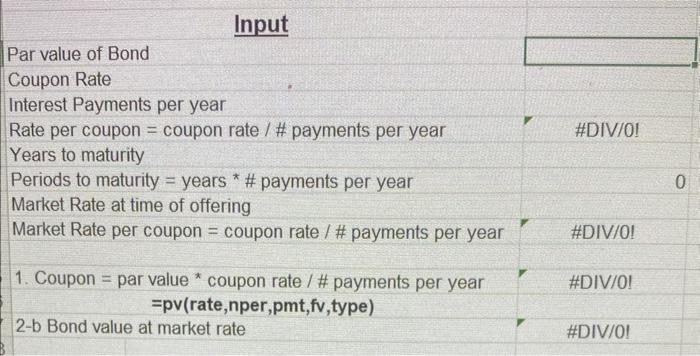

Question: fill in the excel cells in column c please Input Par value of Bond Coupon Rate Interest Payments per year Rate per coupon = coupon

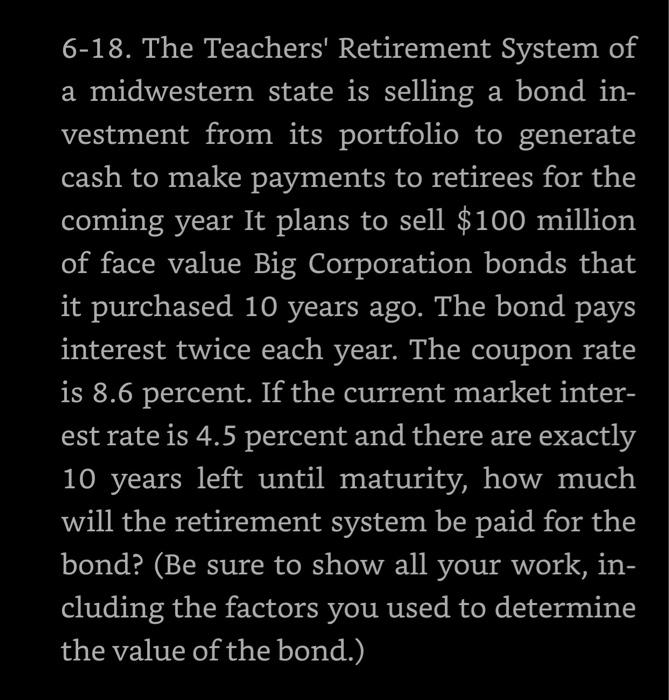

Input Par value of Bond Coupon Rate Interest Payments per year Rate per coupon = coupon rate / \# payments per year \#DIV/0! Years to maturity Periods to maturity = years * \# payments per year Market Rate at time of offering Market Rate per coupon = coupon rate / \# payments per year " \#DIV/0! 1. Coupon = par value * coupon rate / \# payments per year \#DIV/O! =pv( rate, n per, pmt, fv,type) 2-b Bond value at market rate \#DIV/0! 6-18. The Teachers' Retirement System of a midwestern state is selling a bond investment from its portfolio to generate cash to make payments to retirees for the coming year It plans to sell $100 million of face value Big Corporation bonds that it purchased 10 years ago. The bond pays interest twice each year. The coupon rate is 8.6 percent. If the current market interest rate is 4.5 percent and there are exactly 10 years left until maturity, how much will the retirement system be paid for the bond? (Be sure to show all your work, including the factors you used to determine the value of the bond.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts