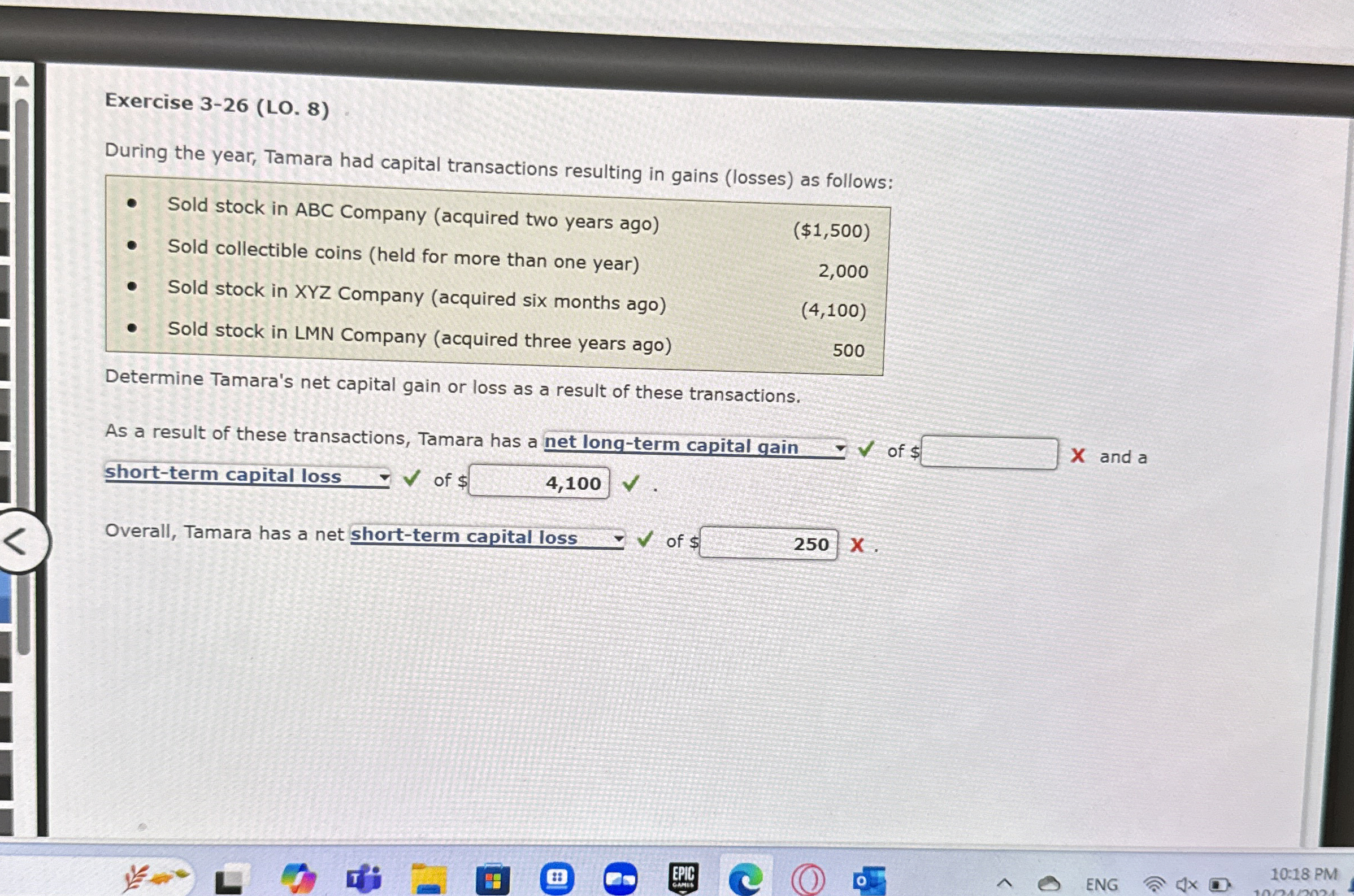

Question: Exercise 3 - 2 6 ( LO . 8 ) During the year, Tamara had capital transactions resulting in gains ( losses ) as follows:

Exercise LO

During the year, Tamara had capital transactions resulting in gains losses as follows:

Sold stock in ABC Company acquired two years ago

Sold collectible coins held for more than one year

$

Sold stock in XYZ Company acquired six months ago

Sold stock in LMN Company acquired three years ago

Determine Tamara's net capital gain or loss as a result of these transactions.

As a result of these transactions, Tamara has a net longterm capital gain of X and a shortterm capital loss of $

Overall, Tamara has a net shortterm capital loss of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock