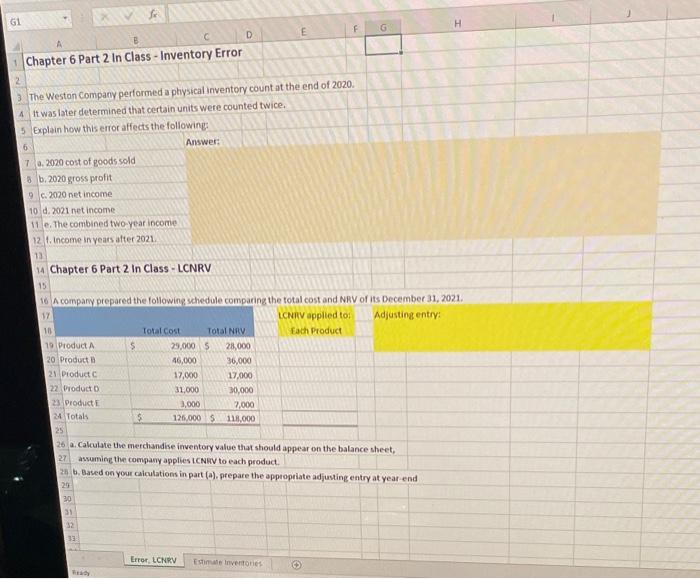

Question: F G GI H D Chapter 6 Part 2 In Class - Inventory Error 2 The Weston Company performed a physical inventory count at the

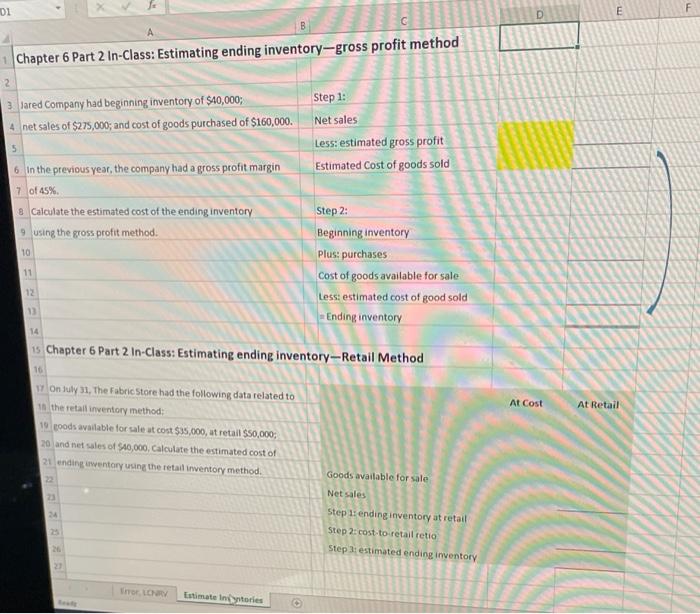

F G GI H D Chapter 6 Part 2 In Class - Inventory Error 2 The Weston Company performed a physical inventory count at the end of 2020 4 It was later determined that certain units were counted twice, 5 Explain how this error affects the following: 5 Answer: 7 0.2020 cost of goods sold b.2020 gross profit 9c2020 net income 10 d.2021 net income 11 . The combined two year income 12. 1. Income in years after 2021 13 14 Chapter 6 Part 2 In Class - LCNRV 15 16 A company prepared the following schedule comparing the total cost and NRV of its December 31, 2021 17 LCNRV applied to: Adjusting entry: 10 Total Cost Total NRV Each Product 19 Product $ 29,0005 28,000 20 Product 46,000 36.000 21 Product 17,000 17,000 22 Product 31,000 30,000 23 Product 3,000 2.000 Totals $ 126.000 118.000 26 a.calculate the merchandise inventory value that should appear on the balance sheet, 27 assuming the company applies CNRV to each product. 23 6. Based on your calculations in part(a), prepare the appropriate adjusting entry at year end 20 30 31 33 Error LCNRV Esimene stories 01 E Chapter 6 Part 2 In-Class: Estimating ending inventory-gross profit method 2 3. Jared Company had beginning inventory of $40,000; A net sales of $275,000; and cost of goods purchased of $160,000. Step 1: Net sales Less: estimated gross profit Estimated Cost of goods sold 5 6. In the previous year, the company had a gross profit margin 7 of 45%. & Calculate the estimated cost of the ending inventory 9 using the gross profit method. 10 Step 2: Beginning inventory Plus: purchases Cost of goods available for sale less: estimated cost of good sold - Ending inventory 11 12 13 14 at cost At Cost At Retail 19 Chapter 6 Part 2 In-Class: Estimating ending inventory--Retail Method 16 17 On July 31, The Fabric Store had the following data related to 10 the retail inventory method: 19 goods available for sale at cost $35,000, at retail $50,000, 20 and net sales of $40,000. Calculate the estimated cost of 21 ending inwentary using the retail inventory method. Goods available for sale Net sales 23 Step 1: ending inventory at retail Step 2: cost-to-retailretio Step 1: estimated ending inventory 24 2 26 2 irror LONRY Estimate in stories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts