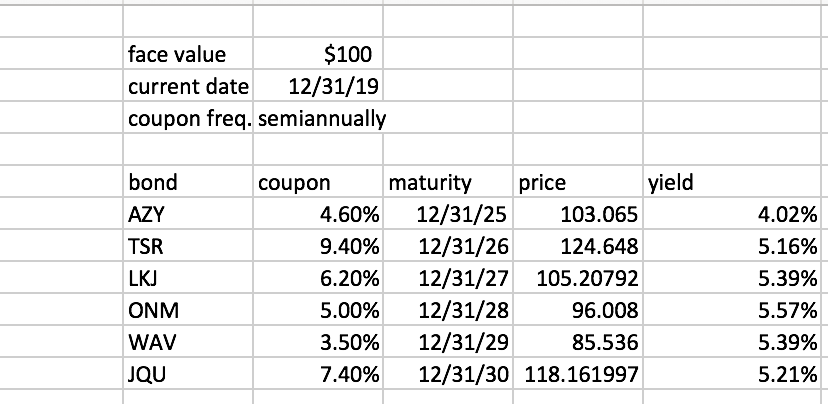

Question: face value $100 current date 12/31/19 coupon freq. semiannually bond yield AZY TSR LKJ ONM WAV JQU coupon maturity price 4.60% 12/31/25 103.065 9.40% 12/31/26

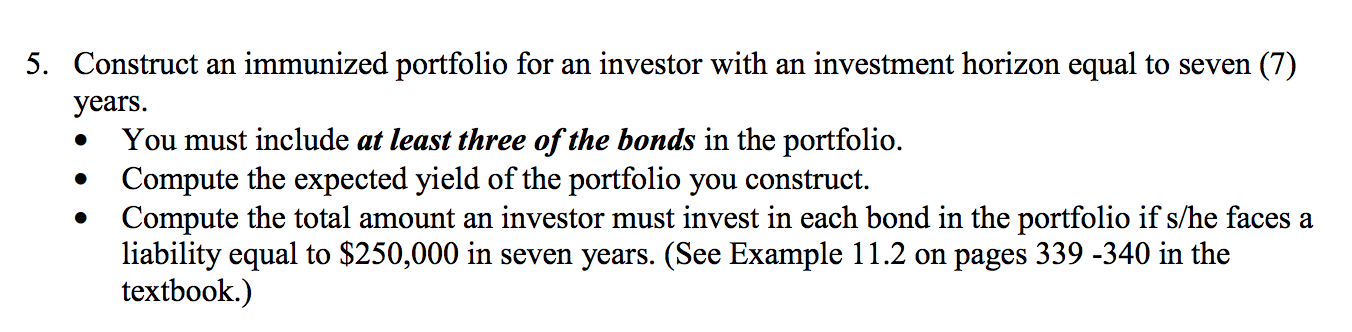

face value $100 current date 12/31/19 coupon freq. semiannually bond yield AZY TSR LKJ ONM WAV JQU coupon maturity price 4.60% 12/31/25 103.065 9.40% 12/31/26 124.648 6.20% 12/31/27 105.20792 5.00% 12/31/28 96.008 3.50% 12/31/29 85.536 7.40% 12/31/30 118.161997 4.02% 5.16% 5.39% 5.57% 5.39% 5.21% 5. Construct an immunized portfolio for an investor with an investment horizon equal to seven (7) years. You must include at least three of the bonds in the portfolio. Compute the expected yield of the portfolio you construct. Compute the total amount an investor must invest in each bond in the portfolio if s/he faces a liability equal to $250,000 in seven years. (See Example 11.2 on pages 339 -340 in the textbook.) face value $100 current date 12/31/19 coupon freq. semiannually bond yield AZY TSR LKJ ONM WAV JQU coupon maturity price 4.60% 12/31/25 103.065 9.40% 12/31/26 124.648 6.20% 12/31/27 105.20792 5.00% 12/31/28 96.008 3.50% 12/31/29 85.536 7.40% 12/31/30 118.161997 4.02% 5.16% 5.39% 5.57% 5.39% 5.21% 5. Construct an immunized portfolio for an investor with an investment horizon equal to seven (7) years. You must include at least three of the bonds in the portfolio. Compute the expected yield of the portfolio you construct. Compute the total amount an investor must invest in each bond in the portfolio if s/he faces a liability equal to $250,000 in seven years. (See Example 11.2 on pages 339 -340 in the textbook.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts