Question: FastForwardAcadenty idacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 G 2 0 2

FastForwardAcadenty

idacademy.comlmsAFTRExam

G CCHS Liv...

I KDE Licensure

MyAccunt Americ....

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History Grant Prof...

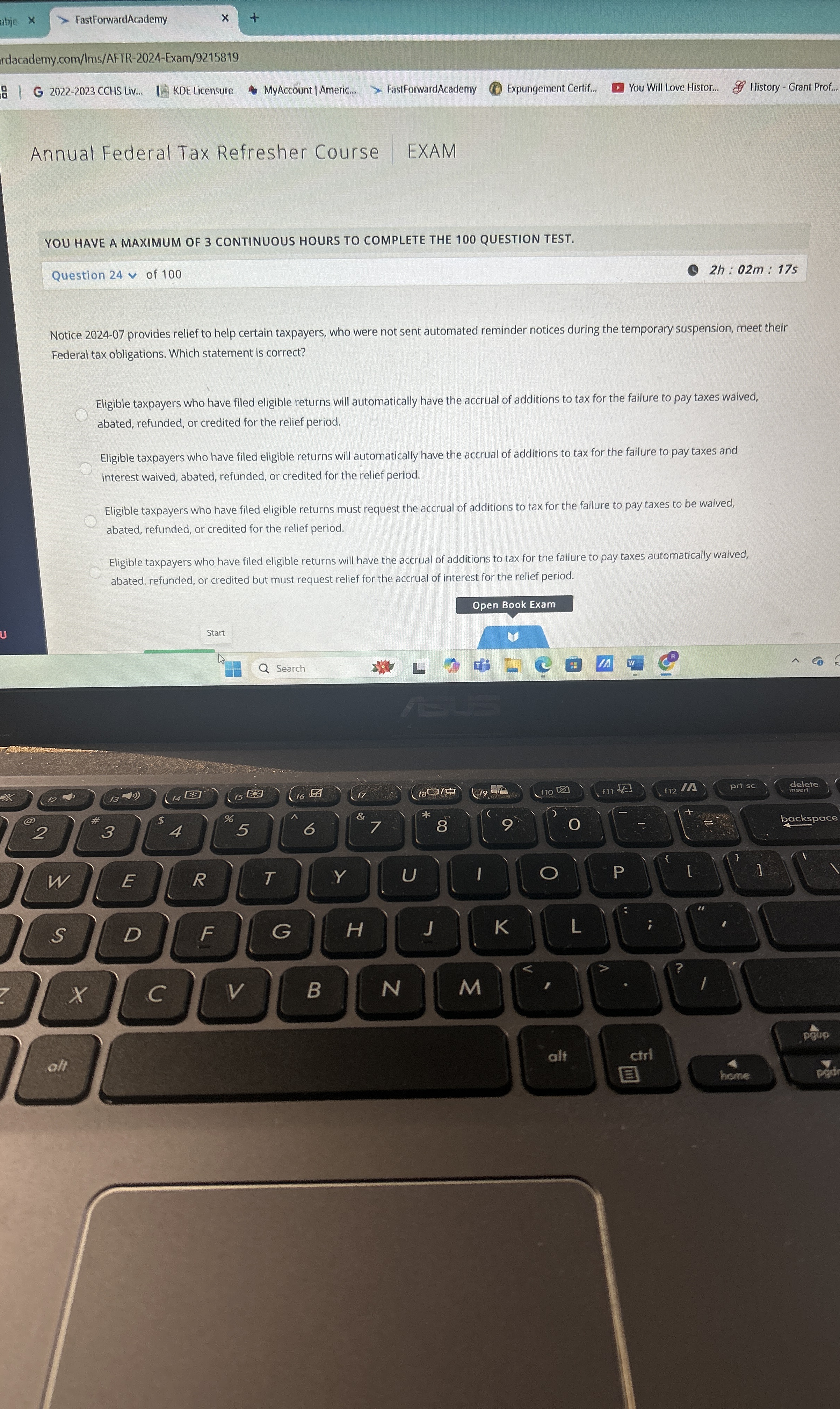

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

::

Notice provides relief to help certain taxpayers, who were not sent automated reminder notices during the temporary suspension, meet their Federal tax obligations. Which statement is correct?

Eligible taxpayers who have filed eligible returns will automatically have the accrual of additions to tax for the failure to pay taxes waived, abated, refunded, or credited for the relief period.

Eligible taxpayers who have filed eligible returns will automatically have the accrual of additions to tax for the failure to pay taxes and interest waived, abated, refunded, or credited for the relief period.

Eligible taxpayers who have filed eligible returns must request the accrual of additions to tax for the failure to pay taxes to be waived, abated, refunded, or credited for the relief period.

Eligible taxpayers who have filed eligible returns will have the accrual of additions to tax for the failure to pay taxes automatically waived, abated, refunded, or credited but must request relief for the accrual of interest for the relief period.

Open Book Exam

Start

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock