #2 Exercise 1 Exercise 2 Exercise 3 2. Two companies, Fred's Landscaping and Joanne's Nurseries have decided to trade assets. Joanne's Nurseries has traded one of her trucks, which has a historical cost of $25,700 and a fair market value of $18,400 for a lift truck from Fred's Landscaping. Fred's Landscaping has a lift truck with a historical cost of $19,500 and a fair market value of $15,325. Record the journal entry done by both companies, Date Debit Credit Particulars Joanne's Nurseries #1 Fred's Landscaping #2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts