Question: Fast answer please sur Just need option No need explain I will rate you go ahead no problem i will rate you up thanks If

Fast answer please sur

Just need option

No need explain

I will rate you

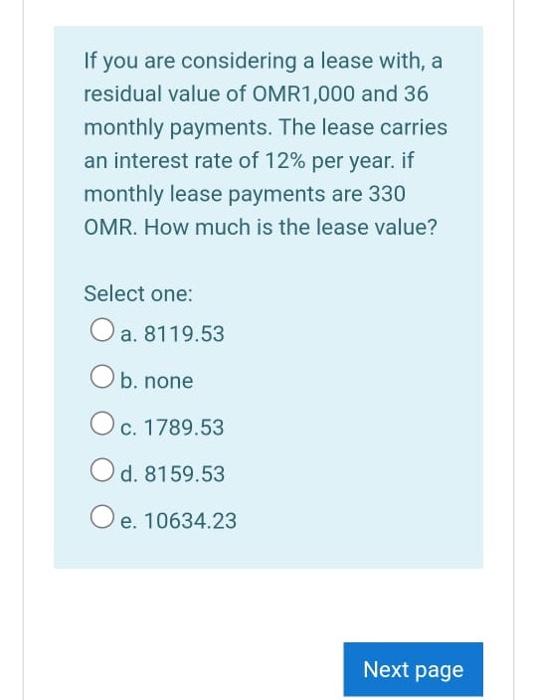

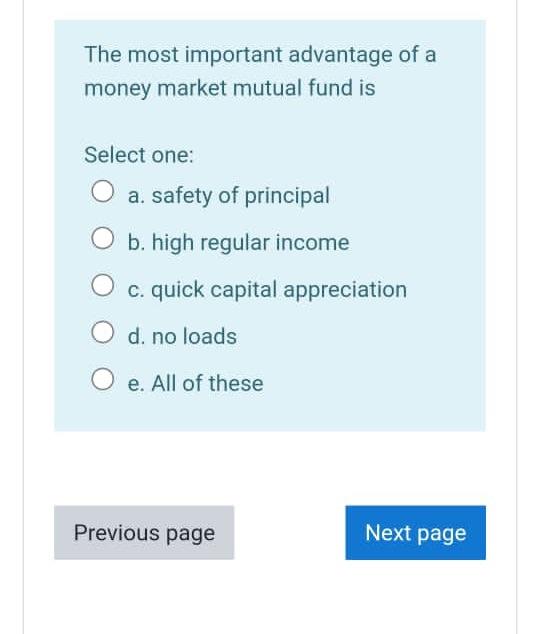

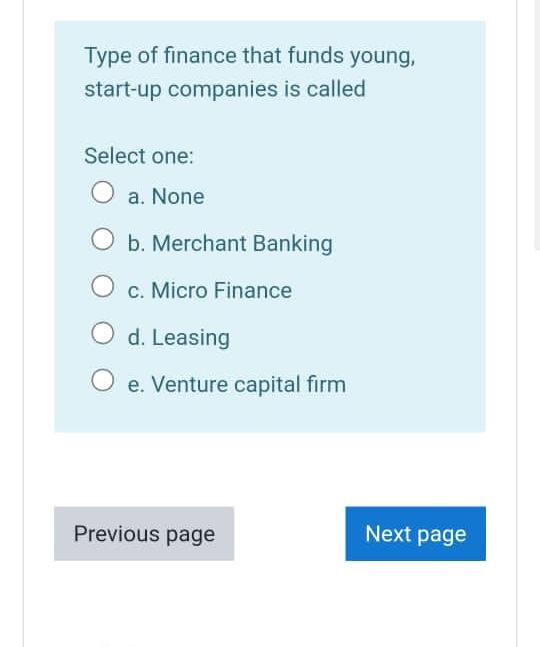

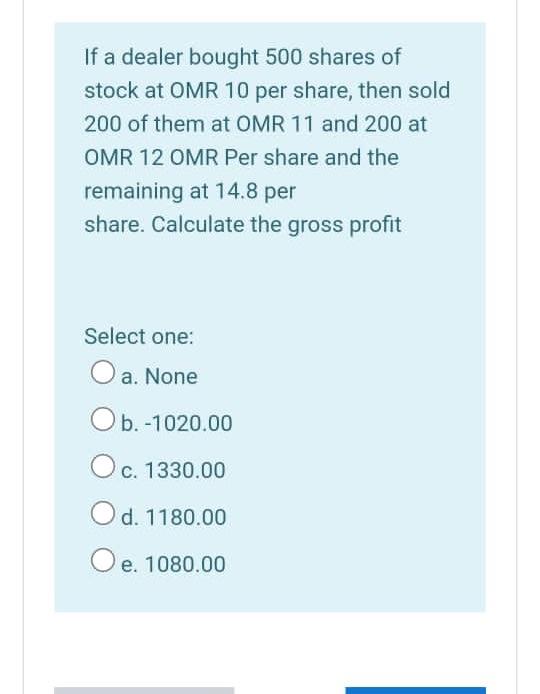

If you are considering a lease with, a residual value of OMR1,000 and 36 monthly payments. The lease carries an interest rate of 12% per year. if monthly lease payments are 330 OMR. How much is the lease value? Select one: O a. 8119.53 b. none O c. 1789.53 O d. 8159.53 e. 10634.23 Next page Equity Shares of 2.9 OMR each are issued by XYZ Company through a right prospectus inviting applications for 10,000 shares. The whole issue was fully underwritten by three underwriters as follows: A=6,000 shares B=3,000 shares C=1,000 shares Applications were received for 8,900 shares of which marked applications were as follows: A=5000 shares B=2000 shares C=1900 shares Find the liability of A and B Select one: O a. 18005.80 O. 1100 Oc. None Od. 1500 Oe. 1160.00 The most important advantage of a money market mutual fund is Select one: a. safety of principal b. high regular income c. quick capital appreciation d. no loads O e. All of these Previous page Next page Type of finance that funds young, start-up companies is called Select one: a. None b. Merchant Banking c. Micro Finance d. Leasing O e. Venture capital firm Previous page Next page If a dealer bought 500 shares of stock at OMR 10 per share, then sold 200 of them at OMR 11 and 200 at OMR 12 OMR Per share and the remaining at 14.8 per share. Calculate the gross profit Select one: . a. None Ob.-1020.00 Oc. c. 1330.00 Od d. 1180.00 e. 1080.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts