Question: how do you solve this ? QUESTION 17 A stock is expected to pay dividends of $1.45 per share in Year 1 and $1.68 per

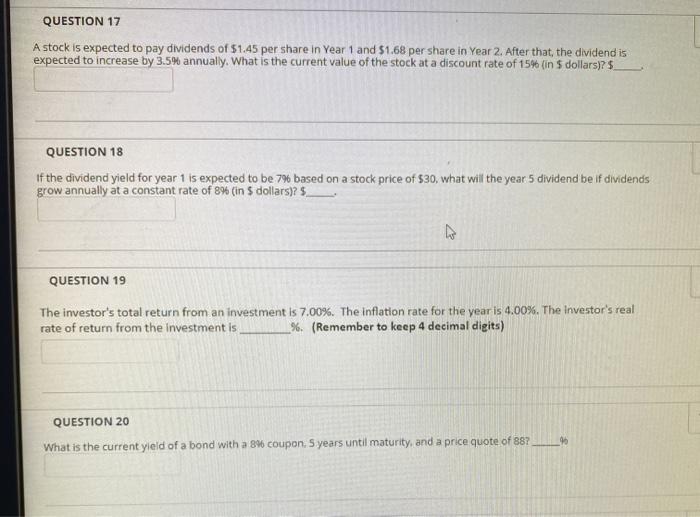

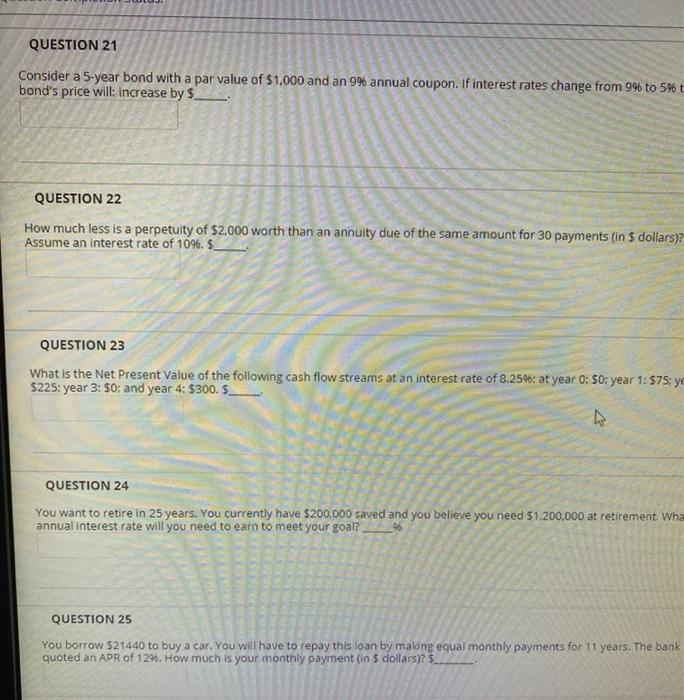

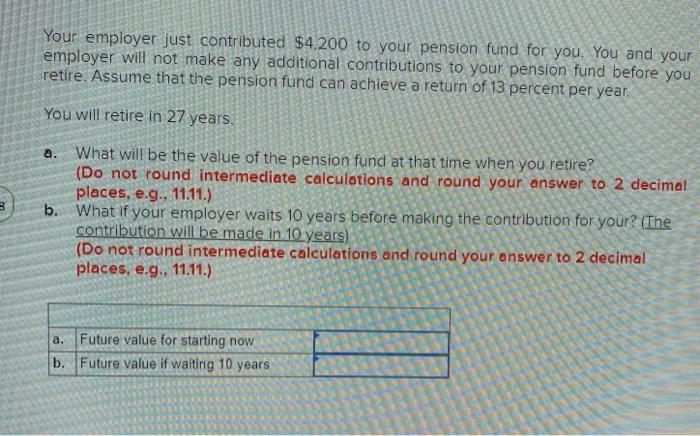

QUESTION 17 A stock is expected to pay dividends of $1.45 per share in Year 1 and $1.68 per share in Year 2. After that, the dividend is expected to increase by 3.5% annually. What is the current value of the stock at a discount rate of 15% (in $ dollars)? $ QUESTION 18 If the dividend yield for year 1 is expected to be 7% based on a stock price of $30, what will the year 5 dividend be if dividends grow annually at a constant rate of 8% (in $ dollars)? 5 QUESTION 19 The investor's total return from an investment is 7.00%. The inflation rate for the year is 4.00%. The investor's real rate of return from the investment is %. (Remember to keep 4 decimal digits) QUESTION 20 90 What is the current yield of a bond with a 8% coupon. 5 years until maturity, and a price quote of 887 QUESTION 21 Consider a 5-year bond with a par value of $1,000 and an 9% annual coupon. If interest rates change from 9% to 5% bond's price will increase by $. QUESTION 22 How much less is a perpetuity of $2,000 worth than an annuity due of the same amount for 30 payments (in $ dollars)? Assume an interest rate of 10%. $. QUESTION 23 What is the Net Present Value of the following cash flow streams at an interest rate of 8.2596: at year 0:50: year 1:575: ye $225: year 3: 50; and year 4: $300. S QUESTION 24 You want to retire in 25 years. You currently have $200.000 saved and you believe you need $1.200.000 at retirement Wha annual interest rate will you need to earn to meet your goal? 96 QUESTION 25 You borrow 521440 to buy a car. You will have to repay this loan by making equal monthly payments for 11 years. The bank quoted an APR of 1296. How much is your monthly payment in $ dollars)? $_ Your employer just contributed $4,200 to your pension fund for you. You and your employer will not make any additional contributions to your pension fund before you retire. Assume that the pension fund can achieve a return of 13 percent per year. You will retire in 27 years. a. 3 What will be the value of the pension fund at that time when you retire? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 11.11.) b. What if your employer waits 10 years before making the contribution for your? (The contribution will be made in 10 years) (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 11.11.) a. Future value for starting now b. Future value if waiting 10 years

Step by Step Solution

There are 3 Steps involved in it

Lets address each question stepbystep Starting with Question 17 Question 17Calculate the current value of the stock given the dividends and a discount rate of 15Step 1 Calculate the Present Value of D... View full answer

Get step-by-step solutions from verified subject matter experts