Question: Fast answer please sur Just need option No need explain I will rate you If a dealer bought 500 shares of stock at OMR 10

Fast answer please sur

Just need option

No need explain

I will rate you

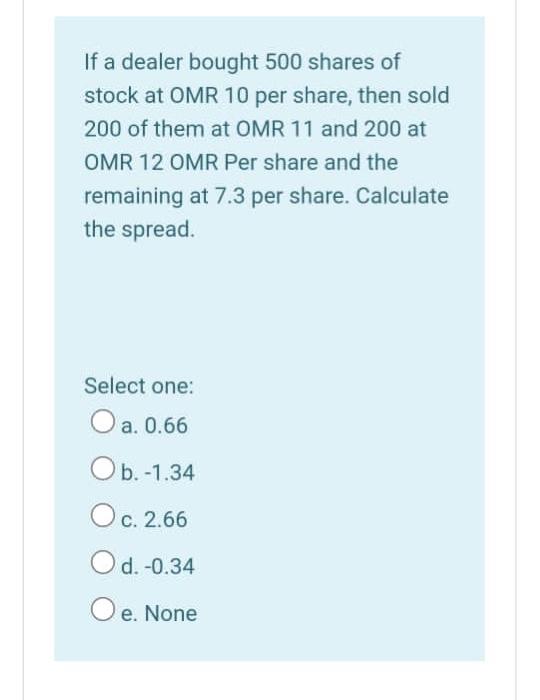

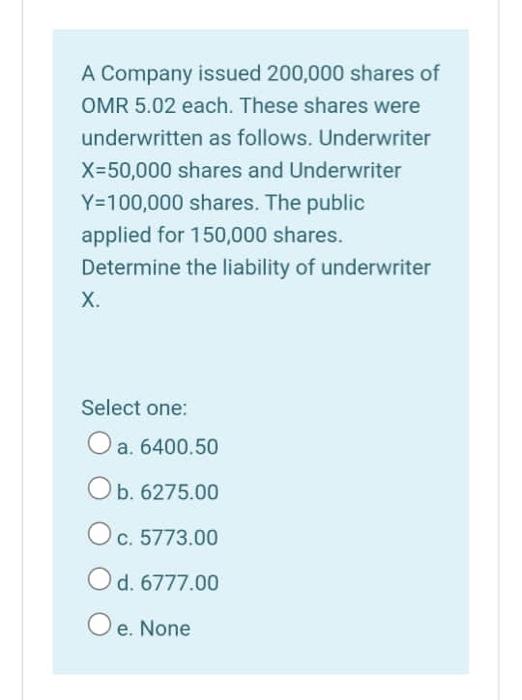

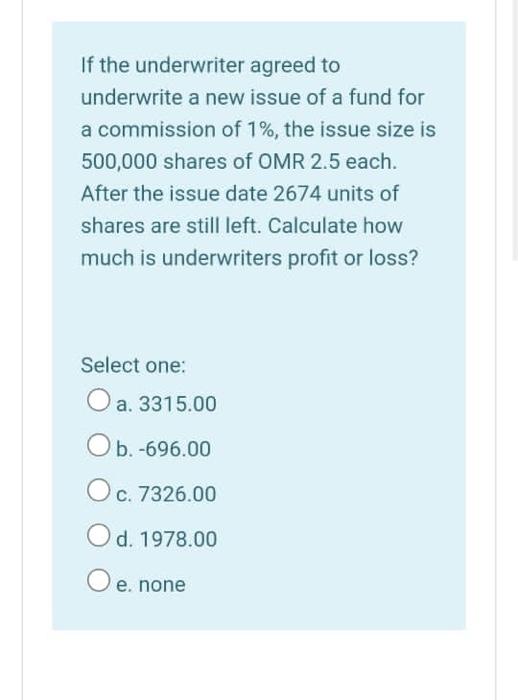

If a dealer bought 500 shares of stock at OMR 10 per share, then sold 200 of them at OMR 11 and 200 at OMR 12 OMR Per share and the remaining at 7.3 per share. Calculate the spread. Select one: O a. 0.66 O b.-1.34 Oc. 2.66 O d. -0.34 Oe. None A Company issued 200,000 shares of OMR 5.02 each. These shares were underwritten as follows. Underwriter X=50,000 shares and Underwriter Y=100,000 shares. The public applied for 150,000 shares. Determine the liability of underwriter X. Select one: O a. 6400.50 Ob. 6275.00 O c. 5773.00 Od. 6777.00 Oe. None If the underwriter agreed to underwrite a new issue of a fund for a commission of 1%, the issue size is 500,000 shares of OMR 2.5 each. After the issue date 2674 units of shares are still left. Calculate how much is underwriters profit or loss? Select one: O a. 3315.00 Ob. -696.00 O c. 7326.00 O d. 1978.00 O e none

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts