Question: February 2 4 th , 2 0 2 4 , is the end of the final pay period for the month and is a full

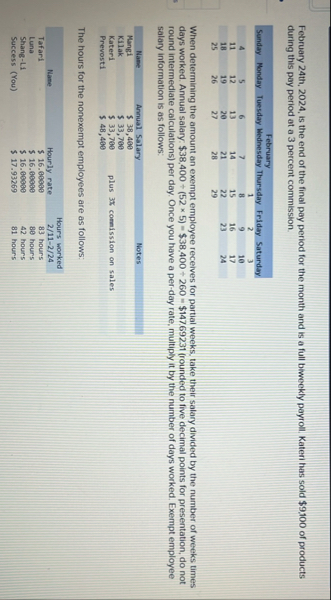

February th is the end of the final pay period for the month and is a full biweekly payroll. Kateri has sold $ of products during this pay period at a percent commission.

tableTuesday

When determining the amount an exempt employee receives for partial weeks, take their salary divided by the number of weeks times days worked. Annual salary: $$$rounded to five decimal points for presentation, do not round intermediate calculations per day. Once you have a perday rate, multiply it by the number of days worked. Exempt employee salary information is as follows:

tableNameAnnual alary,NotesMangi$Kilak$Kateri$plus commission on salesPrevosti$

The hours for the nonexempt employees are as follows:

tableHourly rate,Hours workedName$ hoursTafari$ hoursLuna$ hoursShangLi$ hoursSuccess You

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock