Question: please show excel functions used :) face value $100 current date 12/31/19 coupon freq. semiannually bond yield AZY TSR LKJ ONM WAV JQU coupon maturity

please show excel functions used :)

please show excel functions used :)

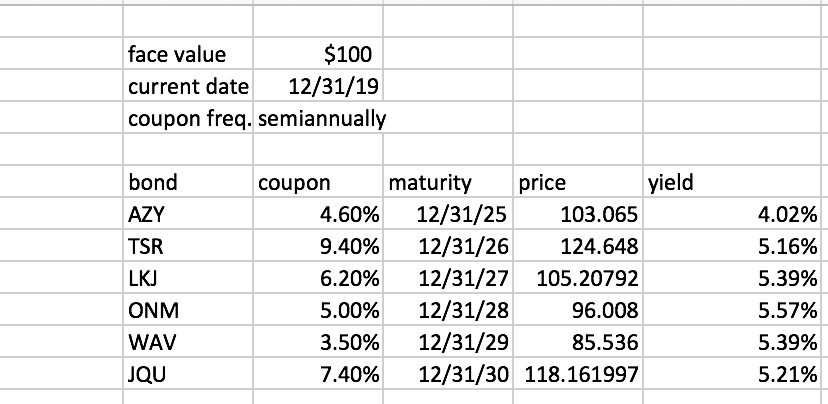

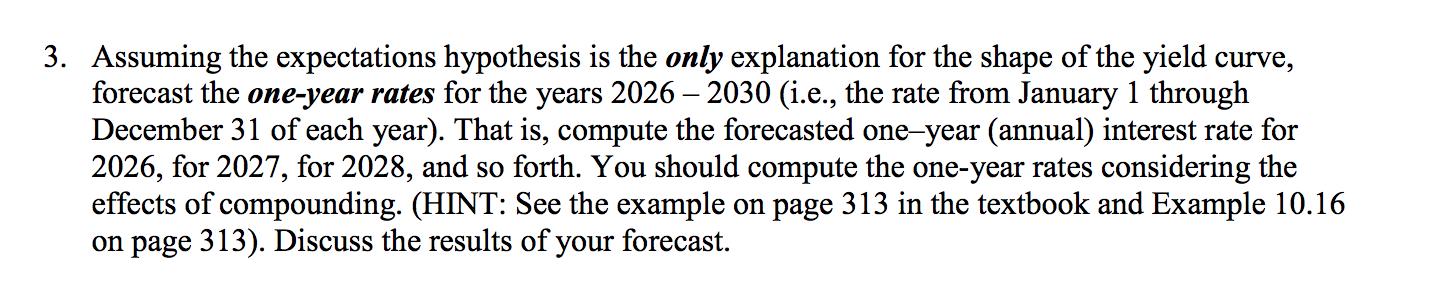

face value $100 current date 12/31/19 coupon freq. semiannually bond yield AZY TSR LKJ ONM WAV JQU coupon maturity price 4.60% 12/31/25 103.065 9.40% 12/31/26 124.648 6.20% 12/31/27 105.20792 5.00% 12/31/28 96.008 3.50% 12/31/29 85.536 7.40% 12/31/30 118.161997 4.02% 5.16% 5.39% 5.57% 5.39% 5.21% 3. Assuming the expectations hypothesis is the only explanation for the shape of the yield curve, forecast the one-year rates for the years 2026 2030 (i.e., the rate from January 1 through December 31 of each year). That is, compute the forecasted one-year (annual) interest rate for 2026, for 2027, for 2028, and so forth. You should compute the one-year rates considering the effects of compounding. (HINT: See the example on page 313 in the textbook and Example 10.16 on page 313). Discuss the results of your forecast. face value $100 current date 12/31/19 coupon freq. semiannually bond yield AZY TSR LKJ ONM WAV JQU coupon maturity price 4.60% 12/31/25 103.065 9.40% 12/31/26 124.648 6.20% 12/31/27 105.20792 5.00% 12/31/28 96.008 3.50% 12/31/29 85.536 7.40% 12/31/30 118.161997 4.02% 5.16% 5.39% 5.57% 5.39% 5.21% 3. Assuming the expectations hypothesis is the only explanation for the shape of the yield curve, forecast the one-year rates for the years 2026 2030 (i.e., the rate from January 1 through December 31 of each year). That is, compute the forecasted one-year (annual) interest rate for 2026, for 2027, for 2028, and so forth. You should compute the one-year rates considering the effects of compounding. (HINT: See the example on page 313 in the textbook and Example 10.16 on page 313). Discuss the results of your forecast

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts