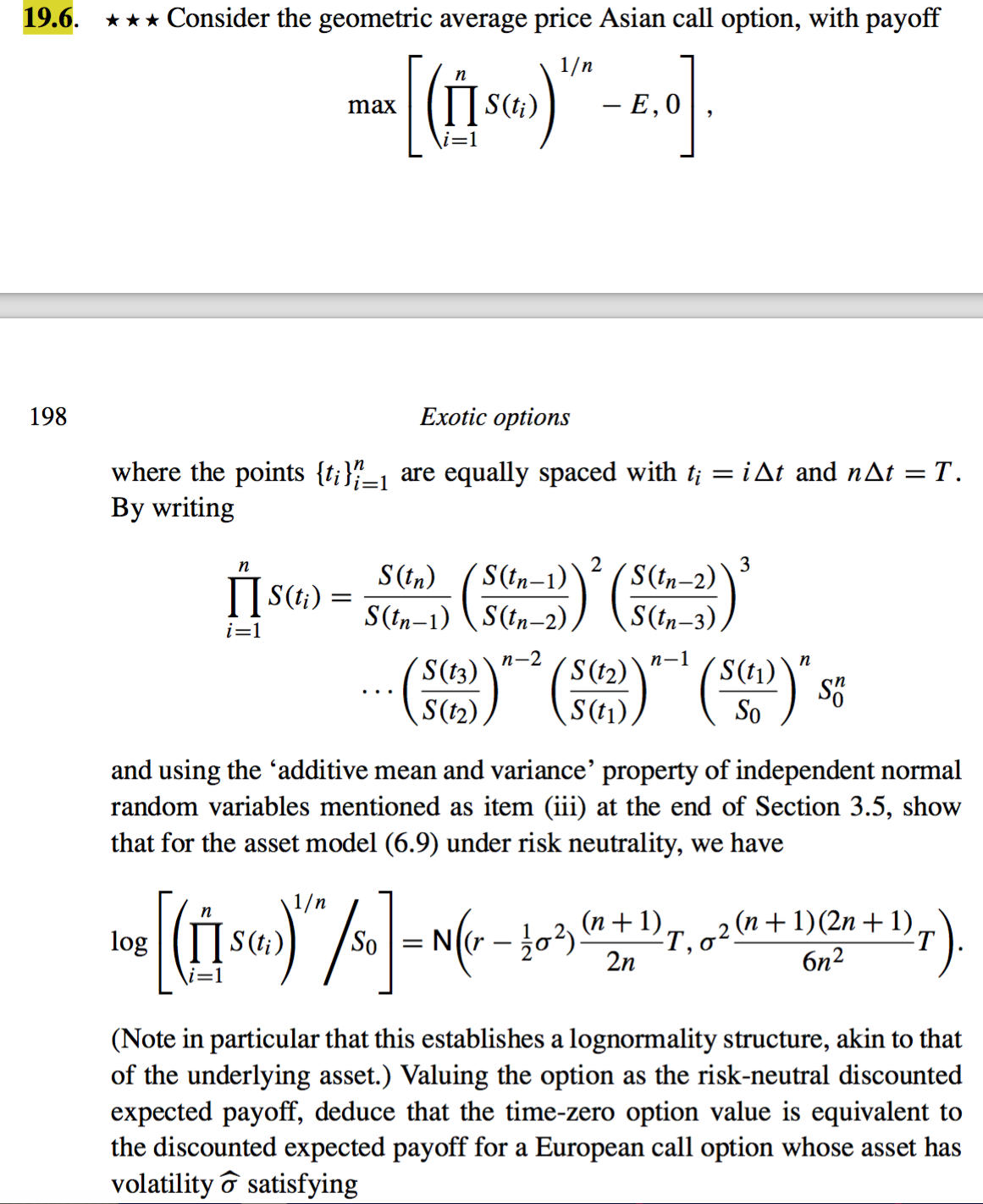

Question: f19,6 * * * Consider the geometric average price Asian call option, with payo n l max (H500) -E,0 , i=1 198 Exotic options where

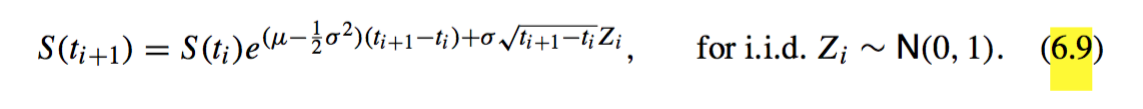

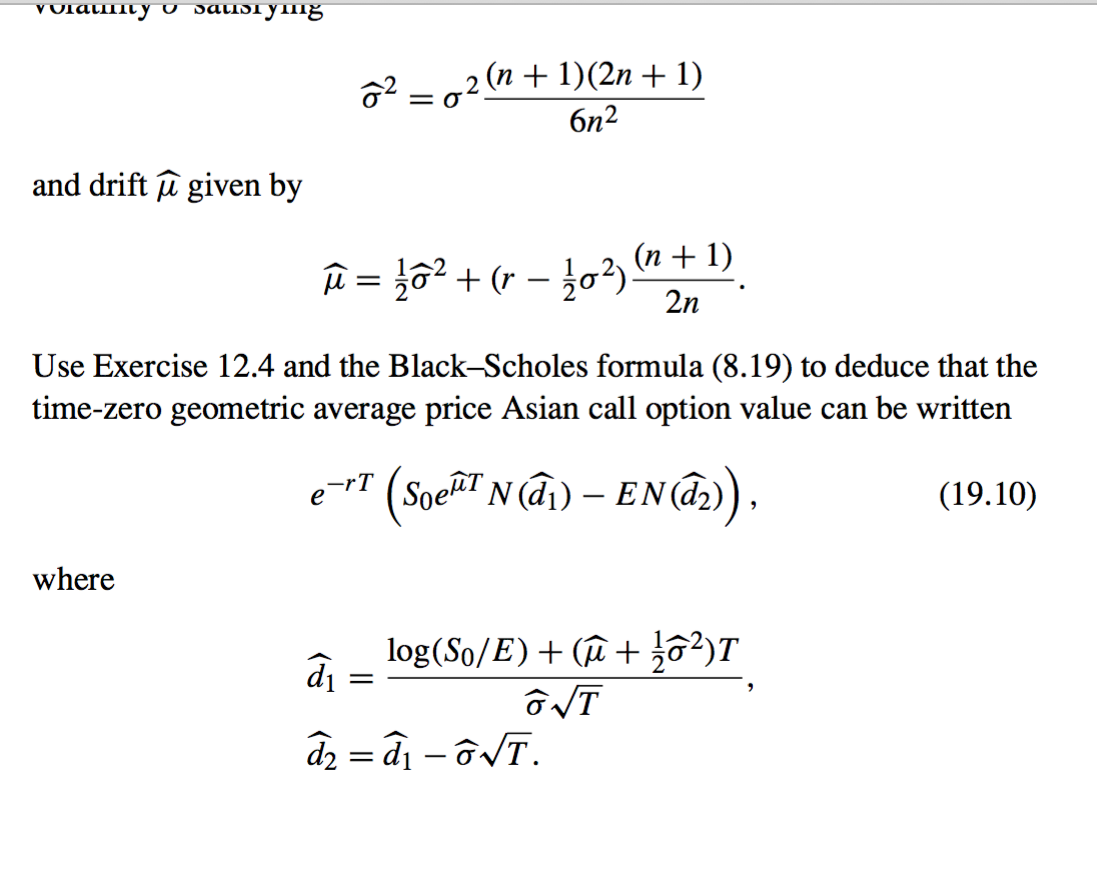

\f19,6 * * * Consider the geometric average price Asian call option, with payo n l max (H500) -E,0 , i=1 198 Exotic options where the points {t5}?=1 are equally spaced with t.- = iAt and nAt = T. By writing " _ sun) S(r,,_1) 2 San2) 3 HS\") ' 50H) (sum) (San3)) ___ (5(t3))n_2(502))n_1 (801))\" S, $02) 501) So 0 and using the 'additive mean and variance' property of independent normal random variables mentioned as item (iii) at the end of Section 3.5, show that for the asset model (6.9) under risk neutrality, we have n l 10, (11mm) /, =N(r_,az)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts