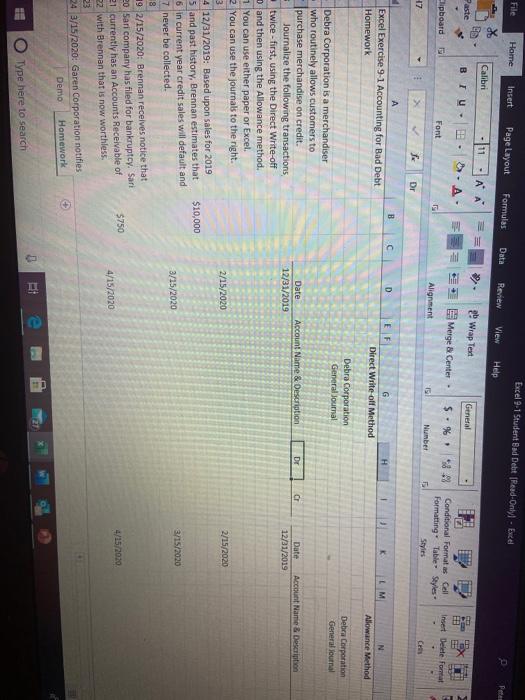

Question: - File Excel 9.1 Student Bad Debt [Read-Only - Excel Home Insert Page Layout Formulas Data Review View Help Pete Calibri Paste 2. Wrap Text

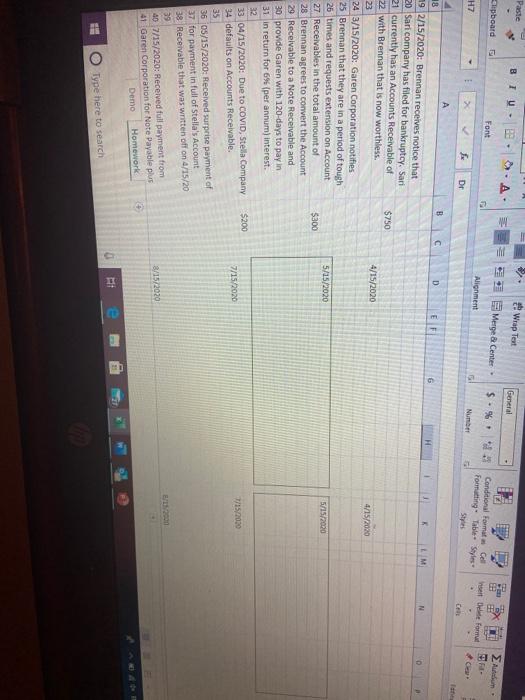

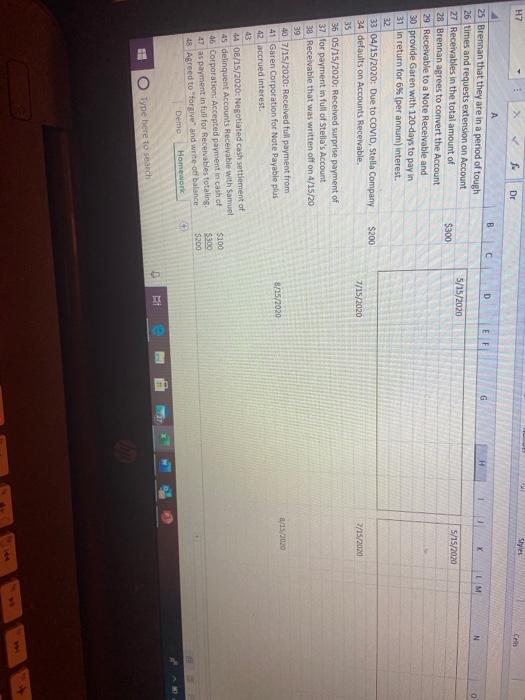

- File Excel 9.1 Student Bad Debt [Read-Only - Excel Home Insert Page Layout Formulas Data Review View Help Pete Calibri Paste 2. Wrap Text General BIU- - Merge Center - Clipboard $. % 8.92 Insert Delete format Font Conditional Formatas Cell Formatting Table Styles Styles Alignment 151 Number F 17 CE f Dr B D A Excel Exercise 9-1 Accounting for Bad Debt Homework EF H 1 K G Direct Write-off Method LM N Allowance Method Debra Corporation General Journal Debra Corporation General Journal Date Account Name & Description Dr CH Account Name & Description 12/31/2019 Date 12/31/2019 2/15/2020 2/15/2020 Debra Corporation is a merchandiser who routinely allows customers to purchase merchandise on credit. Journalize the following transactions, twice-first, using the Direct Write-off and then using the Allowance method. 1 You can use either paper or Excel. You can use the journals to the right. 3 4 12/31/2019: Based upon sales for 2019 5 and past history, Brennan estimates that 6 in current year credit sales will default and 7 never be collected 19 19 2/15/2020: Brennan receives notice that 20 Sari company has filed for bankruptcy, Sari 21 currently has an Accounts Receivable of 22 with Brennan that is now worthless. 23 24 3/15/2020: Garen Corporation notifies Demo Homework $10,000 3/15/2020 3/15/2020 $750 4/15/2010 4/15/2020 e G O Type here to search Paste BIU- Wrap Text ..A General Clipboard Aurum - Font Merge Center Alignment $. % . Condtional Format Gol Formatting Table Styles H7 > Numbe Dr Styles B C D EE G LM $750 4/15/2020 4/15/2020 5/15/2020 5715/2000 $300 A 18 19 2/15/2020: Brennan receives notice that 20. Sari company has filed for bankruptcy, Sari 21 currently has an Accounts Receivable of 22 with Brennan that is now worthless. 23 24 3/15/2020: Garen Corporation notifies 25 Brennan that they are in a period of tough 26 times and requests extension on Account 27 Receivables in the total amount of 28 Brennan agrees to convert the Account 29 Receivable to a Note Receivable and 30 provide Garen with 120 days to pay in 31 in return for 6% (per annum) interest. 32 33 04/15/2020: Due to COVID, Stella Company 34 defaults on Accounts Receivable. 35 36 05/15/2020: Received surprise payment of 37 for payment in full of Stella's Account 38 Receivable that was written off on 4/15/20 39 40 7/15/2020: Received full payment from 41 Garen Corporation for Note Payable plus Demo Homework $200 7/15/2020 T/15/2020 8/15/2020 3 Type here to search H7 Styles f Dr Ceo B D EF G X LM N 5/15/2020 S/15/2020 $300 A 25 Brennan that they are in a period of tough 26 times and requests extension on Account 27 Receivables in the total amount of 28 Brennan agrees to convert the Account 29 Receivable to a Note Receivable and 30 provide Garen with 120 days to pay in 31 in return for 6% (per annum) interest. 32 33 04/15/2020: Due to COVID, Stella Company 34 defaults on Accounts Receivable. 35 36 05/15/2020: Received surprise payment of 37 for payment in full of Stella's Account 38 Receivable that was written off on 4/15/20 39 40 7/15/2020: Received full payment from 41 Garen Corporation for Note Payable plus 42 accrued interest. $200 7/15/2020 2/15/2020 1/15/2020 8/15/2020 08/25/2020: Negotiated cash settlement of 45 delinquent Accounts Receivable with Samuel 46 Corporation: Accepted payment in cash of 47 as payment in full for Receivables totaling 18 Agreed to forgive and write off balance Deme Homework $100 $300 $200 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts