Question: Answer Key Problem #2 (11 points) Your company has a new project available. You will sell 125,000 units per year at a price Of

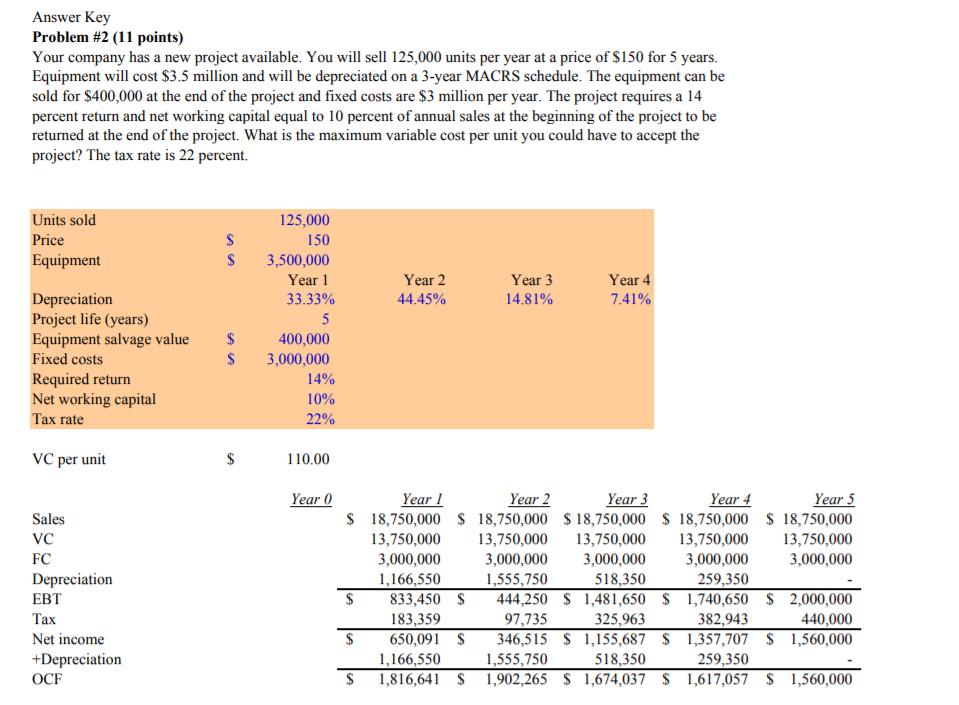

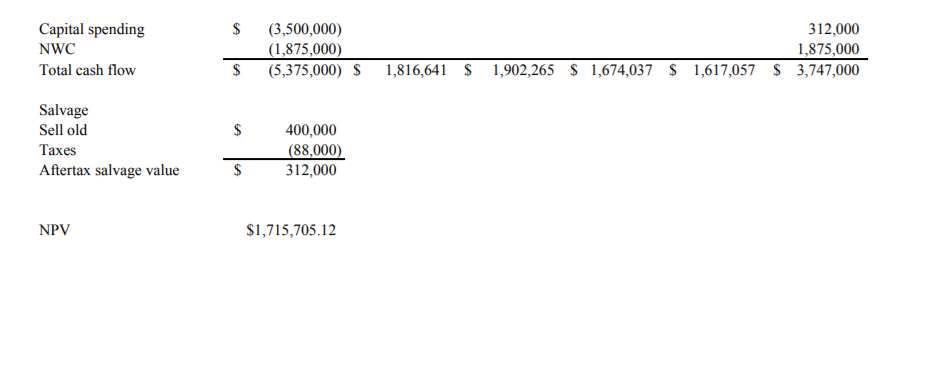

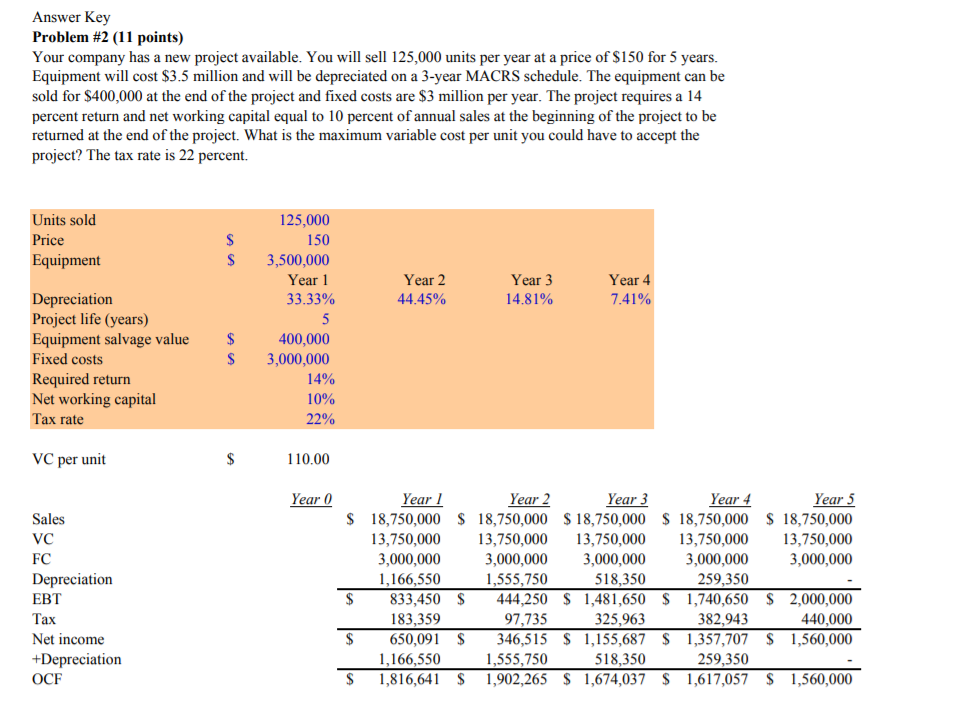

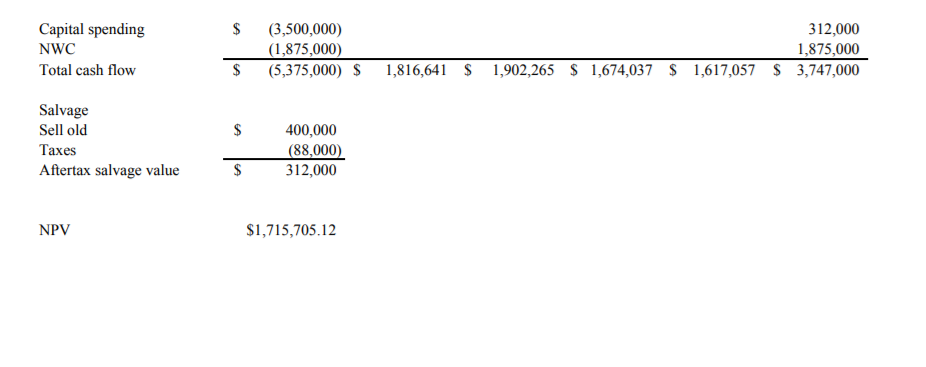

Answer Key Problem #2 (11 points) Your company has a new project available. You will sell 125,000 units per year at a price Of $150 for 5 years. Equipment will cost $3.5 million and will be depreciated on a 3-year MACRS schedule. The equipment can be sold for S400,000 at the end of the project and fixed costs are $3 million per year _ The project requires a 14 percent return and net working capital equal to 10 percent Of annual sales at the beginning Of the project to be returned at the end Of the project. What is the maximum variable cost per unit you could have to accept the project? The tax rate is 22 percent. units sold price Equipment Depreciation project life (years) Equipment salvage value Fixed costs Required return Net working capital rate VC per unit Sales FC Depreciation EBT Tax Net income +Depreciation OCF s 125,000 150 Year 1 33.33% 5 400,000 140/0 22% 110.00 Year O Year 2 44.45% Year I 833,450 183,359 650,091 Year 5 440,000 s Year 3 14.81% Year 2 444250 97,735 346,515 1,555,750 1,902,265 Year 4 7.41% Year 3 518,350 325,963 518,350 1,674,037 Year 4 259,350 382,943 259,350 s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts