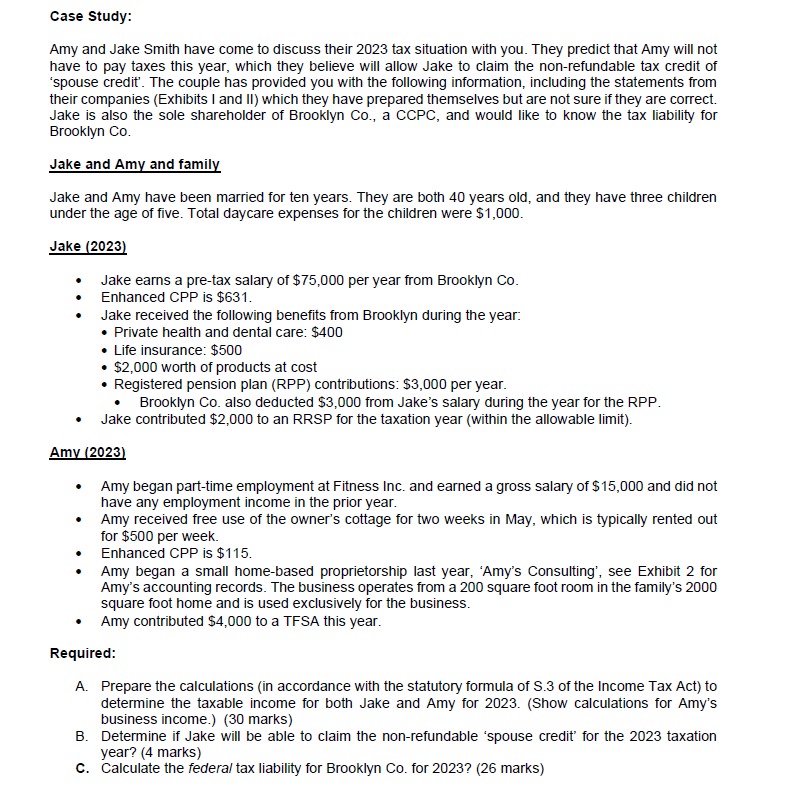

Question: Exhibit I - Brooklyn Co . begin { tabular } { | c | c | c | } hline & 2 0

Exhibit I Brooklyn Co

begintabularccc

hline & &

hline Revenue from manufacturing and sales & $ & $

hline Dividend income from a taxable Canadian corporation & $ & $

hline Investment interest income & $ & $

hline Cost of goods sold & $ & $

hline Gross profit & $ & $

hline Employees' salaries, wages, and associated costs & $ & $

hline Other administrative costs & $ & $

hline Net income before interest and amortization & $ & $

hline Interest expense & $ & $

hline Amortization & $ & $

hline Net income after interest and amortization & $ & $

hline

endtabular

Other information:

Capital cost allowance calculations totaled $ in and $ in

In a bonus was announced for Jake's key employee, equal to a total of of the annual revenue from manufacturing and sales. The bonus has been structured to be distributed in two equal payments during on January text st and November text th and has been included in the employees' costs.

Cost of goods sold and other administrative costs adhere to the rules of the Income Tax Act.

Interest expense is compliant with Section c of the Income Tax Act.

Brooklyn Cos revenue from manufacturing and sales is from active business.

The dividends were received from a public corporation, of which Brooklyn owns less than of the shares.

Brooklyn did not pay any dividends in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock