Question: Farn BCLE, SE CHAPTER 3:CONTINUOUS TAX RETURN PROBLEMS 3-1 Problem Facts. Larry K. and Cathy L. Zepp have been married 18 years. Larry i 62

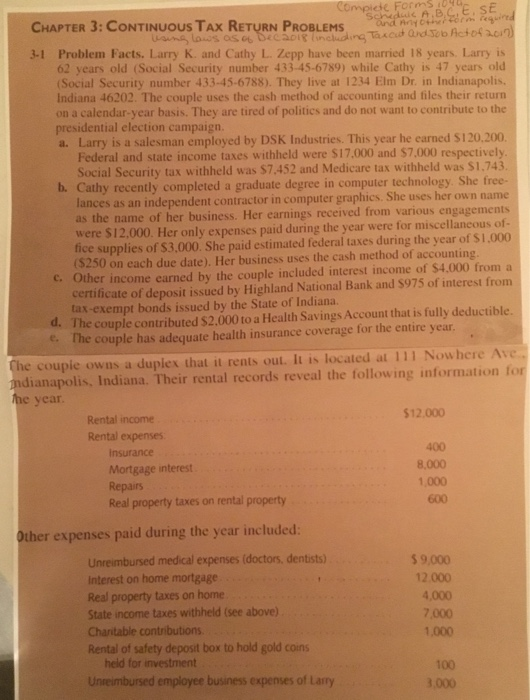

Farn BCLE, SE CHAPTER 3:CONTINUOUS TAX RETURN PROBLEMS 3-1 Problem Facts. Larry K. and Cathy L. Zepp have been married 18 years. Larry i 62 years old (Social Security number 433-45-6789) while Cathy is 47 years old (Social Security number 433-45-6788). They live at 1234 Elm Dr. in Indianapolis, Indiana 46202. The couple uses the cash method of accounting and files their return on a calendar-year basis. They are tired of politics and do not want to contribute to t presidential election campaign a. Larry is a salesman employed by DSK Industries. This year he earned $120.200 Federal and state income taxes withheld were $17.000 and $7.000 respectively Social Security tax withheld was $7.452 and Medicare tax withheld was $1,743 ly completed a graduate degree in computer technology She free- b. Cathy recent lances as an independent contractor in computer graphics. She uses her own name the name of her business. Her earnings received from various engagements were $12,000. Her only expenses paid during the year were for miscellancous of- fice supplies of $3.000. She paid estimated federal taxes during the year of $1,000 c. Other income earned by the couple included interest income of $4.000 from a certificate of deposit issued by Highland National Bank and $975 of interest from (S250 on each due date). Her business uses the cash method of accounting tax-exempt bonds issued by the State of Indiana. The couple has adequate health insurance coverage for the entire year d. The couple contributed $2.000 to a Health Savings Account that is fully deductible. Che coupie owns a duplex that it rents out. It is located at 111 Nowhere Ave ndianapolis, Indiana. Their rental records reveal the following information for e year $12.000 Rental income Rental expenses 400 8,000 1,000 600 insurance Mortgage interest Real property taxes on rental property Other expenses paid during the year included Unreimbursed medical expenses (doctors, dentists) Interest on home mortgage Real property taxes on home State income taxes withheld (see above) Charitable contributions Rental of safety deposit box to hold gold coin $ 9,000 12.000 4,000 held for investment Uneimbursed employee businessexpenses of Lany 100 Farn BCLE, SE CHAPTER 3:CONTINUOUS TAX RETURN PROBLEMS 3-1 Problem Facts. Larry K. and Cathy L. Zepp have been married 18 years. Larry i 62 years old (Social Security number 433-45-6789) while Cathy is 47 years old (Social Security number 433-45-6788). They live at 1234 Elm Dr. in Indianapolis, Indiana 46202. The couple uses the cash method of accounting and files their return on a calendar-year basis. They are tired of politics and do not want to contribute to t presidential election campaign a. Larry is a salesman employed by DSK Industries. This year he earned $120.200 Federal and state income taxes withheld were $17.000 and $7.000 respectively Social Security tax withheld was $7.452 and Medicare tax withheld was $1,743 ly completed a graduate degree in computer technology She free- b. Cathy recent lances as an independent contractor in computer graphics. She uses her own name the name of her business. Her earnings received from various engagements were $12,000. Her only expenses paid during the year were for miscellancous of- fice supplies of $3.000. She paid estimated federal taxes during the year of $1,000 c. Other income earned by the couple included interest income of $4.000 from a certificate of deposit issued by Highland National Bank and $975 of interest from (S250 on each due date). Her business uses the cash method of accounting tax-exempt bonds issued by the State of Indiana. The couple has adequate health insurance coverage for the entire year d. The couple contributed $2.000 to a Health Savings Account that is fully deductible. Che coupie owns a duplex that it rents out. It is located at 111 Nowhere Ave ndianapolis, Indiana. Their rental records reveal the following information for e year $12.000 Rental income Rental expenses 400 8,000 1,000 600 insurance Mortgage interest Real property taxes on rental property Other expenses paid during the year included Unreimbursed medical expenses (doctors, dentists) Interest on home mortgage Real property taxes on home State income taxes withheld (see above) Charitable contributions Rental of safety deposit box to hold gold coin $ 9,000 12.000 4,000 held for investment Uneimbursed employee businessexpenses of Lany 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts