Question: Exercise Three - 1 Subject: Bonus Neelson Inc. has a September 30 year end. On August 1, 2019, it declares a bonus of $100,000

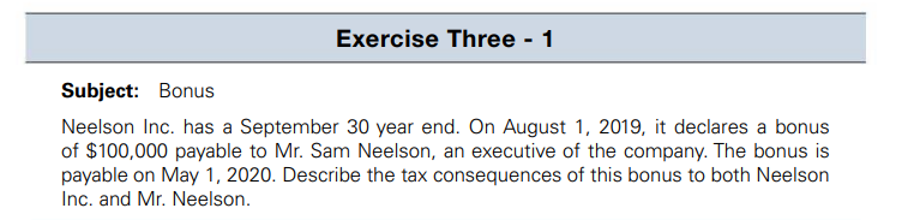

Exercise Three - 1 Subject: Bonus Neelson Inc. has a September 30 year end. On August 1, 2019, it declares a bonus of $100,000 payable to Mr. Sam Neelson, an executive of the company. The bonus is payable on May 1, 2020. Describe the tax consequences of this bonus to both Neelson Inc. and Mr. Neelson.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

The image is of a question about the tax consequences of a bonus The question is Exercise Three 1 Su... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock