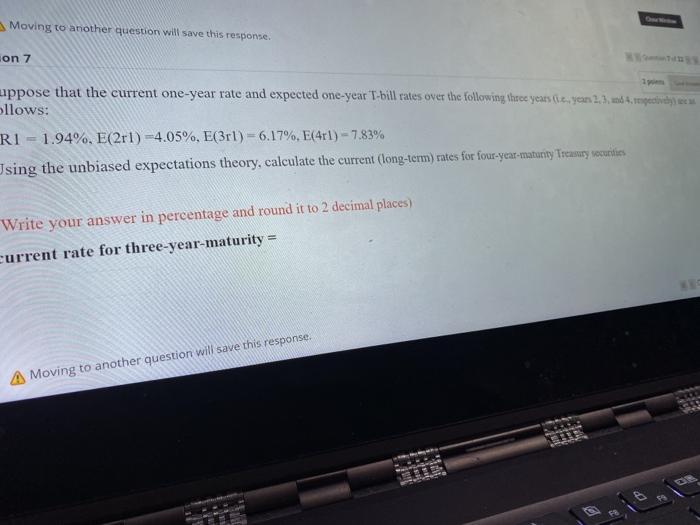

Question: fast please Moving to another question will save this response. on 7 uppose that the current one-year rate and expected one-year T-bill rates over the

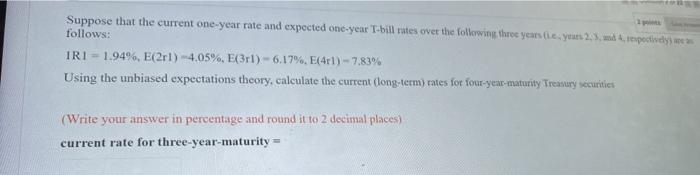

Moving to another question will save this response. on 7 uppose that the current one-year rate and expected one-year T-bill rates over the following three years i.... year 2.3. un 4. pective llows: R1 - 1.94%, E(2rl) -4.05%, E(3r1)=6.17%, E(41) - 7.83% Jsing the unbiased expectations theory, calculate the current (long-term) rates for four-year-maturity Treasury securities Write your answer in percentage and round it to 2 decimal places) current rate for three-year-maturity = A Moving to another question will save this response. Suppose that the current one-year rate and expected one-year T-bill rates over the following three years die years 2. 3. 4. expectively follows: IRI - 1.94%, E(21) 4.05%, E(3:1) -6.17%, E(41) - 7.83% Using the unbiased expectations theory, calculate the current long-term) rates for four-year-maturity Treasury securities (Write your answer in percentage and round it to 2 decimal places) current rate for three-year-maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts