Question: Explain and calculate the differences resulting from a $2,000 tax credit versus a $2,000 tax deduction for a single t income. The standard deduction in

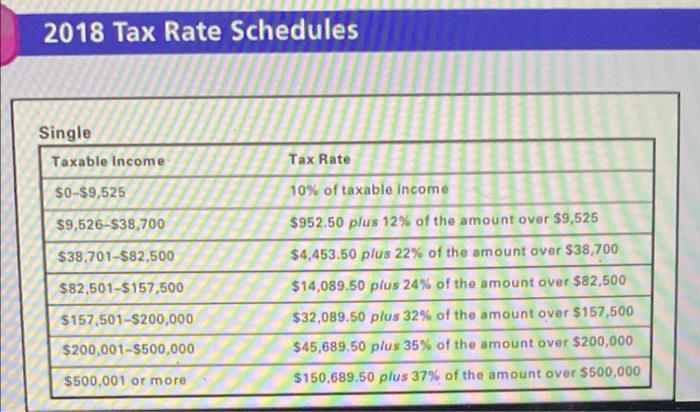

Explain and calculate the differences resulting from a $2,000 tax credit versus a $2,000 tax deduction for a single t income. The standard deduction in 2018 was $12,000 for single. Note that personal exemptions were suspended for the corresponding tax rate. Round the answers to the nearest cent. After-tax Income (Tax Deduction) After-tax Income (Tax Credit) VA xemption es resulting from a $2,000 tax credit versus a $2,000 tax deduction for a single taxpayer with $46,000 of pre-tax 2018 was $12,000 for single. Note that personal exemptions were suspended for 2018. Use Exhibit 3.3 to determine the answers to the nearest cent. Grade it Now Save & Continue Continue without saving 2018 Tax Rate Schedules Single Taxable Income Tax Rate $0-$9,525 10% of taxable income $9,526-$38,700 $952.50 plus 12% of the amount over $9,525 $38.701-$82,500 $4,453.50 plus 22% of the amount over $38,700 $82,501-$157,500 $157,501-$200,000 $14,089.50 plus 24% of the amount over $82,500 $32,089.50 plus 32% of the amount over $157,500 $45,689.50 plus 35% of the amount over $200,000 $200,001-$500,000 $500,001 or more $150,689.50 plus 37% of the amount over $500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts