Question: Fianance Accouting (14e) Email Instructor Save Exit Submit Assignment for Grading uestions Exercise 10-19 Question 2 of 4 Check My Work eBook Exercise 10-19 Calculations

Fianance Accouting (14e)

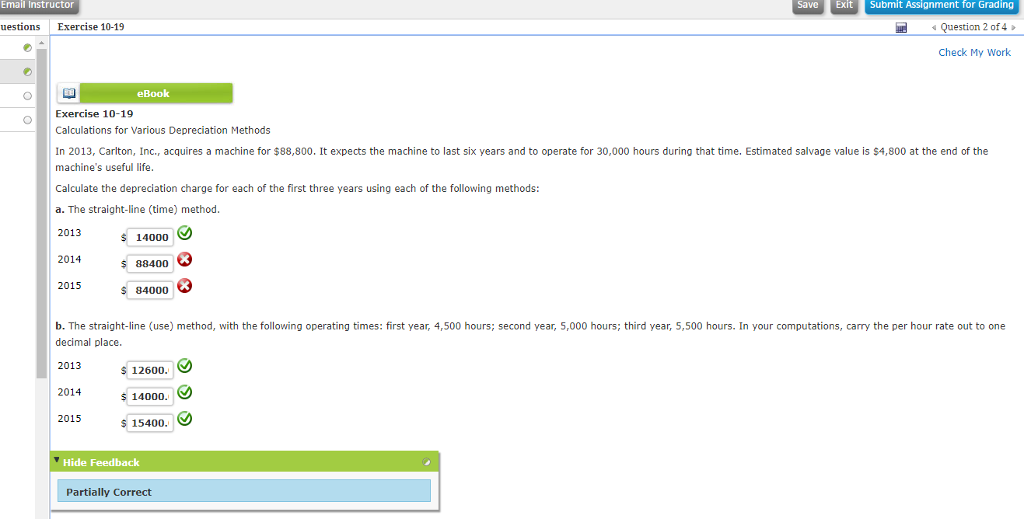

Email Instructor Save Exit Submit Assignment for Grading uestions Exercise 10-19 Question 2 of 4 Check My Work eBook Exercise 10-19 Calculations for Various Depreciation Methods In 2013, Carlton, Inc,, acquires a machine for $88,800, It expects the machine to last six years and to operate for 30,000 hours during that time. Estimated salvage value is $4,800 at the end of the machine's useful life Calculate the depreciation charge for each of the first three years using each of the following methods: a. The straight-line (time) method. 2013 14000 2014 88400 2015 84000 b. The straight-line (use) method, with the following operating times: first year, 4,500 hours; second year, 5,000 hours; third year, 5,500 hours. In your computations, carry the per hour rate out to one decimal place 2013 2014 12600 14000 15400 2015 Hide Feedback Partially Correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts