Question: File ge Edit View History Bookmarks Develop Window Help Paragraph CD ecampuslife.ca Calculate the CPP deduction Amount for the following a) Regular Salary 2500

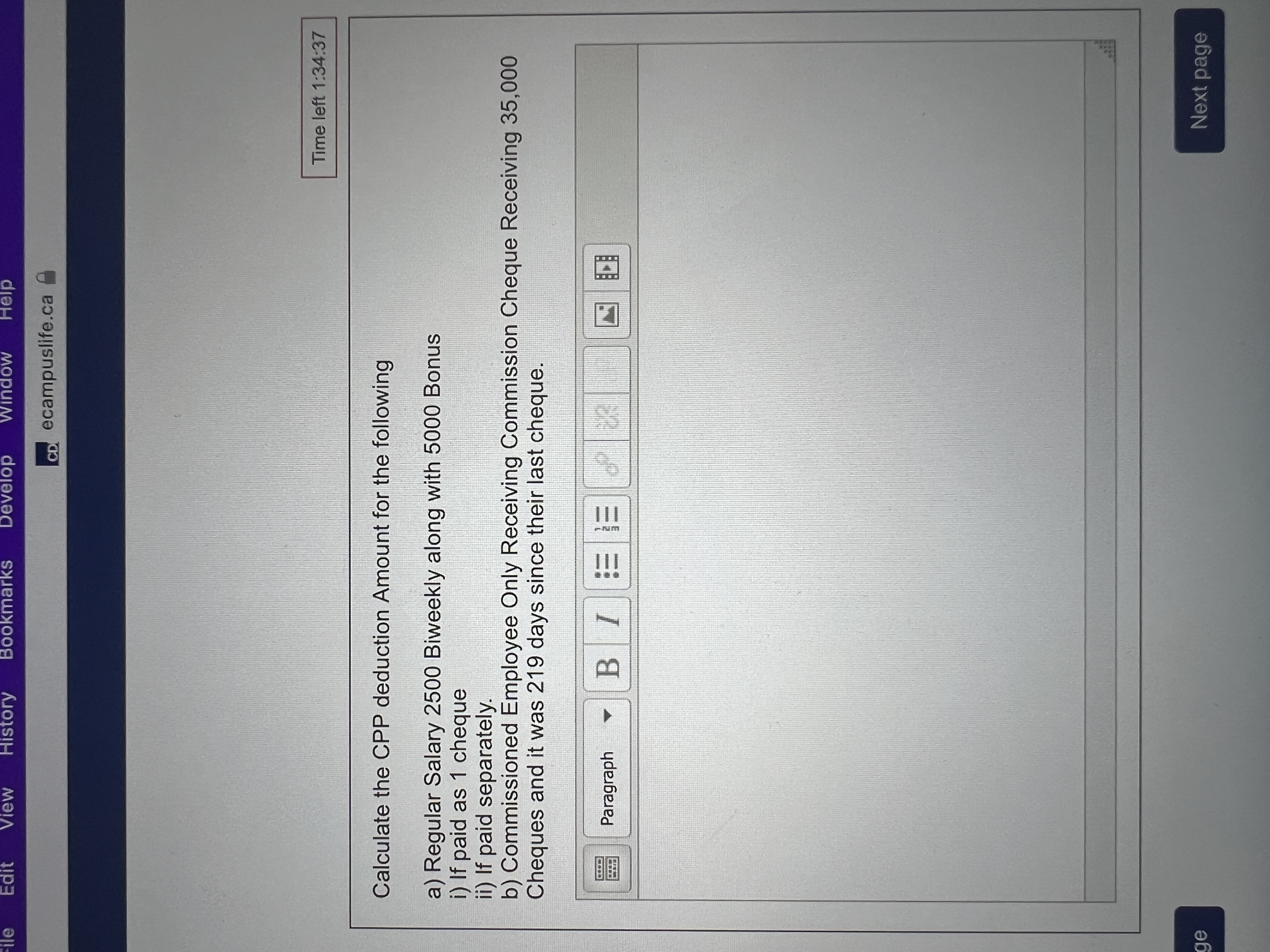

File ge Edit View History Bookmarks Develop Window Help Paragraph CD ecampuslife.ca Calculate the CPP deduction Amount for the following a) Regular Salary 2500 Biweekly along with 5000 Bonus i) If paid as 1 cheque ii) If paid separately. b) Commissioned Employee Only Receiving Commission Cheque Receiving 35,000 Cheques and it was 219 days since their last cheque. BIEE Time left 1:34:37 201 Next page

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

The Canada Pension Plan CPP contributions are based on employment income and the contribution ... View full answer

Get step-by-step solutions from verified subject matter experts