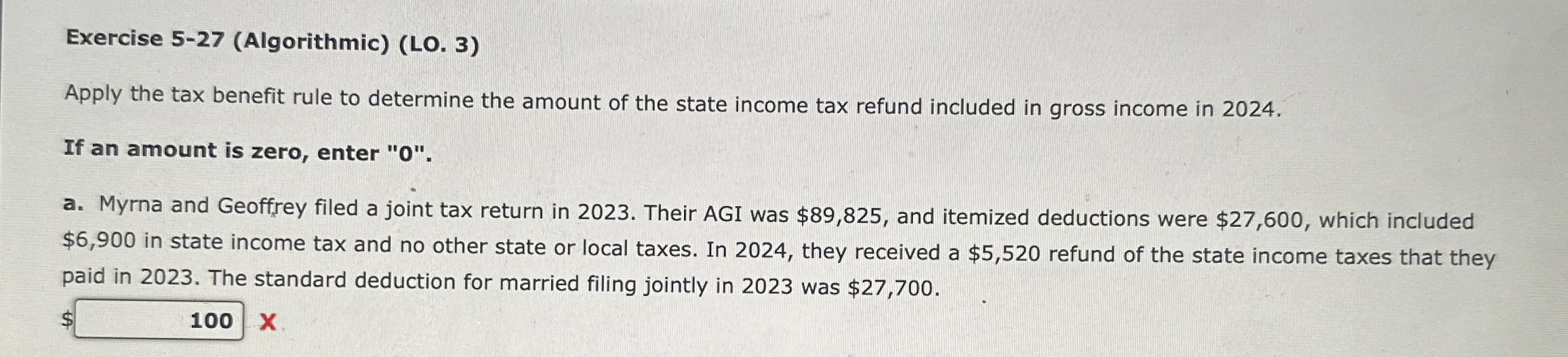

Question: Exercise 5 - 2 7 ( Algorithmic ) ( LO . 3 ) Apply the tax benefit rule to determine the amount of the state

Exercise AlgorithmicLO

Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in

If an amount is zero, enter

a Myrna and Geoffrey filed a joint tax return in Their AGI was $ and itemized deductions were $ which included

$ in state income tax and no other state or local taxes. In they received a $ refund of the state income taxes that they

paid in The standard deduction for married filing jointly in was $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock