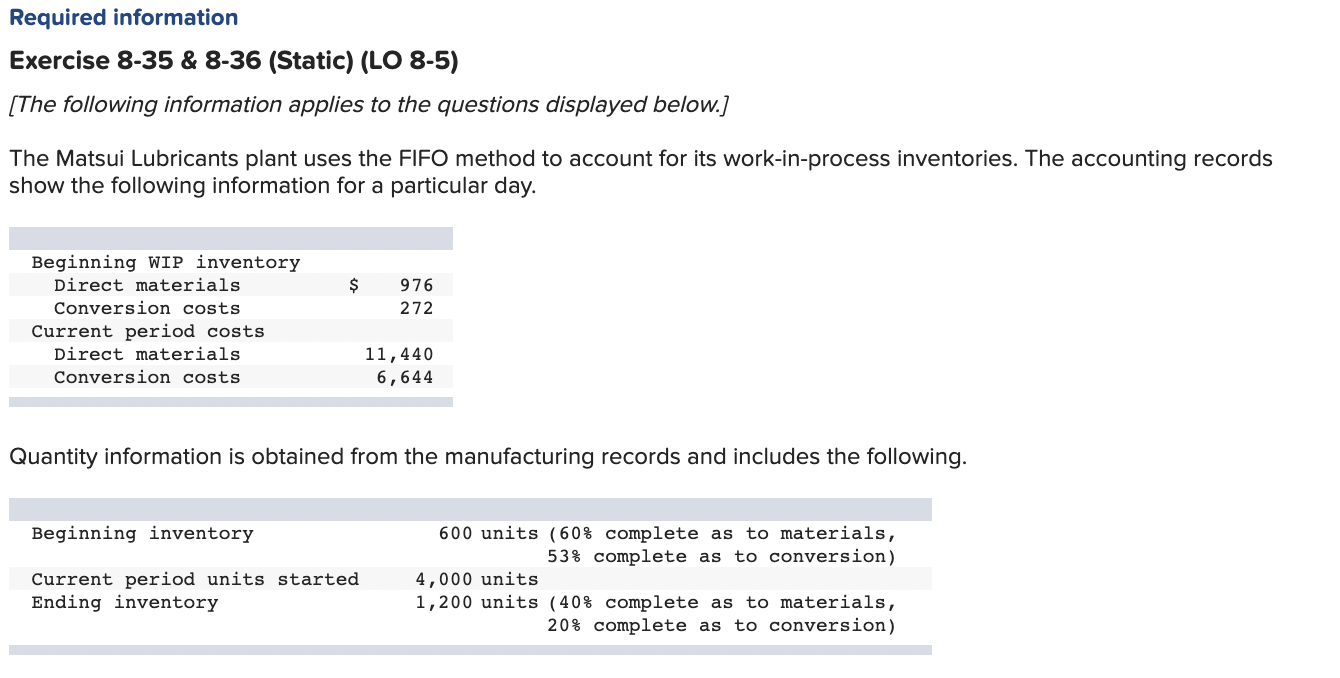

Question: Exercise 8-35 & 8-36 (Static) (LO 8-5) [The following information applies to the questions displayed below.] The Matsui Lubricants plant uses the FIFO method to

![to the questions displayed below.] The Matsui Lubricants plant uses the FIFO](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e58ac50ec58_30066e58ac480088.jpg)

Exercise 8-35 \& 8-36 (Static) (LO 8-5) [The following information applies to the questions displayed below.] The Matsui Lubricants plant uses the FIFO method to account for its work-in-process inventories. The accounting records show the following information for a particular day. Quantity information is obtained from the manufacturing records and includes the following. Exercise 8-36 (Static) Assign Costs to Goods Transferred Out and Ending Inventory: FIFO Method (LO 85) Compute the cost of goods transferred out and the ending inventory using the FIFO method. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock