Question: File Home Insert Page Layout Formulas Data Review View Help X Cut Calibri 11 A A al Wrap Text General LA Copy Paste Conditional Format

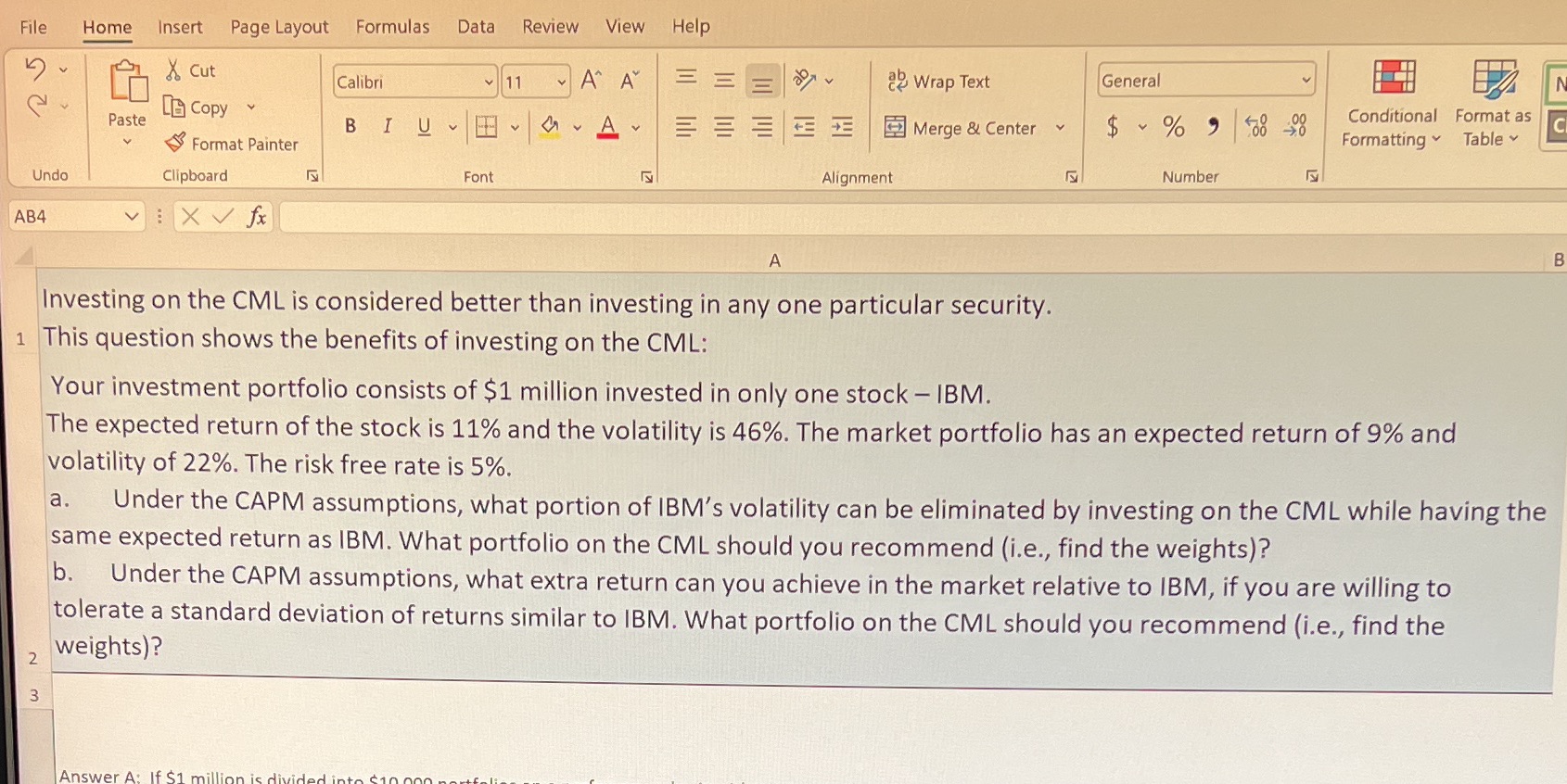

File Home Insert Page Layout Formulas Data Review View Help X Cut Calibri 11 A A al Wrap Text General LA Copy Paste Conditional Format as BI UV A v Merge & Center $ ~ % 9 78 98 Format Painter Formatting Table Undo Clipboard Font Alignment Number AB4 v : X V fx A Investing on the CML is considered better than investing in any one particular security. This question shows the benefits of investing on the CML: Your investment portfolio consists of $1 million invested in only one stock - IBM. The expected return of the stock is 11% and the volatility is 46%. The market portfolio has an expected return of 9% and volatility of 22%. The risk free rate is 5%. a. Under the CAPM assumptions, what portion of IBM's volatility can be eliminated by investing on the CML while having the same expected return as IBM. What portfolio on the CML should you recommend (i.e., find the weights)? b. Under the CAPM assumptions, what extra return can you achieve in the market relative to IBM, if you are willing to tolerate a standard deviation of returns similar to IBM. What portfolio on the CML should you recommend (i.e., find the 2 weights)? 3 Answer A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts