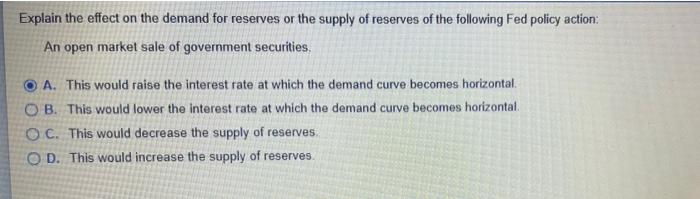

Question: Explain the effect on the demand for reserves or the supply of reserves of the following Fed policy action: An open market sale of government

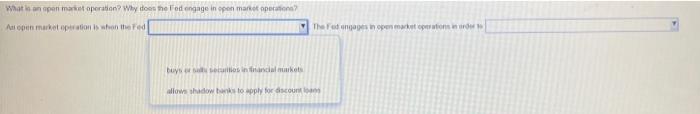

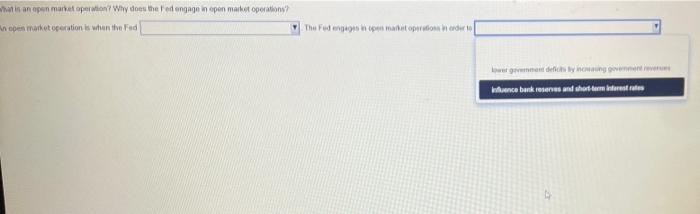

Explain the effect on the demand for reserves or the supply of reserves of the following Fed policy action: An open market sale of government securities. A. This would raise the interest rate at which the demand curve becomes horizontal. OB. This would lower the interest rate at which the demand curve becomes horizontal. OC. This would decrease the supply of reserves. OD. This would increase the supply of reserves. What is an open market operation? Why does the Fed engage in open market operations? An open market operation is when the Fed The Fed engages in open market operations in order to buys or sa securities in financial markets allows shadow banks to apply for discount loans What is an open market operation? Why does the Fed engage in open market operations? An open market operation is when the Fed The Fed engeges in open market operations in order to lower gremment defichs by incwasing government revere influence bank reserves and short-term interest rates

Step by Step Solution

There are 3 Steps involved in it

To understand the effect of an open market sale of government securities by the Federal Reserve Fed ... View full answer

Get step-by-step solutions from verified subject matter experts