Answered step by step

Verified Expert Solution

Question

1 Approved Answer

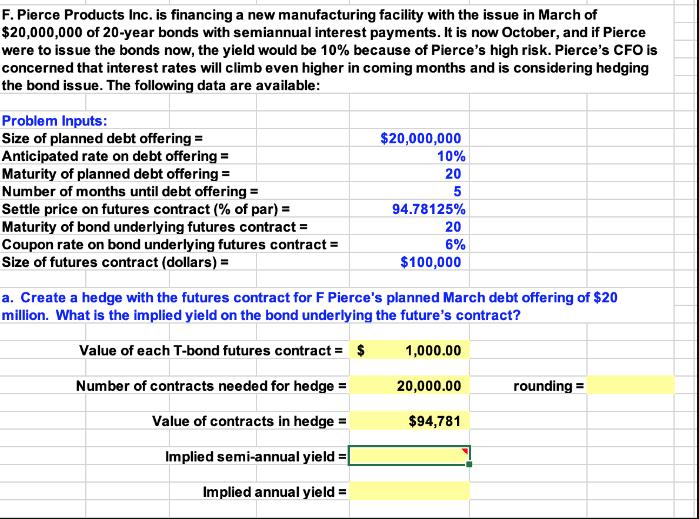

F. Pierce Products Inc. is financing a new manufacturing facility with the issue in March of $20,000,000 of 20-year bonds with semiannual interest payments.

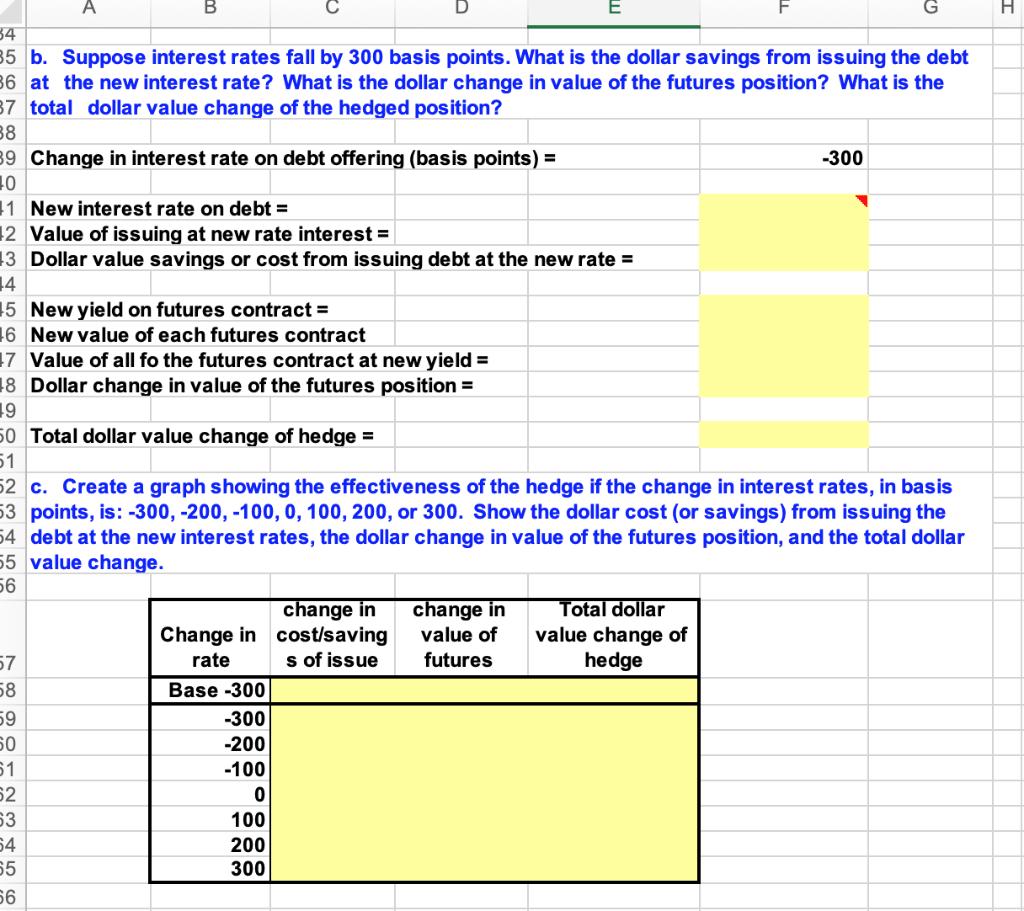

F. Pierce Products Inc. is financing a new manufacturing facility with the issue in March of $20,000,000 of 20-year bonds with semiannual interest payments. It is now October, and if Pierce were to issue the bonds now, the yield would be 10% because of Pierce's high risk. Pierce's CFO is concerned that interest rates will climb even higher in coming months and is considering hedging the bond issue. The following data are available: Problem Inputs: Size of planned debt offering = Anticipated rate on debt offering = Maturity of planned debt offering = $20,000,000 10% 20 Number of months until debt offering = 5 Settle price on futures contract (% of par) = 94.78125% Maturity of bond underlying futures contract = 20 Coupon rate on bond underlying futures contract= 6% Size of futures contract (dollars) = $100,000 a. Create a hedge with the futures contract for F Pierce's planned March debt offering of $20 million. What is the implied yield on the bond underlying the future's contract? Value of each T-bond futures contract = $ 1,000.00 Number of contracts needed for hedge = 20,000.00 rounding = Value of contracts in hedge = $94,781 Implied semi-annual yield= Implied annual yield = 34 85 b. Suppose interest rates fall by 300 basis points. What is the dollar savings from issuing the debt 86 at the new interest rate? What is the dollar change in value of the futures position? What is the 37 total dollar value change of the hedged position? 38 39 Change in interest rate on debt offering (basis points) = 40 41 New interest rate on debt = 42 Value of issuing at new rate interest = 43 Dollar value savings or cost from issuing debt at the new rate = 14 15 New yield on futures contract = 16 New value of each futures contract 17 Value of all fo the futures contract at new yield = 48 Dollar change in value of the futures position = 49 50 Total dollar value change of hedge = 51 -300 52 c. Create a graph showing the effectiveness of the hedge if the change in interest rates, in basis 53 points, is: -300, -200, -100, 0, 100, 200, or 300. Show the dollar cost (or savings) from issuing the 54 debt at the new interest rates, the dollar change in value of the futures position, and the total dollar 55 value change. 56 change in Change in cost/saving 57 rate s of issue change in value of futures 58 Base -300 59 -300 50 -200 $1 -100 52 0 53 100 54 200 55 300 56 Total dollar value change of hedge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets start by answering part a of the problem Creating a hedge with the futures contract for the planned March debt offering of 20 million 1 Calculate the implied semiannual yield of the bond underlyi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started