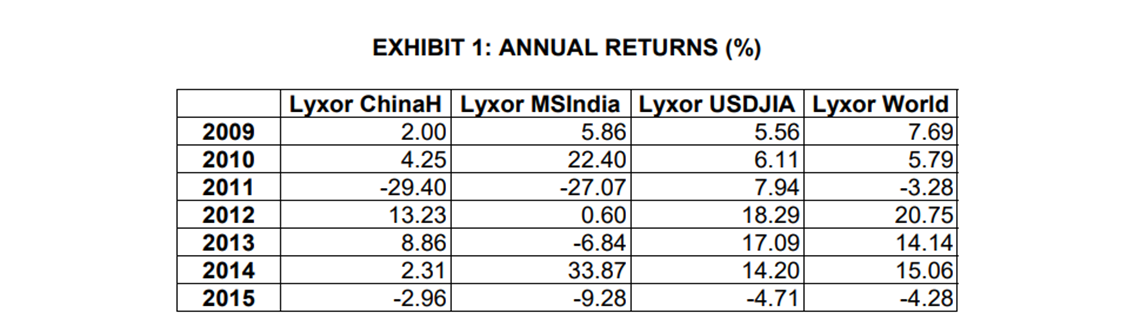

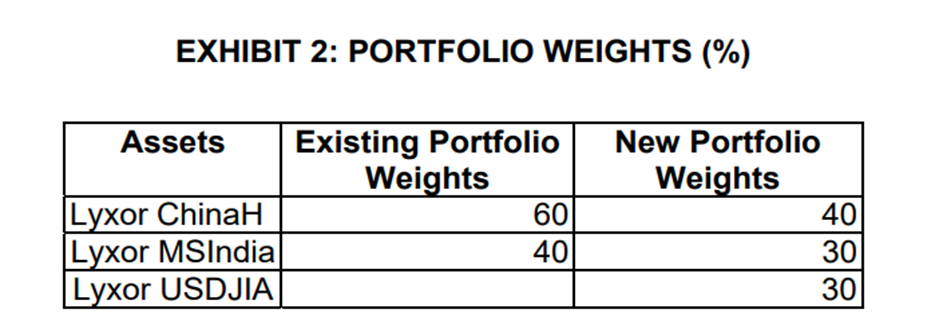

Question: EXHIBIT 1: ANNUAL RETURNS (%) EXHIBIT 2: PORTFOLIO WEIGHTS (%) 1. Using the annual return data in Exhibit 1, calculate the average return and standard

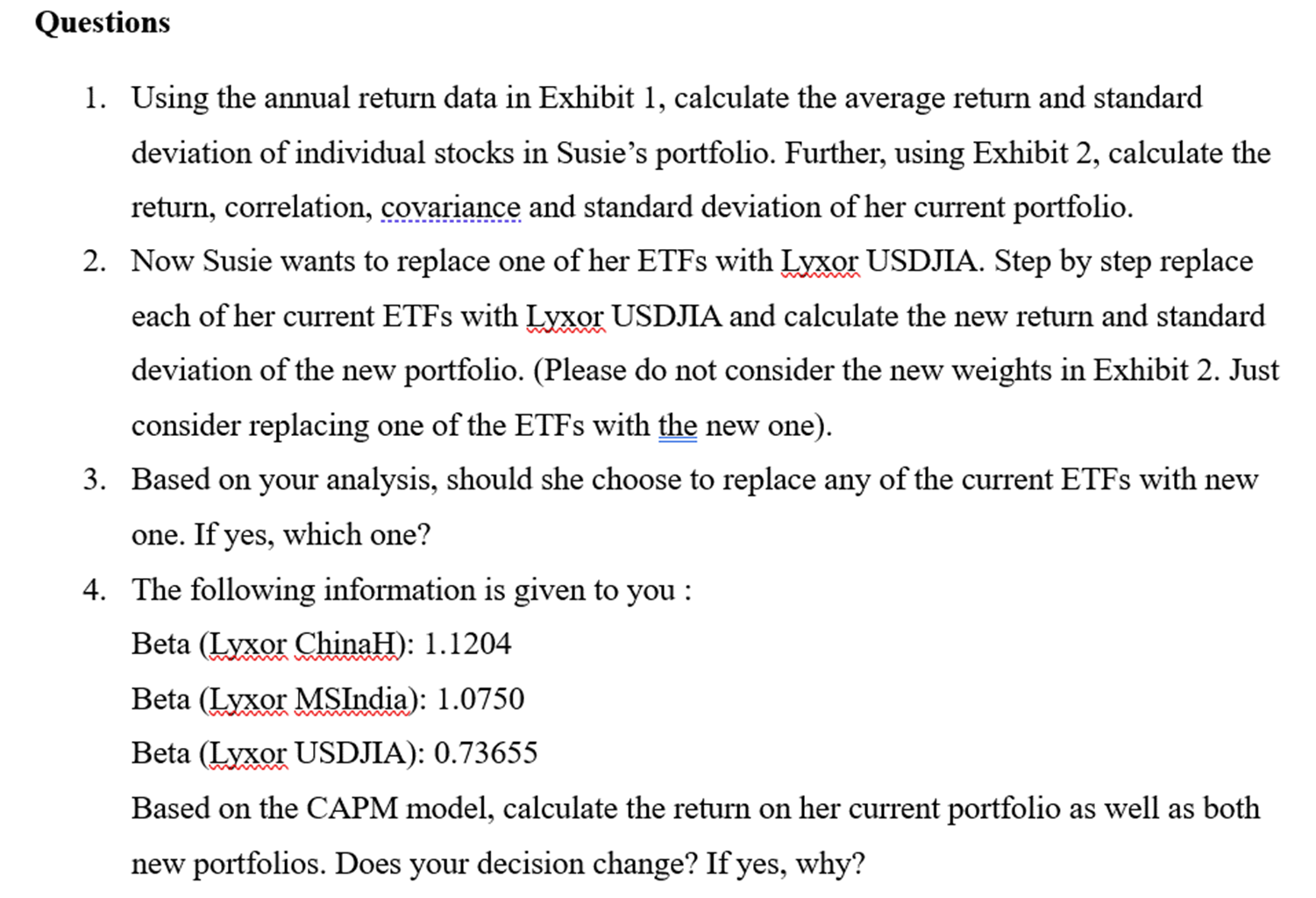

EXHIBIT 1: ANNUAL RETURNS (\%) EXHIBIT 2: PORTFOLIO WEIGHTS (\%) 1. Using the annual return data in Exhibit 1, calculate the average return and standard deviation of individual stocks in Susie's portfolio. Further, using Exhibit 2, calculate the return, correlation, covariance and standard deviation of her current portfolio. 2. Now Susie wants to replace one of her ETFs with Lyxor USDJIA. Step by step replace each of her current ETFs with Lyxor USDJA and calculate the new return and standard deviation of the new portfolio. (Please do not consider the new weights in Exhibit 2. Just consider replacing one of the ETFs with the new one). 3. Based on your analysis, should she choose to replace any of the current ETFs with new one. If yes, which one? 4. The following information is given to you : Beta (Lyxor ChinaH): 1.1204 Beta (Lyxor MSIndia): 1.0750 Beta (Lyxor USDJIA): 0.73655 Based on the CAPM model, calculate the return on her current portfolio as well as both new portfolios. Does your decision change? If yes, why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts