Question: expected to be less robust at 2 0 , 0 0 0 . And, sales in the final 6 months of the expected life cycle

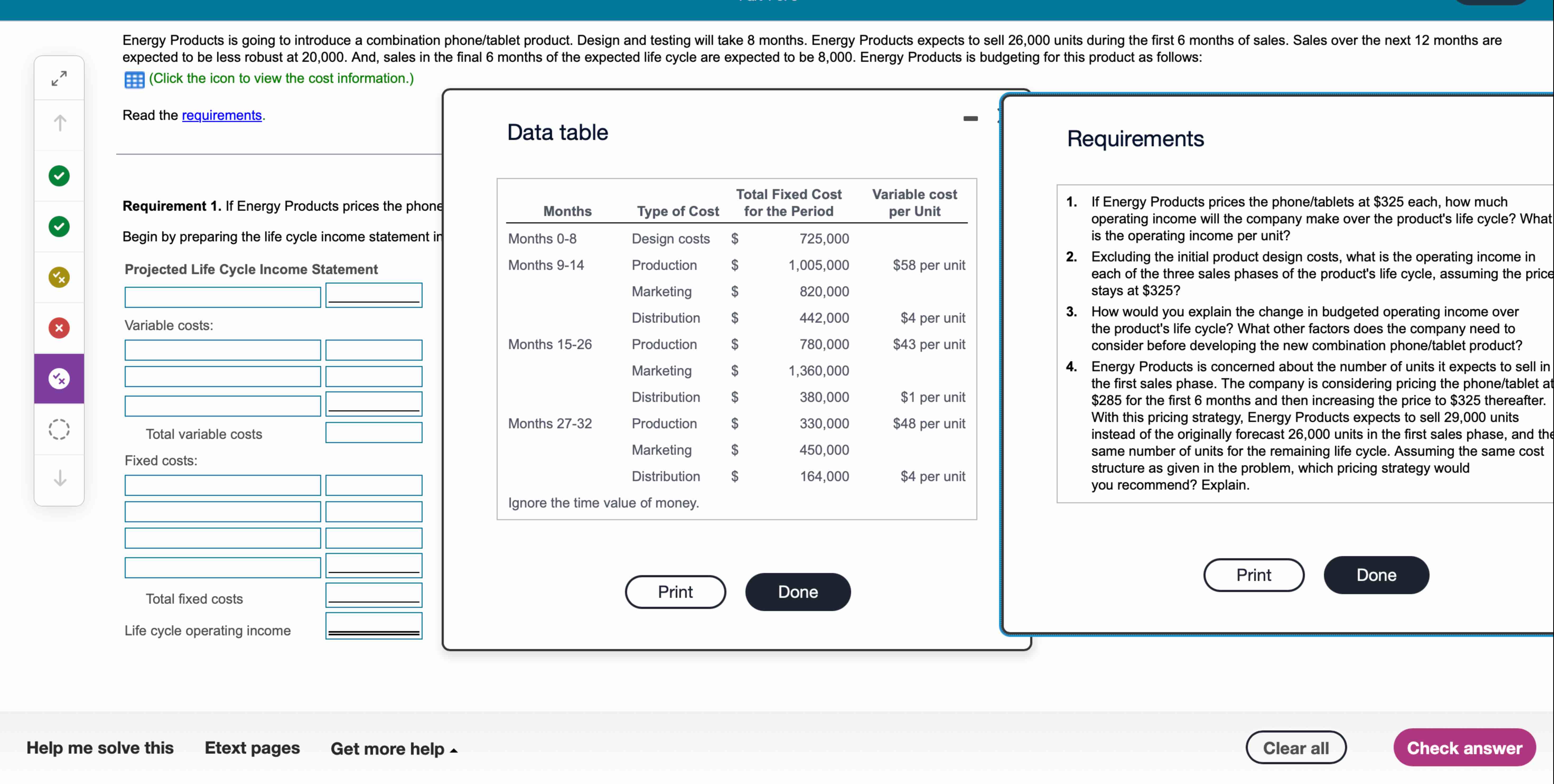

expected to be less robust at And, sales in the final months of the expected life cycle are expected to be Energy Products is budgeting for this product as follows:

Click the icon to view the cost information.

Read the requirements.

Requirement If Energy Products prices the phone

Begin by preparing the life cycle income statement in

Projected Life Cycle Income Statement

Variable costs:

Total variable costs

Fixed costs:

Total fixed costs

Life cycle operating income

Requirements

If Energy Products prices the phonetablets at $ each, how much operating income will the company make over the product's life cycle? What is the operating income per unit?

Excluding the initial product design costs, what is the operating income in each of the three sales phases of the product's life cycle, assuming the price stays at $

How would you explain the change in budgeted operating income over the product's life cycle? What other factors does the company need to consider before developing the new combination phonetablet product?

Energy Products is concerned about the number of units it expects to sell in the first sales phase. The company is considering pricing the phonetablet at $ for the first months and then increasing the price to $ thereafter. With this pricing strategy, Energy Products expects to sell units instead of the originally forecast units in the first sales phase, and the same number of units for the remaining life cycle. Assuming the same cost structure as given in the problem, which pricing strategy would you recommend? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock