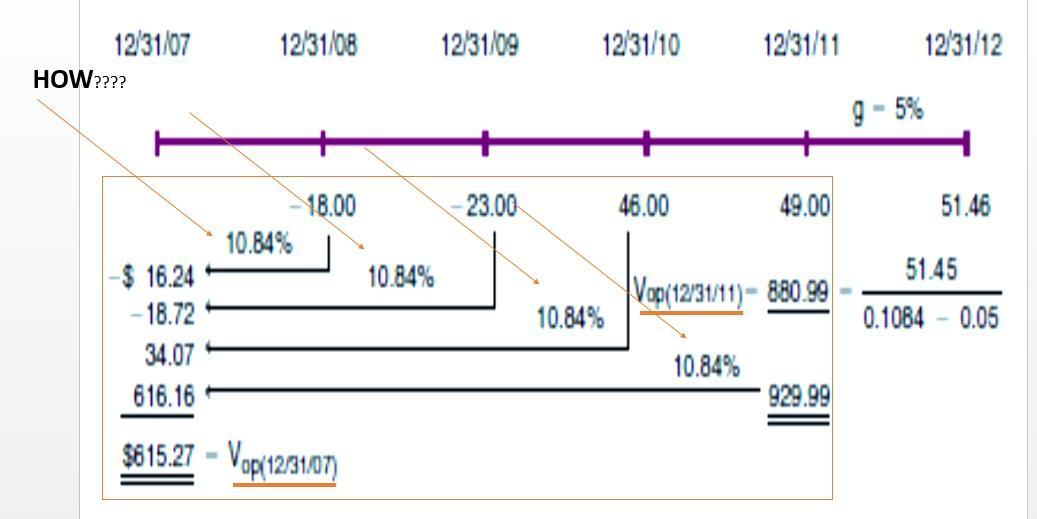

Question: EXPLAIN THE WHOLE ANSWER IN WORDS STEP BY STEP, ESPECIALLY THE LAST IMAGE WHERE THERE IS ASKED HOW?? EXPLAIN THE WHOLE IMAGE THROUGH PROPER FINANCIAL

EXPLAIN THE WHOLE ANSWER IN WORDS STEP BY STEP, ESPECIALLY THE LAST IMAGE WHERE THERE IS ASKED HOW?? EXPLAIN THE WHOLE IMAGE THROUGH PROPER FINANCIAL ACCOUNTING TERMS AND GIVE REASONS

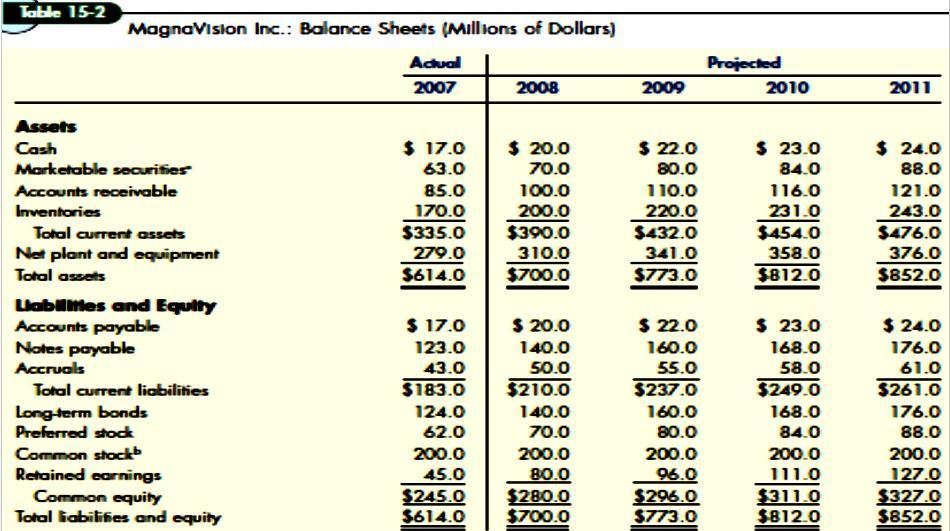

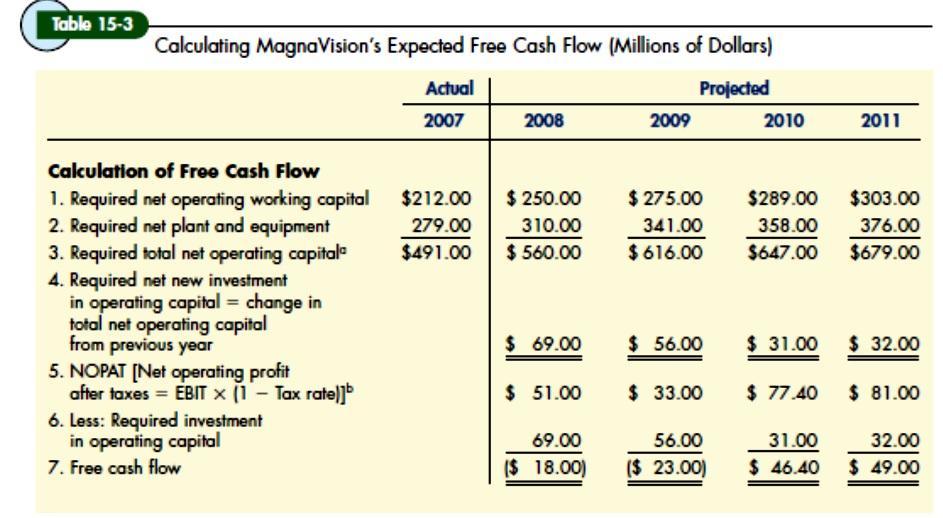

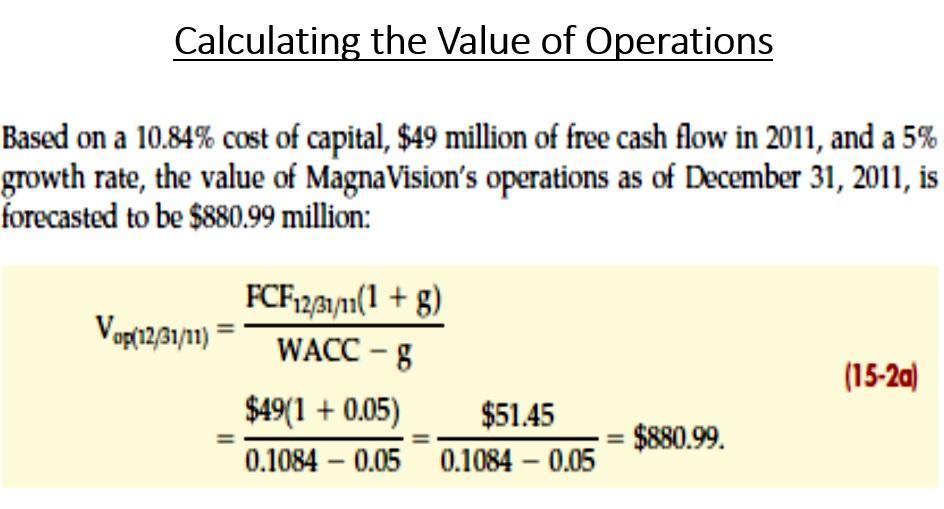

Table 15-2 Assets Cash MagnaVision Inc.: Balance Sheets (Millions of Dollars) Marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Preferred stock Common stockb Retained earnings Common equity Total liabilities and equity Actual 2007 $ 17.0 63.0 85.0 170.0 $335.0 279.0 $614.0 $ 17.0 123.0 43.0 $183.0 124.0 62.0 200.0 45.0 $245.0 $614.0 2008 $ 20.0 70.0 100.0 200.0 $390.0 310.0 $700.0 $ 20.0 140.0 50.0 $210.0 140.0 70.0 200.0 80.0 $280.0 $700.0 2009 $ 22.0 80.0 110.0 220.0 $432.0 341.0 $773.0 $ 22.0 160.0 55.0 $237.0 160.0 80.0 200.0 96.0 $296.0 $773.0 Projected 2010 $ 23.0 84.0 116.0 231.0 $454.0 358.0 $812.0 $ 23.0 168.0 58.0 $249.0 168.0 84.0 200.0 111.0 $311.0 $812.0 2011 $ 24.0 88.0 121.0 243.0 $476.0 376.0 $852.0 $ 24.0 176.0 61.0 $261.0 176.0 88.0 200.0 127.0 $327.0 $852.0

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

ANSWER Lets go through the explanation stepbystep 1 Solving the Economic Order Quantity EOQ and Periodic Order Quantity POQ The case study mentions th... View full answer

Get step-by-step solutions from verified subject matter experts